FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

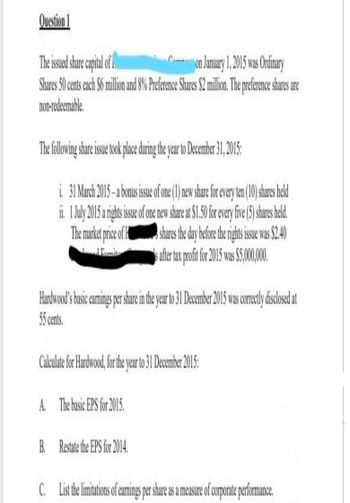

Transcribed Image Text:Question 1

The issued share capital of 1.

Con January 1, 2015 was Ordinary

Shares 50 cents each $6 million and 8% Preference Shares $2 million. The preference shares are

non-redeemable

The following share issue took place during the year to December 31, 2015:

i. 31 March 2015-a bonus issue of one (1) new share for every ten (10) shares held

ii. 1 July 2015 a rights issue of one new share at $1.50 for every five (5) shares held.

The market price of shares the day before the rights issue was $2.40

is after tax profit for 2015 was $5,000,000.

Hardwood's basic earnings per share in the year to 31 December 2015 was correctly disclosed at

55 cents.

Calculate for Hardwood, for the year to 31 December 2015:

A. The basic EPS for 2015.

B. Restate the EPS for 2014.

C. List the limitations of earnings per share as a measure of corporate performance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, 2018, Western Corporation had 40,000 shares outstanding of $90 par value common stock. The shares were originally issued for $252 per share. On January 1, 2019, Pacific split its common stock 3 for 1 with a corresponding reduction in the stock's par value. After the split, the balance of the common stock paid-in-capital account is: 1. $18,000,000 2. $10,080,000 3. $10,800,000 4. $ 3,600,000arrow_forwardThe stockholder's Equity of BOA Incorporated at January 1, 2015 was as follows: Ordinary shares, P25, 150,000 authorized 40,000 shares issued and outstanding 1, 000, 000 Share premium 240,000 Retained Earnings-appropriated 450,000 Retained Earnings-unappropriated 1, 550,000 During 2015 the following transactions occurred Jan 4 Issued 16, 000 common shares for 40 per share. Feb5 Noa subscribed 4,000 shares ata subscription price of 28 per share. Noa made a 50% down payment June Reacquired its own 11,500 shares at 15 per share issued last January 4 Nov 24 Noa made its payment of his balance. The corporation issued the shares Dec 12 Reissue 1,500 treasury shares at 19 per share Dec 27 Declared P2 per share cash dividend Required: Outstanding shares Ending Balance of shareholder's equityarrow_forwardRaxx Ltd. began 2020 with the following balances in its shareholders' equity accounts: Common shares, unlimited shares authorized, 500,000 shares issued and outstanding.... $3,000,000 Retained earnings... 2,500,000 The following share-related transactions occurred during the year: Date Transaction Issued at $200 per share 100,000 $2.50 non-cumulative preferred shares with an unlimited number authorized. March 1 May Issued 50,000 common shares at $15 per share. Sept. 1 Repurchased and retired 150,000 common shares at $16 per share. Nov. 30 Declared and distributed a 3:1 share split on the common shares. Required a. Calculate the weighted-average number of shares outstanding using the information above b. Using the information provided, prepare an income statement for 2020 similar to Exhibit Cumulative effect of a change in depreciation method (net of $26,000 tax benefit). $ (136,500) Operating expenses (related to continuing operations). Gain on disposal of discontinued operations'…arrow_forward

- At the beginning of current year, Axed Company was authorized to issue share capital of 100,000 shares with P30 par value. Axed had the following share capital transactions during the year: January 1 Issued 80,000 shares at P70 per share May 1 Reacquired 4,000 treasury shares at P65 per share July 1 Approved a share split of 5 for 1 October 31 Issued a 10% share dividend when the market value of a share is P25 December 31 Reissued all of the treasury shares at P35 December 31 Net income for the year was P4,500,000. What total amount should be reported as share capital at year-end? 3,200,000 3,428,000 2,940,000 2,628,000 What total amount should be reported as share premium at year-end? 3,200,000 3,640,000 3,922,000 4,362,000 What amount of retained earnings should be reported at year-end? 3,550,000 4,500,000 3,430,000 2,950,000arrow_forwardShare-based Compenstation On January 1, 2015, WAY Inc. granted 100 share options to its 500 employees. The share options are subject to the condition that the employees must remain to the company for a period of 3 years. The share option is not traded at the stock market. Each share option entitles the holder to acquire one ordinary share with P2 par value for P5 per share. The ordinary shares of WAY Inc. which are listed at the stock market are trading at the following prices: 12/31/2015 – P8; 12/31/2016 – P7; 12/31/2017 – P10. As of December 31, 2015, 80 employees have left and the company estimated based on weighted average probability that 20 employees will leave during the vesting period. As of December 31, 2016, 40 employees have left and the company estimated based on weighted average probability that 30 employees will leave during the vesting period. As of December 31, 2017, 130 employees have left. On January 1, 2018, all share options are exercised. Required: 1.…arrow_forwardwinter provided the following shareholders’ equity on December 31, 2021: Preference share capital, 10% P50 par (noncumulative and nonparticipating) 1,000,000 Preference share capital, 8% P50 par (cumulative and nonparticipating) 1,500,000 Ordinary share capital, P100 2,500,000 Share premium 500,000 Retained earnings 600,000 Dividends have been paid on the preference share up to December 31, 2018. Book value per 8% preference sharearrow_forward

- Buffalo Ltd. issues 8,700, $5 cumulative preferred shares at $62 each and 15,000 common shares at $30 each at the beginning of 2019. Each preferred share is convertible into two common shares. The appropriate preferred share dividend was declared and paid in 2019. During the years 2020 and 2021, the following transactions affected Buffalo's shareholders' equity accounts: 2020 Jan. 10 Paid $11,000 of annual dividends to preferred shareholders. 2021 Jan. 10 Paid annual dividend to preferred shareholders and a $3,400 dividend to common shareholders. Mar. 1 The preferred shares were converted into common shares. Journalize each of the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit 2020Jan . 10 (To record preferred…arrow_forward4. ABC Co. issued a prospectus for the issue of 900,000shares at $6 per shares on 1 January 2019. The prospectus specified that $3.50 was payable on application, a further $1.25 was payable on allotment and the final $1.25 was payable at call. On 31 January 2019 ABC issued 300,000 shares. On 31 May 2019, the company made the call for the outstanding balance of $1.25 per share. The call was payable by 30 June 2019. At 30 June 2019, the call on 30,000 shares remained unpaid.Instructions:a) Prepare the journal entries to account for the issue of shares for ABC andb) The Share Capital that would appear in the Balance Sheet of ABC Co.arrow_forward4. ABC Co. issued a prospectus for the issue of 900,000shares at $6 per shares on 1 January 2019. The prospectus specified that $3.50 was payable on application, a further $1.25 was payable on allotment and the final $1.25 was payable at call. On 31 January 2019 ABC issued 300,000 shares. On 31 May 2019, the company made the call for the outstanding balance of $1.25 per share. The call was payable by 30 June 2019. At 30 June 2019, the call on 30,000 shares remained unpaid. Instructions: a) Prepare the journal entries to account for the issue of shares for ABC and b) The Share Capital that would appear in the Balance Sheet of ABC Co.arrow_forward

- Weisberg Corporation has 10,000 shares of $100 par value, 6%, preference shares and 50,000 ordinary shares of $10 par value outstanding at December 31, 2017. InstructionsAnswer the questions in each of the following independent situations.(a) If the preference shares are cumulative and dividends were last paid on the preference shares on December 31, 2014, what are the dividends in arrears that should be reported on the December 31, 2017, statement of financial position? How should these dividends be reported?(b) If the preference shares are convertible into seven shares of $10 par value ordinary shares and 3,000 shares are converted, what entry is required for the conversion, assuming the preference shares were issued at par value?(c) If the preference shares were issued at $107 per share, how should the preference shares be reported in the equity section?arrow_forwardAt 31 December 2019, B Plc had post-tax profits was $2,500,000 and had an issued share capital of $2,000,000 comprising 2,000,000 ordinary shares of 50p each and 1,000,000 $1 10% preference shares that are classified as equity. Assume that the post-tax profits for 2018 and 2019 were same at $ 2,500,000. The time-weighted number of shares was as follows: No. of Shares Shares (nominal value 50p) in issue at 01 January 2019 2,000,000 Shares issued for cash at market price on 30 September 2019 1,000,000 On 30 September 2019, B plc made a right issue of one share for every two shares (i.e one new share for every two shares held) at $3.25 per share. The following information is also given for B Plc as at 31 December 2019: Share option in existence 1,000,000 shares issuable in 2020 at $3.25 per share. An average market price per share of $4%; 1. Convertible 8% preference shares of $1 each totaling $2,000,000 convertible at one ordinary share for every five convertible preference shares. 2.…arrow_forwardOn January 01, 2021, ABC Corporation provided you the following information: Ordinary share capital, 300,000 shares issued, P10 par 3,000,000 Preference share capital, 400,000 shares issued, P20 par 8,000,000 Share premium – ordinary shares 1,200,000 Share premium – preference 2,000,000 Retained earnings 6,000,000 Share transactions for the year 2021: March 10 – Reacquired 80,000 preference shares at P35 per share April 20 – Reissued 30,000 preference treasury shares at P43 per share April 25 - Reissued 10,000 preference treasury shares at P30 per share May 13 – Retired 20,000 preference treasury shares. Journal entry on May 13 should include a.Debit share premium – treasury shares – 200,000 b.Debit retained earnings – 200,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education