FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format thanku

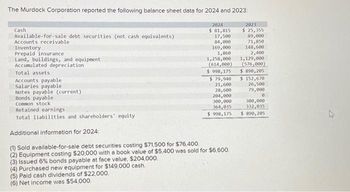

Transcribed Image Text:The Murdock Corporation reported the following balance sheet data for 2024 and 2023:

Cash

Available-for-sale debt securities (not cash equivalents)

Accounts receivable

Inventory

Prepaid insurance

Land, buildings, and equipment

Accumulated depreciation

Total assets

Accounts payable.

Salaries payable

Notes payable (current)

Bonds payable

Common stock

Retained earnings

Total liabilities and shareholders' equity

2024

$ 81,815

17,500

84,000

169,000

1,860

1,258,000

(614,000)

$998, 175

$ 79,940

21,600

28,600

204,000

300,000

364,035

$ 998,175

Additional information for 2024:

(1) Sold available-for-sale debt securities costing $71,500 for $76,400.

(2) Equipment costing $20,000 with a book value of $5,400 was sold for $6,600.

(3) Issued 6% bonds payable at face value, $204,000.

(4) Purchased new equipment for $149,000 cash.

(5) Paid cash dividends of $22,000.

(6) Net Income was $54,000.

2023

$ 25,355

89,000

71,850

148,600

2,400

1,129,000

(576,000)

$ 890,205

$152,670

26,500

79,000

0

300,000

332,035

$ 890,205

A

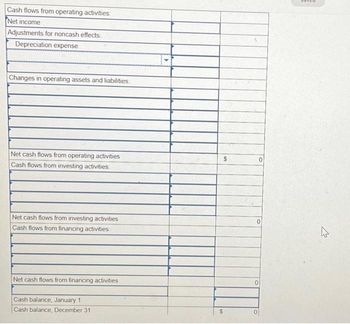

Transcribed Image Text:Cash flows from operating activities:

Net income

Adjustments for noncash effects:

Depreciation expense

Changes in operating assets and liabilities:

Net cash flows from operating activities

Cash flows from investing activities

Net cash flows from investing activities

Cash flows from financing activities

Net cash flows from financing activities

Cash balance, January 1

Cash balance, December 31

$

$

0

0

01

0

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education