FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

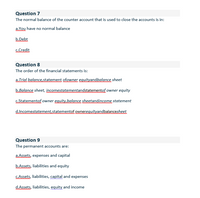

Transcribed Image Text:Question 7

The normal balance of the counter account that is used to close the accounts is in:

a.You have no normal balance

b.Debt

G.Credit

Question 8

The order of the financial statements is:

a.Trial balance,statement ofowner eguityandbalance sheet

b.Balance sheet, incomestatementandstatementof owner equity

CStatementof owner eguity,balance sheetandincome statement

d.Incomestatement statementof ownereguityandbalancesheet

Question 9

The permanent accounts are:

a.Assets, expenses and capital

b.Assets, liabilities and equity

C.Assets, liabilities, capital and expenses

d.Assets, liabilities, equity and income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Janet works in the credit department handling accounts receivable transactions. At the end of each period, the allowance for uncollectible accounts has a larger and larger debit balance. What may be going wrong here? What possible corrections should be made?arrow_forwardWhich following statement is a correct statement about the direct write-off method for calculating credit loss expense? A. It is in accordance with GAAP. B. It uses an allowance for credit losses account. C. It tends to understate accounts receivable on the balance sheet. D. It recognizes credit loss expense when a specific account is determined to be uncollectible.arrow_forwardTo calculate the withdrawal amount from an account in which you want to decrease the balance, you use the __________________ formulaarrow_forward

- What two steps are required to open an account with a zero balance? (Check all that apply)arrow_forwardWhen referring to a note receivable or promissory note a.the note cannot be factored to another party b.the note may be used to settle an account receivable c.the note is not considered a formal credit instrument d.the maker is the party to whom the money is duearrow_forwardWhy can't Accounts Receivable ever have a credit balance? Why can't Accounts Payable ever have a debit balance.arrow_forward

- Customer deposits (prepayments) are recorded - Select one: a. as debits to accounts receivable for the customer b. as negative sales invoices C. as credits to accounts receivable for the customer O d. when the customer makes a partial payment on accountarrow_forwardPosting errors are identified in the following table. In column (1), enter the amount of the difference between the two trial balance columns (debit and credit) due to the error. In column (2), identify the trial balance column (debit or credit) with the larger amount if they are not equal. In column (3), identify the account(s) affected by the error. In column (4), indicate the amount by which the account(s) in column (3) is under- or overstated. Item (a) is completed as an example. Note: Select "None" if there is no effect. (1) Difference between Description of Posting Error Debit and Credit Columns Larger Total (2) Column with the (3) Identify Account(s) Incorrectly Stated (4) Amount of account over- or understatement a. $1,720 debit to Rent Expense is posted as a $1,270 debit. $ 450 Credit Rent Expense Rent Expense is understated by $450 b. $3,440 credit to Cash is posted twice as two credits to Cash. c. $1,570 debit to Prepaid Insurance is posted as a debit to Insurance Expense.…arrow_forwardWhich of the following is incorrect? Group of answer choices A. In a double-entry accounting system every transaction will affect at least two accounts. B. Across all accounts, the total amount of debits must always equal the total amount of credits. C. A debit can be recorded on either side of the t-account depending on the type of account. D. The difference between the total debit and credit amounts for an account is called the account balance.arrow_forward

- Under the direct charge-off method, when a specific account receivable is written off, what account is debited and what is the effect of the write-off on net income and on assets? debit Accounts Receivable; the write off decreases net income and total assets debit Allowance for Uncollectible Accounts; the write off increases net income and total assets debit Uncollectible Accounts Expense the write off decreases net income and total assets debit Uncollectible Accounts Expense; the write off increases net income and total assets Aarrow_forwardA trial balance does not balance. The owner believes the following mistakes WOULD cause animbalance. Do you agree? (Answer TRUE or FALSE for each statement) A. The owner forgot to record a cash saleB. A credit sale was recorded as a debit to sales and a debit to trade receivablesC. When transferring the bank overdraft from the Cash T account it was entered on thedebit side of the trial balanceD. Rates expense of £500 was debited to rent expenses and credited to cashE. A payment to a supplier of £690 was entered to cash as £690 but to trade payables as£609arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education