FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Multiple Choice

-

18,400.

-

19,550.

-

22,000.

-

23,000.

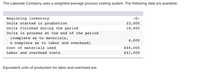

Transcribed Image Text:The Lakeside Company uses a weighted-average process costing system. The following data are available:

Beginning inventory

Units started in production

Units finished during the period

-0-

23,000

18,400

Units in process at the end of the period

(complete as to materials,

4,600

* complete as to labor and overhead)

Cost of materials used

$40,000

Labor and overhead costs

$41,000

Equivalent units of production for labor and overhead are:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardRefer to the following selected financial information from Texas Electronics. Compute the company's working capital for Year 2. Year 1 $ 33,250 Year 2 $ 38,500 100,000 90,500 65,000 84,500 126,000 130,000 13,100 10,700 393,000 343,000 108,400 112,800 Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales Cost of goods sold 716,000 395,000 681,000 380,000arrow_forwardam. 115.arrow_forward

- Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start- up company. What amount of child and dependent care credit can Julie claim in 2021 in each of the following alternative scenarios? Use Exhibit 8-10 b. Julie paid $5,650 to the day care center and her AGI is $52,600 (all salary). Child and dependent care creditarrow_forwardSave FNHPCF714 Corporation's info is below: Sales $635,000 VC $127,000 (ID#56554) FC $17,340 NOI $490,660 Q: How much is FNHPCF714's Contribution Margin? A: $ < Prev 20 of 25arrow_forwardData for January for Bondi Corporation and its two major business segments, North and South, appear below: Sales revenues, North Variable expenses, North Traceable fixed expenses, North Sales revenues, South Variable expenses, South Traceable fixed expenses, South $ 673,000 $ 390,600 $ 80,600 $ 520,300 $ 296,900 $ 67,400 In addition, common fixed expenses totaled $182,700 and were allocated as follows: $94,900 to the North business segment and $87,800 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the North business segment is:arrow_forward

- Popper Company acquired 80% of the common stock of Cocker Company on January 1, 2022, when Cocker had the following stockholders' equity accounts. Common stock 40,000 shares outstanding $ 140,000 105,000 476,000 $ 721,000 Additional paid-in capital Retained earnings Total stockholders' equity To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2025. Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2025, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker. On January 1, 2025, Cocker issued 10,000 additional shares of common stock for $21 per share. Popper did not…arrow_forwardOption A В -А C-B C-A -4500 -7500 -9000 -3000 -1500 -4500 1500 3000 3400 1500 400 1900 2. 2000 3000 3740 1000 740 1740 3 2500 3000 4114 50 1114 1614 8/C or AB/C 0.91 1.18 1.07 1.11 1.31 1.04 Your accountant has provided you with the table below comparing three alternatives using benefit-cost ratio analysis and an MARR of 6%, the best option is: Option A Option B O Option C There is not enough information provided. Yeararrow_forwardTestbank Multiple Choice Question 99 A markup of 32% on cost is equivalent to what markup on selling price? O 24.20% O 32.00% O 68.00% O 75.80%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education