ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

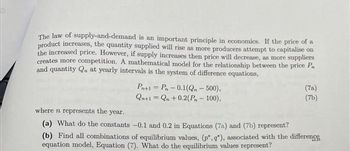

Transcribed Image Text:The law of supply-and-demand is an important principle in economics. If the price of a

product increases, the quantity supplied will rise as more producers attempt to capitalise on

the increased price. However, if supply increases then price will decrease, as more suppliers

creates more competition. A mathematical model for the relationship between the price Pa

and quantity Q. at yearly intervals is the system of difference equations,

Pn+1 P-0.1(Q. - 500),

Qn+1=Qn +0.2(P-100),

M

(7a)

(7b)

where n represents the year.

(a) What do the constants

-0.1 and 0.2 in Equations (7a) and (7b) represent?

(b) Find all combinations of equilibrium values, (p, q), associated with the differenc

equation model, Equation (7). What do the equilibrium values represent?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- R(p) = pN(p).| Bob is currently selling tires for 60 dollars each. His weekly sales are running at 130 tires per week, so N(60) = 130. His marketing department estimates that he will lose 2 sales per week for each 10 dollar increase in unit price, so N'(60) = -0.2. Estimate Bob's increase in weekly revenue for each one dollar increase in tire price. Revenue increase =1 dollarsarrow_forwardCompute to three decimal places. (See attached) Initial values are: PX = $9500 PY = $10000 I = $15000 A = $170000 W = 160 This function is: Qs = 89830 -40PS +20PX +15PY +2I +.001A +10Warrow_forwardIt is known that The New York Times’ circulation is 731,500 print copies. You publish three advertisements in the NYT a week and run your campaign for 12 weeks. What are the total audience impressions (TAI) you can get over the period of 12 weeks?arrow_forward

- Question 22 A computer depreciates 32% per year. A computer is bought for $1200. What is an equation to model this where V is the value of the computer and t is the years that passs since it is bought. Ov= 1200(-0.32)t OV= 1200(0.32) OV = 1200(1.32) OV = 1200(0.68) Question 23 A computer depreciates 32% per year. A computer is bought for $1200. What is an equation for the year since the comupter is bought as a function of the computer's worth? Ot=10g0.68 (1200)arrow_forwardEastman Publishing Company is considering publishing an electronic textbook about spreadsheet applications for business. The fixed cost of manuscript preparation, textbook design, and web site construction is estimated to be $165,000. Variable processing costs are estimated to be $5 per book. The publisher plans to sell single-user access to the book for $44. Through a series of web-based experiments, Eastman has created a predictive model that estimates demand as a function of price. The predictive model is demand price of the e-book. (b) Use Goal Seek to calculate the price (in dollars) that results in breakeven. (Round your answer to the nearest cent.) = (a) Construct an appropriate spreadsheet model for calculating the profit/loss at a given single-user access price taking into account the above demand function. What is the profit estimated by your model for the given costs and single user access price (in dollars). $ 3736 X (c) Use a data table that varies price from $50 to $400…arrow_forwardEastman Publishing Company is considering publishing an electronic textbook about spreadsheet applications for business. The fixed cost of manuscript preparation, textbook design, and web site construction is estimated to be $156,000. Variable processing costs are estimated to be $9 per book. The publisher plans to sell single-user access to the book for $41. Through a series of web-based experiments, Eastman has created a predictive model that estimates demand as a function of price. The predictive model is demand 4,000 -6p, where p is the price of the e-book. (a) Construct an appropriate spreadsheet model for calculating the profit/loss at a given single-user access price taking into account the above demand function. What is the profit estimated by your model for the given costs and single user access price (in dollars). (b) Use Goal Seek to calculate the price (in dollars) that results in breakeven. (Round your answer to the nearest cent.) (c) Use a data table that varies price…arrow_forward

- The demand function for apples is the following. Qn = 10 – Pn + 0.2Y +0.5 Pc – 2Ps + 0.2A Where: Qn = annual sales of apples (millions of kilos) Pn = price of apples (£1 per kilo) Y = disposable income in the UK £trillions (£10 trillions) Pc = price of a pies £ per kilo (£2 per kilo) Ps = price of pear (£2 per kilo) A = advertising measured in hundreds of thousands of £5 (use as 5 in your calculations) What direction should the apple producers move the price if they wanted to maximize their revenue? a. There is not enough information. b. Don't change the price. c. Cut the price. d. Raise the price.arrow_forward10.61 The per-store daily customer count (i.e., the mean number of customers in a store in one day) for a nationwide convenience store chain that operates nearly 10,000 stores has been steady, at 900, for some time. To increase the customer count, the chain is considering cutting prices for coffee beverages. The question to be determined is how much to cut prices to increase the daily customer count without reducing the gross margin on coffee sales too much. You decide to carry out an experiment in a sample of 24 stores where customer counts have been running almost exactly at the national average of 900. In 6 of the stores, the price of a small coffee will now be $0.59, in 6 stores the price of a small coffee will now be $0.69, in 6 stores, the price of a small coffee will now be $0.79, and in 6 stores, the price of a small coffee will now be $0.89. After four weeks of selling the coffee at the new price, the daily customer count in the stores was recorded and stored in . At the 0.05…arrow_forwardA manufacture has been selling 1400 television sets a week at $450 each. A market survey indicates that for each $22 rebate offered to a buyer, the number of sets sold will increase by 220 per week. a) Find the demand function p(x), where x is the number of the television sets sold per week. p(x) = b) How large rebate should the company offer to a buyer, in order to maximize its revenue? $ c) If the weekly cost function is 105000 + 150x, how should it set the size of the rebate to maximize its profit? $ Submit Questionarrow_forward

- In October 2015, amid rising fears about the security of credit card transactions, financial institutions and businesses made the transition to using chip cards. Unlike the quick swipe of a magnetic stripe on the back of traditional credit and debit cards, chip cards have to be left inside the terminal while the embedded chip verifies the transaction. While there is no consistent method for measuring transaction speed, news agencies report average chip speeds of anywhere from 8 seconds to 13 seconds. The switch to chip readers was precarious, with many businesses taping over the chip card slots in the terminals until the kinks were worked out. Even after a year, some businesses still could not process chips and continued to utilize the magnetic stripe for transactions. Financial institutions thought the additional security benefits of the chips would overshadow the added wait times. Yet a survey conducted by Harbortouch, a leading point-of-sale company, in 2016 showed that nearly four…arrow_forwardQ1: KSU Products has just carried out a survey of the demand for their guidebooks to spoken Arabic. They have found the following results over the last six months. Sales revenue 356 398 372 360 365 350 Price ($) 4.5 4.0 4.2 4.5 4.3 4.8 a. Estimate an appropriate demand relationship; Q=apb b. Make a forecast of sales revenue for a price of $5, stating any assumptions. c. Éstimate the price elasticity of demand for the data as a whole. d. If price is raised 10 per cent in general terms, what will happen to revenue?arrow_forwardA(n) variable is calculated from within the model. A(n). endogenous; endogenous endogenous; exogenous exogenous; endogenous exogenous; exogenous none of the above variable can never be taken as given.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education