Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

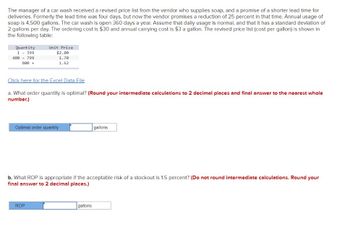

Transcribed Image Text:The manager of a car wash received a revised price list from the vendor who supplies soap, and a promise of a shorter lead time for

deliveries. Formerly the lead time was four days, but now the vendor promises a reduction of 25 percent in that time. Annual usage of

soap is 4,500 gallons. The car wash is open 360 days a year. Assume that daily usage is normal, and that it has a standard deviation of

2 gallons per day. The ordering cost is $30 and annual carrying cost is $3 a gallon. The revised price list (cost per gallon) is shown in

the following table:

Quantity

1 - 399

400 799

800 +

Unit Price

$2.00

1.70

1.62

Click here for the Excel Data File

a. What order quantity is optimal? (Round your intermediate calculations to 2 decimal places and final answer to the nearest whole

number.)

Optimal order quantity

ROP

b. What ROP is appropriate if the acceptable risk of a stockout is 1.5 percent? (Do not round intermediate calculations. Round your

final answer to 2 decimal places.)

gallons

gallons

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 8 images

Knowledge Booster

Similar questions

- PART A Speedy Bicycle Company (SBC) is a wholesale distributor of a wide variety of bicycles and bicycle parts. The most popular model is the Dragonfly, which sells for $170. All manufacturing is done at a plant in China, and shipment takes a month (30 days) from the time an order is placed. The estimated order cost is $75, including customs clearance. SBC's cost per bicycle is 65% of retail price, and inventory carrying cost is 11% per year of SBC's cost. If the company cannot fulfill a retail order, the retailer will get the shipment from another distributor and SBC loses that business. SBC is planning inventory for 2023 based on forecasted demand and wants to maintain a 93% service level to minimize lost orders. The company has 300 working days per year. 2021 Forecasted Demand for the Dragonfly Bicycle Model: F A J 15 58 J 8 M 31 M 96 J 59 38 A 23 S 16 0 14 N 26 D 41arrow_forwardplease solve within 30 minutesarrow_forwardJohnson's Juice sells bottles of "keep me awake during class" fruit juice to college students. Annual demand is 88,000 bottles. The company uses an annual holding cost percentage of 16% in its setup cost is $45 per order. The current price per bottle from the supplier is $.75, and Johnson's Juice resells it to customers for $2.00 each. However, the supplier has notified Johnson's Juice that starting nect week the purchase price will rise to $1.15 due to tariffs imposed by the government. Johnson's inventory of bottles is about to be depleted. How many bottles should Johnson's jiuce purchase in the next order. (assume the bottles are full of chemicals so the juice will never expire.)arrow_forward

- The relationship between price and quantity supplied is typically O direct O inversearrow_forwardPlease do not give solution in image format thanku A small mail-order company uses 14,000 boxes a year. Holding cost rate is 18 percent of unit cost per year, and ordering cost is $33 per order. The following quantity discounts are available. Number of Boxes Price per Box 1,000 to 1,999 $1.15 2,000 to 4,999 1.10 5,000 to 9,999 1.05 10,000 or more 1.00 a. Determine the optimal order quantity. Optimal order quantity boxes b. Determine the number of orders per year. (Round the final answer to 1 decimal place.) No. of orders per yeararrow_forwardAt a recent manufacturing workshop, XYZ, Incorporated explained that demand for disposable masks increase rapidly in March 2020 when quarantine mandates first took effect. At the time, retailers could only place a single order to cover demands through the end of the summer. A certain retailer purchased disposal masks from a supplier at a cost of $20 per unit and sold them for $30 per unit. By the end of summer, demand for masks subsided considerably and all masks that weren't sold during the summer could be sold at a discounted price of $18 per unit. The retailer estimated that demand between March and August would be Normally distributed with mu = 10,000 and sigma = 1525 units With, supply chains becoming more stable since March 2020, the retailer is currently in the process of establishing a contract with a disposable mask supplier. The supplier has agreed to sell masks to the retailer for $18 per unit and will make deliveries any time the supplier places an order for a cost of $100…arrow_forward

- Stuart's Custom Golf manufactures steel castings for use in premium lob wedges. The annual demand for these steel castings is 1,500 units. Stuart's Custom Golf can produce 12 steel castings per hour and the company works an 8 hour day for 250 days each year.The cost to set up for production of the steel castings is $1000. Each steel casting costs $8.85. The company uses a rate of 30% of the item cost to determine the annual holding cost. Calculate the economic production quantity.arrow_forwardDetermine which delivery alternative would be most economical for 50 boxes of parts. Each box costs $434 and the annual holding cost is 20% of the cost. Assume 365 days per year. Overnight delivery option costs $300, and eight-day delivery option costs $125 a. The overnight option is at least $182 cheaper than eight-day b. The overnight option is at least $91 cheaper than eight-day c. The eight-day option is at least $182 cheaper than overnight d. The eight-day option is at least $91 cheaper than overnightarrow_forwardA daily newspaper is stocked by a coffee shop so its patrons can purchase and read it while they drink coffee. The newspaper costs $1.14 per unit and sells for $1.55 per unit. If units are unsold at the end of the day, the supplier takes them back at a rebate of $1 per unit. Assume that daily demand is approximately normally distributed with µ = 150 and σ = 30. (a) What is your recommended daily order quantity for the coffee shop? (Round your answer to the nearest integer.) (b) What is the probability that the coffee shop will sell all the units it orders? (Round your answer to four decimal places.) (c) In problems such as these, why would the supplier offer a rebate as high as $1? For example, why not offer a nominal rebate? Find the recommended order quantity at 25¢ per unit. (Round your answer to the nearest integer.) What happens to the coffee shop's order quantity as the rebate is reduced? The higher rebate ---Select--- ▾ the quantity that the coffee shop should order.arrow_forward

- Give typed full explanationarrow_forwardA manufacturer buys cardboard boxes from a supplier. The annual demand is 40,000 boxes and is uniformly distributed. The boxes cost $5 each. The estimated order cost is $10, and the carrying cost rate is 20% per year. What is the EOQ and what is the annual order and carrying cost? How many times a year are orders placed, and what is the average time, in weeks, between orders? Using the answer from (b), if you round the average time between orders to the nearest week, what should the order quantity be? Would you recommend using this order quantity and time interval? Suppose that the actual demand turns out to be 80,000 boxes instead of 40,000 boxes.If you had used the EOQ from the (a), what would be the annual order and carrying cost be?arrow_forwardA local distributor for a national tire company expects to sell approximately 200 steel-belted radial tires of a certain size and tread design next year. Annual carrying cost is $20 per tire, and ordering cost is $5. The distributor operates 200 days a year. What is the Total Cost?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.