Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

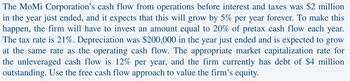

Transcribed Image Text:The MoMi Corporation's cash flow from operations before interest and taxes was $2 million

in the year just ended, and it expects that this will grow by 5% per year forever. To make this

happen, the firm will have to invest an amount equal to 20% of pretax cash flow each year.

The tax rate is 21%. Depreciation was $200,000 in the year just ended and is expected to grow

at the same rate as the operating cash flow. The appropriate market capitalization rate for

the unleveraged cash flow is 12% per year, and the firm currently has debt of $4 million

outstanding. Use the free cash flow approach to value the firm's equity.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Bondi Beachwear Company expects sales next year to be $310,000. Inventory and accounts receivable will have to be increased by $65,000 to accommodate this sales level. The company has a steady profit margin of 15 percent, with a 10 percent dividend payout. How much external funding will Bondi Beachwear Company have to seek? Assume there is no increase in liabilities other than that which will occur with the external financing. External funds neededarrow_forwardZycad has sales of $110 million a year. If Zycad reduces their processing float by 3 days, what is the increase in the firm's average cash balance? Assume 365 days per year.arrow_forwardRequired: The MoMi Corporation's cash flow from operations before interest and taxes was $2 million in the year just ended, and it expects that this will grow by 5% per year forever. To make this happen, the firm will have to invest an amount equal to 20% of pretax cash flow each year. The tax rate is 21%. Depreciation was $200,000 in the year just ended and is expected to grow at the same rate as the operating cash flow. The appropriate market capitalization rate for the unleveraged cash flow is 12% per year, and the firm currently has debt of $4 million outstanding. Use the free cash flow approach to calculate the value of the firm and the firm's equity. (Enter your answer in dollars not in millions.) X Answer is complete but not entirely correct. Value of the firm Value of the firm's equity $ $ 14,550,000 X 10,550,000 Xarrow_forward

- A retail coffee company is planning to open new coffee 95 outlets that are expected to generate $13.3 million in free cash flows per year, with a growth rate of 3.3% in perpetuity. If the coffee company's WACC is 10.6%, what is the NPV of this expansion?arrow_forwardThe Seattle Corporation has been presented with an investment opportunity that will yield end of year cash flows of $30,000 in Year 1, $35,000 per year in years 2 and 3, $45,000 in year 4, and $50,000 in year 5. Thus investment will cost the firm $135,000 today, and the firms cost of capital is 13%. What is the firm’s NPV for this investment?arrow_forwardPraxis Corp. is expected to generate a free cash flow (FCF) of $5,670.00 million this year (FCF, = $5,670.00 million), and the FCF is expected to grow at a rate of 22.60% over the following two years (FCF, and FCF). After the third year, however, the FCF is expected to grow at a constant rate of 3.18% per year, which will last forever (FCF). Assume the firm has no nonoperating assets. If Praxis Corp.'s weighted average cost of capital (WACC) is 9.54%, what is the current total firm value of Praxis Corp.? (Note: Round all intermediate calculations to two decimal places.) $155,715.35 million O $17,453.56 million $122,645.86 million $147,175.03 million Praxis Corp.'s debt has a market value of $91,984 million, and Praxis Corp. has no preferred stock. If Praxis Corp. has 375 million shares of common stock outstanding, what is Praxis Corp.'s estimated intrinsic value per share of common stock? (Note: Round all intermediate calculations to two decimal places.) $81.76 $80.76 $89.94 $245.29arrow_forward

- A retail coffee company is planning to open 95 new coffee outlets that are expected to generate $15.5 million in free cash flows per year, with a growth rate of 3.2% in perpetuity. If the coffee company's WACC is 10.7%, what is the NPV of this expansion? The present value of the free cash flows is $ __ million ? (Round to two decimal places.)arrow_forward. The Indiana Company has had a great year financially and they are wanting to better understand the amount of free cash flows that they have to invest back into the company. After having sales of $1 million, total costs of $500,000, interest expense of $50,000, depreciation of $100,000, and Capex of $90,000, what is the amount of free cash flow for the company? Assume a 35% tax rate and only use the information that is provided above. a. $220,000 b. $270,000 c. $237,500 d. $335,000 SOOK 50-100arrow_forwardYou have the opportunity to expand your business by purchasing new equipment for $152,000. The equipment has a useful life of 9 years. You expect to incur cash fixed costs of $79,000 per year to use this new equipment, and you expect to incur cash variable costs in the amount of 5% of annual revenues. Your cost of capital is 6%. Required: 1. Assume instead you expect a cash revenue stream for this investment. Based on this estimated revenue stream, Year 1 $ 105,000 Year 2 115,000 Year 3 110,000 Year 4 90,000 Year 5 160,000 Year 6 150,000 Year 7 160,000 Year 8 110,000 Year 9 160,000 What are the payback and discounted payback periods for this investment?arrow_forward

- Nugent Communication Corp. is investing $7,311,256 in new technologies. The company expects significant benefits in the first three years after installation (as can be seen by the following cash flows), and smaller constant benefits in each of the next four years. Year 1 2 3 4-7 Cash Flows $2,540,230 $3,617,345 $2,867,006 $1,505,500 What is the discounted payback period for the project assuming a discount rate of 10 percent? (Round answer to 2 decimal places, e.g. 15.25. If discounted payback period exceeds life of the project, enter 0 for the answer.) The discounted payback period for the project is ___________arrow_forwardNovel Industries purchases a 41.2 million cyclo-converter. The cyclo-converter will be depreciated by 10.30 million per year over 4 years, starting this year. Suppose Nokela's tax rate is 40%. a) a. What impact will the cost of the purchase have on earnings for each of the next 4 years? b) What impact will the cost of the purchase have on the firm's cash flow for the next 4 years?arrow_forwardYou are evaluating a new product. In year 3 of your analysis, you are projecting pro forma sales of $5.9 million and cost of goods sold of $3.54 million. You will be depreciating a $2 million machine for 5 years using straight-line depreciation. Your tax rate is 33%. Finally, you expect working capital to increase from $210,000 in year 2 to $ 295,000 in year 3. What are your pro forma earnings for year 3? What are your pro forma free cash flows for year 3?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education