Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

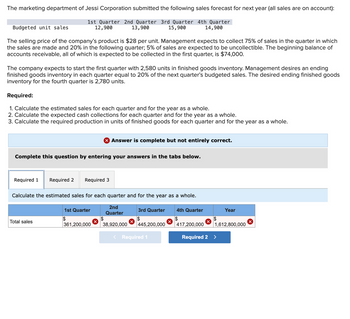

Transcribed Image Text:The marketing department of Jessi Corporation submitted the following sales forecast for next year (all sales are on account):

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

12,900

13,900

15,900

14,900

Budgeted unit sales

The selling price of the company's product is $28 per unit. Management expects to collect 75% of sales in the quarter in which

the sales are made and 20% in the following quarter; 5% of sales are expected to be uncollectible. The beginning balance of

accounts receivable, all of which is expected to be collected in the first quarter, is $74,000.

The company expects to start the first quarter with 2,580 units in finished goods inventory. Management desires an ending

finished goods inventory in each quarter equal to 20% of the next quarter's budgeted sales. The desired ending finished goods

inventory for the fourth quarter is 2,780 units.

Required:

1. alculate the estimated sales for each quarter and for the year as a whole.

2. Calculate the expected cash collections for each quarter and for the year as a whole.

3. Calculate the required production in units of finished goods for each quarter and for the year as a whole.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Total sales

Required 3

Calculate the estimated sales for each quarter and for the year as a whole.

2nd

Quarter

> Answer is complete but not entirely correct.

1st Quarter

$

361,200,000

$

38,920,000

3rd Quarter

$

445,200,000

< Required 1

4th Quarter

$

417,200,000

$

Year

1,612,800,000

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A companys sales for the coming months are as follows: About 20 percent of sales are cash sales, and the remainder are credit sales. The company finds that typically 10 percent of a months credit sales are paid in the month of sale, 70 percent are paid the next month, and 15 percent are paid in the second month after sale. Expected cash receipts in July are budgeted at what amount? a. 114,520 b. 143,150 c. 145,720 d. 156,000arrow_forwardIf the sales forecast estimates that 50,000 units of product will be sold during the following year, should the factory plan on manufacturing 50,000 units in the coming year? Explain.arrow_forwardMacom Manufacturing has total contribution margin of $61,250 and net income of $24,500 for the month of June. Marcus expects sales volume to increase by 10% in July. What are the degree of operating leverage and the expected percent change in income for Macom Manufacturing? 0.4 and 10% 2.5 and 10% 2.5 and 25% 5.0 and 50%arrow_forward

- The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account):1st Quarter 2nd Quarter 3rd Quarter 4th QuarterBudgeted unit sales ............................ 11,000 12,000 14,000 13,000The selling price of the company’s product is $18.00 per unit. Management expects to collect 65% of salesin the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to beuncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in thefi rst quarter, is $70,200.The company expects to start the first quarter with 1,650 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter’s budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,850 units.Required:1. Prepare the company’s sales budget and schedule of expected cash…arrow_forwardThe marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 11, 600 2nd Quarter 12,600 3rd Quarter 14, 600 4th Quarter 13, 600 Budgeted unit sales The selling price of the company's product is $15 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $71,400. The company expects to start the first quarter with 1,740 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,940 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2.…arrow_forwardThe marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 11, 600 2nd Quarter 12,600 3rd Quarter 14,600 4th Quarter 13, 600 Budgeted unit sales The selling price of the company's product is $15 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $71,400. The company expects to start the first quarter with 1,740 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,940 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2.…arrow_forward

- The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 2nd Quarter 11, 600 3rd Quarter 14, 600 4th Quarter 13, 600 Budgeted unit sales 12, 600 The selling price of the company's product is $15 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $71,400. The company expects to start the first quarter with 1,740 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,940 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole.…arrow_forwardThe marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Budgeted unit sales 12,000 13,000 15,000 14,000 The selling price of the company’s product is $19 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $72,200. The company expects to start the first quarter with 2,400 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter’s budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2,600 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as…arrow_forwardThe marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 11,000 2nd Quarter 12,000 3rd Quarter 4th Quarter 13,000 Budgeted unit sales 14,000 The selling price of the company's product is $18.00 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $70,200. The company expects to start the first quarter with 1,650 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,850 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2.…arrow_forward

- The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Budgeted unit sales 12,600 13,600 15,600 14,600 The selling price of the company’s product is $25 per unit. Management expects to collect 65% of sales in the quarter in which the sales are made, 30% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $73,400. The company expects to start the first quarter with 2,520 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 20% of the next quarter’s budgeted sales. The desired ending finished goods inventory for the fourth quarter is 2,720 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the…arrow_forwardPlease help with this three-part problemarrow_forwardThe sales forecast for birdhouses built by Splish Enterprises follows. Beginning inventory for the year is expected to be 8,000 birdhouses, and the production manager prefers to maintain an ending inventory of 15% of the next quarter's sales. Quarter Number of Birdhouses First 8,000 Second 24,000 Third 29,000 Fourth 40,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning