FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

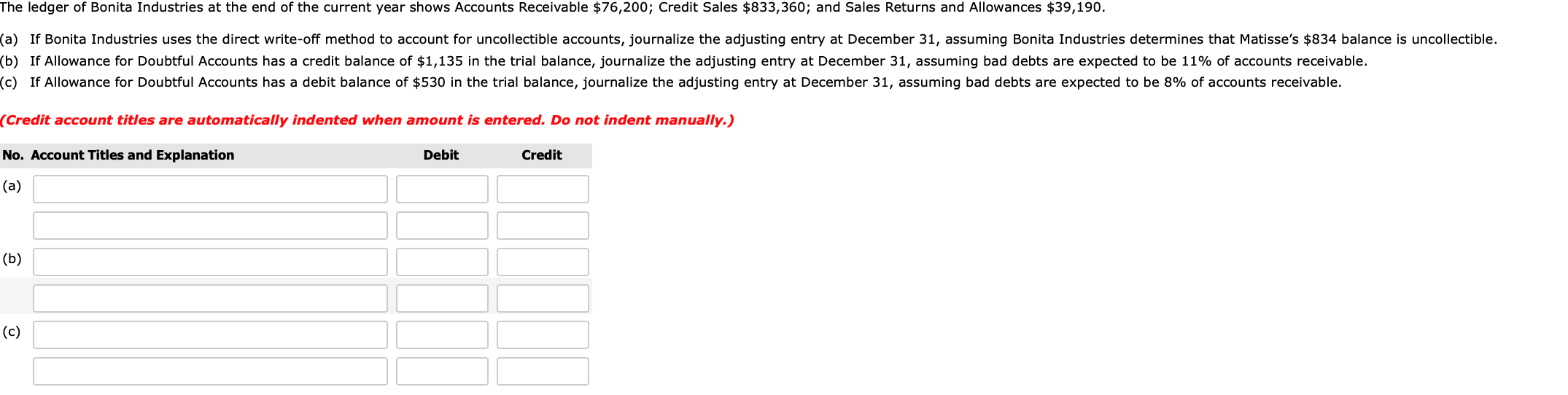

Transcribed Image Text:The ledger of Bonita Industries at the end of the current year shows Accounts Receivable $76,200; Credit Sales $833,360; and Sales Returns and Allowances $39,190.

(a) If Bonita Industries uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Bonita Industries determines that Matisse's $834 balance is uncollectible.

(b) If Allowance for Doubtful Accounts has a credit balance of $1,135 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable.

(c) If Allowance for Doubtful Accounts has a debit balance of $530 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable.

(Credit account titles are automatically indented when amount is entered. Do not indent manually.)

No. Account Titles and Explanation

Credit

Debit

(a)

(b)

(c)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Allen Bikes Ltd. has a year-end of December 31, 20x9. During the year, the company wrote off accounts receivable in the amount of $ 2,140. Allen's December 31, 20x9 general ledger account balances, prior to making any year-end adjusting journal entries, were as follows: Account Debit Credit Accounts Receivable 125,477 Allowance for Doubtful Accounts 614 Net Credit Sales 2,059,391 Allen Bikes Ltd. has estimated that bad debts will equal 2 of 1% of sales. What will be the dollar amount of the bad debt expense when making the adjusting journal entry for the year-ended December 31, 20x9 (round to the nearest whole dollar)?arrow_forwardMazie Supply Company uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $104,500, and it estimates that 3% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has: (a) a $1,777 credit balance before the adjustment. (b) a $523 debit balance before the adjustment.arrow_forwardMKE Goods’ year-end unadjusted trial balance shows accounts receivable of $198,000, allowance for doubtful accounts of $1,200 (credit), and sales of $560,000. Uncollectibles are estimated to be 1.5% of accounts receivable. 1. Prepare the December 31 year-end adjusting entry for uncollectibles.2. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $600?arrow_forward

- Coronet Suppliers uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $80,500, and it estimates that 3% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Account has: (a) a $1,369 credit balance before the adjustment. (b) a $403 debit balance before the adjustment. View transaction list Journal entry worksheet 1 2 Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has a $1,369 credit balance before the adjustment. ansaction (a) te: Enter debits before credits. General Journal Debit Creditarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) On December 31, a company has outstanding accounts receivable of $69,000, and it estimates that 3% of its receivables will be uncollectible. Prepare the adjusting journal entry at year-end to record bad debts expense if the Allowance for Doubtful Accounts has a: $1,173 credit balance before the adjustment. $345 debit balance before the adjustment.arrow_forwardAfter the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $754,825 and Allowance for Doubtful Accounts has a balance of $18,222. What is the net realizable value of accounts receivable?arrow_forward

- Before any adjustments, Snow Company had an end of the year accounts receivable balance of $225,000 and the allowance for uncollectible accounts had a $800 credit balance. An analysis of accounts receivable determines that the allowance for uncollectible accounts should be 4% of accounts receivable. The adjusting entry would include a credit to Allowance for Uncollectible Accounts of: O A. $8,000. O B. $9,800. OC. $9,000. $8,200. OD.arrow_forwardThe ledger of Pina Colada Corp. at the end of the current year shows Accounts Receivable $108,000; Sales Revenue $832,000; and Sales Returns and Allowances $18,100. If Pina Colada uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at (a) December 31, assuming Pina Colada determines that L. Dole's $1,000 balance is uncollectible. If Allowance for Doubtful Accounts has a credit balance of $2,000 in the trial balance, journalize the adjusting entry at (b) December 31, assuming bad debts are expected to be 11% of accounts receivable. If Allowance for Doubtful Accounts has a debit balance of $199 in the trial balance, journalize the adjusting entry (c) December 31, assuming bad debts are expected to be 8% of accounts receivable.arrow_forwardAt the end of the year, a company reports a balance in its Allowance for Uncollectible Accounts of $2,000 (credit) before any year-end adjustment. The company estimates future uncollectible accounts to be 2% of credit sales for the year. Credit sales for the year total $282,000. Record the adjustment for the allowance for uncollectible accounts using the percentage-of-credit-sales method on a balance sheet.arrow_forward

- Before the year-end adjustment the Allowance for Doubtful Accounts has a debit balance of $5,000. Using the aging of receivables method, the desired balance of the Allowance for Doubtful Accounts is estimated as $35,000. a) What is the uncollectible accounts expense for the period? b) What is the journal entry required? c) What is the balance of the Allowance for Doubtful Accounts after adjustment? d) If the accounts receivable balance is $325,000, what is the net realizable value of the receivables after adjustment?arrow_forwardAt the end of the current year, Accounts Receivable has a balance of $565,000, Allowance for Doubtful Accounts has a credit balance of $5,000, and sales for the year total $2,540,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $26,000. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forwardAllowance for Doubtful Accounts has a credit balance of $800 at the end of the year (before adjustment), and an analysis of accounts in the customers ledger indicates that the estimated amount of uncollectible accounts is $16,000. Based on the estimate, which of the following adjusting entries should be made? a.debit Allowance for Doubtful Accounts, $800; credit Bad Debt Expense, $800 b.debit Bad Debt Expense, $16,800; credit Allowance for Doubtful Accounts, $16,800 c.debit Bad Debt Expense, $800; credit Allowance for Doubtful Accounts, $800 d.debit Bad Debt Expense, $15,200; credit Allowance for Doubtful Accounts, $15,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education