Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

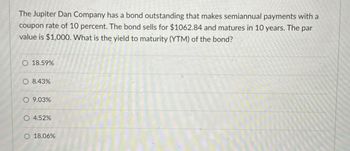

Transcribed Image Text:The Jupiter Dan Company has a bond outstanding that makes semiannual payments with a

coupon rate of 10 percent. The bond sells for $1062.84 and matures in 10 years. The par

value is $1,000. What is the yield to maturity (YTM) of the bond?

O 18.59%

O 8.43%

9.03%

O 4.52%

18.06%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Whatever Incorporated, has a bond outstanding with a coupon rate of 534 percent and semiannual payments. The yield to maturity is 6.7 percent and the bond matures in 18 years. What is the market price of the bond has a par value of $1,000? Multiple Choice O O O O O 100032 180018 186145 $45000 $87618arrow_forwardA bond pays annual interest. Its coupon rate is 7.0%. Its value at maturity is $1,000. It matures in 4 years. Its yield to maturity is currently 4.0%. The modified duration of this bond is ______ years. 3.65 4.00 3.51 3.30arrow_forwardThe Jupiter Dan Company has a bond outstanding that makes semiannual payments with a coupon rate of 9 percent. The bond sells for $982.4 and matures in 20 years. The par value is $1,000. What is the yield to maturity (YTM) of the bond? 4.60% 9.27% 9.19%. 18.33% 18.38%arrow_forward

- A bond has nine years to maturity, a $2,000 face value, and a 5.7% coupon rate with annual coupons. What is its yield to maturity if it is currently trading at $1,566? OA. 13.13% OB. 11.25% OC. 9.38% OD. 7.5%arrow_forwardA bond has a $1,000 par value, 12 years to maturity, and pays a coupon of 7.25% per year, semiannually. The bond is callable in seven years at 110% of its par value. If the bond’s yield to maturity is 7.02% per year, what is its yield to call? A) 7.59% B) 7.68% C) 7.84% D) 8.00% E) 7.76%arrow_forwardWhatever, Incorporated, has a bond outstanding with a coupon rate of 5.64 percent and semiannual payments. The yield to maturity is 6.1 percent and the bond matures in 15 years. What is the market price if the bond has a par value of $1,000? O$955.61 O $974.31 O $955.21 O $956.68 O$957.94arrow_forward

- Ordinary bonds issued by PIMCO have a current quoted price of $830.50. The PIMCO bond has a 5.7% annual coupon rate. The YTM = 8.15% and the PIMCO bonds pays coupon twice per year. If the next coupon will be disbursed in exactly 6 months, the PIMCO bond will mature in: a. 5.19 years b. 29.14 years c. 19.96 years d. 20.77 years e. 10.39 yearsarrow_forwardSolvay Corporation's bonds have a 10-year maturity, a 12% semiannual coupon, and a par value of $1,000. The current market rate is 9%, based on semiannual compounding. What is the bond's price? O s1,276.02 O $1,195.12 O s1,192.53 $1,273.86 O s1,271.81arrow_forwardWhatever, Inc., has a bond outstanding with a coupon rate of 5.66 percent and semiannual payments. The yield to maturity is 6.3 percent and the bond matures in 16 years. What is the market price if the bond has a par value of $ 1,000?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education