FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

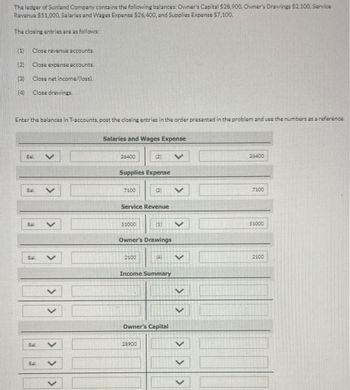

Transcribed Image Text:The ledger of Sunland Company contains the following balances: Owner's Capital $28,900, Owner's Drawings $2,100, Service

Revenue $51,000, Salaries and Wages Expense $26,400, and Supplies Expense $7,100.

The closing entries are as follows:

(1) Close revenue accounts.

(2) Close expense accounts.

(3) Close net income/(loss).

(4) Close drawings.

Enter the balances in T-accounts, post the closing entries in the order presented in the problem and use the numbers as a reference

Bal

64.

Bal.

Bal

Bal.

Bal

>

Salaries and Wages Expense

26400

Supplies Expense

7100

$1000

(2)

Service Revenue

2100

(2)

Owner's Drawings

(4)

28900

(4

Income Summary

Owner's Capital

V

<

>

26400

7100

$1000

2100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with all answersarrow_forwardThe F. Mercury, Capital account has a credit balance of $39,000 before closing entries are made. Services revenue for the period is $57,200, wages expense is $40,800, and withdrawals are $9,800. What is the correct closing entry for the expense accounts? Multiple Choice O Debit Income Summary $40,800; credit Wages expense $40,800. Debit Income Summary $40,800; credit F. Mercury Capital $40,800. Debit Wages expense $39,000; credit F. Mercury, Capital $39,000, Debit Wages expense $40,800; credit Income Summary $40,800. Debit F. Mercury, Withdrawals accounts $40,800; credit Wages expense $40,800.arrow_forwardListed below are balance sheet accounts for Elf’s Gift Shop. Mark currentaccounts with “C” and noncurrent accounts with “NC”_____ (a) Long-term debt._____ (b) Inventories._____ (c) Accounts payable._____ (d) Prepaid expenses._____ (e) Equipment._____ (f) Accrued liabilities._____ (g) Accounts receivable._____ (h) Cash._____ (i) Bonds payable._____ (j) Patents.arrow_forward

- The December 31, Year 4, balance sheet for Finch Corporation is presented here. These are the only accounts on Finch's balance sheet. Amounts indicated by question marks (?) can be calculated using the following additional information: Assets Cash FINCH CORPORATION Balance Sheet As of December 31, Year 4 Accounts receivable (net) Inventory Property, plant, and equipment (net) Liabilities and Stockholders' Equity Accounts payable (trade) Income taxes payable (current) Long-term debt Common stock Retained earnings Additional Information Current ratio (at year end) Total liabilities + Total stockholders' equity Gross margin percentage $35,000 a. Accounts payable b. Retained earnings Inventory C. 292,000 $442,000 $ ? P $ P 35,000 298,000 Inventory turnover (Cost of goods sold + Ending inventory) Gross margin for Year 4 12 1.6 to 1.0 70% 40% 9.6 times Required a. Compute the balance in trade accounts payable as of December 31, Year 4. b. Compute the balance in retained earnings as of…arrow_forwardsarrow_forwardThe income statement for the month of June, 2021 of Stellar Enterprises contains the following information: Revenues $6900 Expenses: Salaries and Wages Expense Rent Expense Advertising Expense Supplies Expense Insurance Expense Total expenses Net income $2890 1560 800 300 100 5650 $1250 The entry to close the expense accounts includes a credit to Income Summary for $5650. debit to Salaries and Wages Expense for $2890. debit to Income Summary for $1250. credit to Rent Expense for $1560.arrow_forward

- Selected accounts and related amounts for Druid Hills Co. for the fiscal year ended May 31, 20Y8, are presented in Problem 6-5A. Adjunt problem 6-5A Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare closing entries as of May 31, 20Y8.arrow_forwardAfter preparing and posting the closing entries for revenues and expenses, the income summary account has a debit balance of $28,000. The entry to close the income summary account will be: __ Debit owner Withdrawals $28,000; credit Income Summary $28,000. __ Debit Income Summary $28,000; credit Owner Withdrawals $28,000. __ Debit Income Summary $28,000; credit Owner Capital $28,000. __ Debit Owner Capital $28,000; credit Income Summary $28,000. __ Credit Owner Capital $28,000; debit Owner Withdrawals $28.000.arrow_forwardAlpesharrow_forward

- Use the following T-accounts to prepare the four journal entries required to close the books: T-Accounts. Accounts Receivable debit balance 45,500. Fees Earned Revenue credit balance 60,000. Commission expense debit balance 7,200. Supplies Expense debit balance 5,500. Wages Expense debit balance 42,000. Dividends debit balance 3,500. Retained Earnings credit balance 51,000.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education