College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

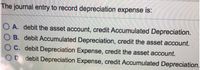

Transcribed Image Text:The journal entry to record depreciation expense is:

A. debit the asset account, credit Accumulated Depreciation.

O B. debit Accumulated Depreciation, credit the asset account.

C. debit Depreciation Expense, credit the asset account.

OD debit Depreciation Expense, credit Accumulated Depreciation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the work sheet, Accumulated Depreciation, Equipment would be recorded in which of the following columns? a. Adjusted Trial Balance, Credit b. Income Statement, Debit c. Balance Sheet, Debit d. Income Statement, Creditarrow_forwardWhich of the following is the correct journal entry to record depreciation expense? Debit Equipment Credit Depreciation Expense Debit Depreciation Expense Credit Cash Debit Depreciation Expense Credit Accumulated Depreciation Debit Accumulated Depreciation Credit Depreciation Expensearrow_forwardThe entry to record depreciation includes a debit to the ________ account. A. Depreciation Expense B. Cash C. Equipment D. Accumulated Depreciationarrow_forward

- Classify the accounts listed below by matching the account name with one of the following financial statementsections in which the account would be reported:a. Current Assetsb. Fixed Assetsc. Intangible Assetsd. Current Liabilitye. Long-Term Liabilityf. Owners’ Equityg. Revenuesh. Operating Expensesi. Other Income/Expense____ 31. Buildings____ 32. Accumulated Depreciation - Buildings____ 33. Depreciation Expense____ 34. Trademarks____ 35. Amortization Expense____ 36. Repairs Expense____ 37. Land Improvements____ 38. Gain on sale of equipment____ 39. Loss on disposal of asset____ 40. Loss from Impaired Goodwillarrow_forward-record depreciation expensearrow_forwardQuestion on the imagearrow_forward

- what type of account accumulated depreciation? and depreciation expense is and on what statement each account goes?arrow_forwardWhen recording the depreciation of equipment in a journal entry using the straight-line method, what accounts are typically involved? A) Debit: Accumulated Depreciation; Credit: EquipmentB) Debit: Equipment; Credit: Depreciation ExpenseC) Debit: Accumulated Depreciation; Credit: Depreciation ExpenseD) Debit: Depreciation Expense; Credit: Equipmentarrow_forwardAccumulated depreciation, equipment is reported: Select one: On the balance sheet as a subtraction from the related asset account On the income statement as an expense On the balance sheet as an addition to total assets On the income statement as revenuearrow_forward

- What would be the adjusting entry to record depreciation each period? a. Debit Accumulated Depreciation, Credit Depreciation Expense. b. Debit Depreciation Expense, Credit Equipment. c. Debit Equipment Expense, Credit Equipment. d. Debit Depreciation Expense, Credit Accumulated Depreciation.arrow_forwardPauly Corporation owns 70% of Shore Company's outstanding common stock. On 01/01/20, Pauly sold a used piece of equipment to Shore in exchange for $271,000 cash. Pauly's original cost of the equipment was $837,000 and accumulated depreciation at 01/01/20 was $635,000. The remaining life of the equipment is 10 years, and Shore will use that same useful life. Both companies use the straight-line method of depreciation. REQUIRED: ANSWER THE FOLLOWING QUESTIONS RELATED TO THE REQUIRED YEAR-END CONSOLIDATION ENTRY: NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000. DEBIT TO 'GAIN ON SALE' IN THE AMOUNT OF:arrow_forwardThe difference between the balance of a fixed asset account and the related accumulated depreciation account is termed: A. book value B. contra asset C. liability D. market value book valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning