Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

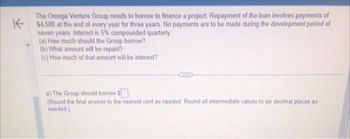

Transcribed Image Text:The Omega Venture Group needs to borrow to finance a project. Repayment of the loan involves payments of

K$4.580 at the end of every year for three years. No payments are to be made during the development period of

seven years. Interest is 5% compounded quarterly

(a) How much should the Group borrow?

(b) What amount will be repaid?

(c) How much of that amount will be interest?

a) The Group should borrow $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as

needed)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The annual interest rate of Jackie's savings account is 6,4%, and simple interest is calculated semiannually. What is the periodic interest rate of jackies account? 1.6% 0.53% 1.07% 3.2%arrow_forwardAlberto invests $100 per month in an annuity that pays a 12% interest rate compounded monthly. a.)Determine the accumulated amount in Alberto’s account after 10 years. b.) Alberto stops making payments and takes the money he accumulated and invests it in a savings account with an interest of 12% compounded monthly. Determine the amount Alberto has in his savings account 30 years later.arrow_forward9arrow_forward

- Jacob wants to accumulate at least $45,000 by depositing $1,300 at the end of each month into a fund that earns interest at 4.75% compounded monthly. a. How many deposits does he need to make in order to reach his goal? 0 Round to the next payment b. How long will it take Jacob to reach his goal? o year(s) o month(s) Express the answer in years and months, rounded to the next payment periodarrow_forwardYou have taken a loan of $66,000.00 for 32 years at 3.4% compounded quarterly. Fill in the table below: (Round all answers to 2 decimal places.) Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) S $ $ Balance $66,000.00 $ $ $arrow_forwardYou have maxed out your credit card and owe $3,100. Its interest rate is 21%. Each month, you make the minimum required payment of $32. (Round your answers to the nearest cent.) (a) During the September 20 through October 19 billing period, you pay the minimum required payment on October 1. Find the average daily balance, the finance charge, and the new balance. average daily balance $ finance charge $ new balance $ (b) During the October 20 through November 19 billing period, you pay the minimum required payment on November 11. Find the average daily balance, the finance charge, and the new balance. average daily balance $ finance charge $ new balance $ (c) During the November 20 through December 19 billing period, you pay the minimum required payment on November 30. Find the average daily balance, the finance charge, and the new balance. average daily balance $ finance charge $ new balance $ (d) Discuss the impact of making the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,