ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

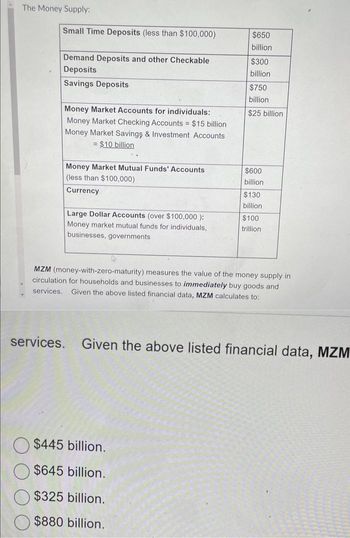

Transcribed Image Text:The Money Supply:

Small Time Deposits (less than $100,000)

Demand Deposits and other Checkable

Deposits

Savings Deposits

Money Market Accounts for individuals:

Money Market Checking Accounts = $15 billion

Money Market Savings & Investment Accounts

= $10 billion

Money Market Mutual Funds' Accounts

(less than $100,000)

Currency

Large Dollar Accounts (over $100,000):

Money market mutual funds for individuals,

businesses, governments

$650

billion

$300

billion

$445 billion.

$645 billion.

$325 billion.

$880 billion.

$750

billion

$25 billion

$600

billion

$130

billion

$100

trillion

MZM (money-with-zero-maturity) measures the value of the money supply in

circulation for households and businesses to immediately buy goods and

services. Given the above listed financial data, MZM calculates to:

services. Given the above listed financial data, MZM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Explain the links between changes in the nation’s money supply, the interest rate, investment spending, aggregate demand, and real GDP (and the price level).arrow_forwardIs it possible that money supply can be more than the money demand (this means that we can have too much money)?arrow_forwardCarefully explain how the Federal Reserve (Fed) will use each of the three monetary policy tools at its disposal to decrease the money supply.arrow_forward

- The table below shows the current money demand in the economy. Assume the money supply is $600 billion. Money Marketarrow_forwardWrite a money demand function and explain the determinants of money demand.arrow_forwardDraw diagrams illustrating the impact on the demand for money, the supply of money and the equilibrium interest rate, of each of the following. Explain what is going on in the money market in each case. (a) The central bank sells securities on the open market. (b) The economy grows (GDP increases) but the central bank moves to keep interest rates constant.arrow_forward

- When money is neutral, which of the following increases when the money supply growth rate increases? real output growth real interest rates nominal interest rates the money supply divided by the price levelarrow_forwardWhat is the difference between temporary and permanent changes in money supply?arrow_forwardtotal demand for money (Click for List) the amount of money people want to hold as a store of value, is the sum of the transactions demand for money and the asset demand for money. M2++ raises the interested ratearrow_forward

- Using the appropriate diagram, show and explain the effect of the increase in income taxes on the equilibrium in the money market.arrow_forwardAnalyze the effect of fiscal and monetary policy in Zimbabwe’s money supplyarrow_forwardDiscuss the functions of money and evaluate how theories of money demand explain themarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education