ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

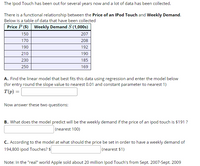

Transcribed Image Text:The Ipod Touch has been out for several years now and a lot of data has been collected.

There is a functional relationship between the Price of an IPod Touch and Weekly Demand.

Below is a table of data that have been collected

Price P ($) Weekly Demand S (1,000s)

150

207

170

208

190

192

210

190

230

185

250

169

A.. Find the linear model that best fits this data using regression and enter the model below

(for entry round the slope value to nearest 0.01 and constant parameter to nearest 1)

T(p) =

Now answer these two questions:

B.. What does the model predict will be the weekly demand if the price of an ipod touch is $191 ?

(nearest 100)

C.. According to the model at what should the price be set in order to have a weekly demand of

194,800 ipod Touches? $

(nearest $1)

Note: In the "real" world Apple sold about 20 million Ipod Touch's from Sept. 2007-Sept. 2009

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- An analyst working for your firm provided an estimated log-linear demand function based on the natural logarithm of the quantity sold, price, and the average income of consumers. Results are summarized in the following table: SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations ANOVA Regression Residual Total Intercept LN Price LN Income df 0.968 0.937 0.933 0.003 30 SS MS F 2 0.003637484 0.001818742 202.48598 0.000242516 8.98206E-06 27 29 0.00388 Coefficients Standard Error 0.57 0.00 0.13 0.51 -0.08 0.15 t Stat 0.90 -19.50 1.13 P-value 0.37 0.00 0.27 Significance F 5.55598E-17 Lower 95% -0.65 -0.09 -0.12 How would a 4 percent increase in income impact the demand for your product? Demand would increase by 60 percent. Demand would increase by 0.6 percent. Demand would decrease by 60 percent. Demand would decrease by 0.6 percent. Upper 95% 1.68 -0.07 0.41arrow_forwardImagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. List 2 factors in your model that might be causing the Multicollinearity and give a reasonarrow_forwardThe data for this question is given in the file 1.Q1.xlsx(see image) and it refers to data for some cities X1 = total overall reported crime rate per 1 million residents X3 = annual police funding in $/resident X7 = % of people 25 years+ with at least 4 years of college (a) Estimate a regression with X1 as the dependent variable and X3 and X7 as the independent variables. (b) Will additional education help to reduce total overall crime (lead to a statistically significant reduction in crime)? Please explain. (c) Will an increase in funding for the police departments help reduce total overall crime (lead to a statistically significant reduction in total overall crime)? Please explain. (d) If you were asked to recommend a policy to reduce crime, then, based only on the above regression results, would you choose to invest in education (local schools) or in additional funding for the police? Please explain.arrow_forward

- The dependent variable in the regression in our cost driver analysis is which of the following? Company sales Total overhead cost for the entire period of time Total overhead cost per montharrow_forwardThe tables to the right give price-demand and price-supply data for the sale of soybeans at a grain market, where x is the number of bushels of soybeans (in thousands of bushels) and p is the price per bushel (in dollars). Use quadratic regression to model the price-demand data and linear regression to model the price-supply data. Complete parts (A) and (B) below. (A) Find the equilibrium quantity and equilibrium price. The equilibrium quantity is thousand bushels. (Round to three decimal places as needed.) (...) Price-Demand p=D(x) 6.67 6.56 6.47 6.36 6.34 X 0 10 20 30 40 Price-Supply p= S(x) 6.46 6.54 6.60 6.61 6.68 X 0 10 20 30 40arrow_forwardImagine you are trying to explain the effect of square footage on home sale prices in the United States. You collect a random sample of 100,000 homes that recently sold. a) Homes can be one of three types: single-family houses, townhomes, or condos. How would you control for a home’s type in a regression model? b) Write down a regression model that includes controls for home type, square footage, and number of bedrooms. c) How would you interpret the estimated coefficients for each of the variables from part b? Be specific. Note Don't forget to include dummy variables.arrow_forward

- Define coefficients of the Linear Regression Model?arrow_forwardIn a regression problem with one output variable and one input variable, we set up two cutpoints z1 and z2 for the input variable and we fit a step function regression model based on these two cutpoints of the input variable. If you write the regression problem in matrix form y = X%*%β + ε, how many rows would the vector β have?arrow_forwardGeneral Cereals is using a regression model to estimate the demand for Tweetie Sweeties, a whistle-shaped, sugar-coated breakfast cereal for children. The following (multiplicative exponential) demand function is being used: QD= 6,280 P 1.35) 42.05 N 2.70 where QD quantity demanded, in 10-oz boxes P = price per box, in dollars A = advertising expenditures on daytime television, in dollars N = proportion of the population under 12 years old, in percent What is the point price elasticity of demand for Tweetie Sweeties? O 2.70 O 2.05 -0.66 -1.35 What is the advertising elasticity of demand? -1.35 O 2.70 O 0.76 O 2.05 According to the estimated model, a percent increase in the proportion of the population under 12 years old by percent. the quantity demandedarrow_forward

- Imagine you are an economist working for the Government of Econville. You are tasked with developing a model to predict the GDP of the country based on various factors such as interest rates, inflation, unemployment rate, and population growth. You collect quarterly data for the past 20 years and start building your model. After running your initial regression, you notice some peculiar patterns in the residuals: (1) residuals do not have identical variances across different levels of the independent variables; (2) two or more independent variables in a regression model are highly correlated with each other; (3) the correlation of a variable with its own past values. You suspect that your model might be suffering from 3 potential issues in the regression analysis that can affect reliability and validity. what are the implications of Heteroscedasticity if this potential issue in your model?arrow_forwardPlease don't provide hand written solutionarrow_forwardGeneral Cereals is using a regression model to estimate the demand for Tweetie Sweeties, a whistle-shaped, sugar-coated breakfast cereal for children. The following (multiplicative exponential) demand function is being used: QD = 6,280 P(-2.15) A1.75N2.70 where QD = quantity demanded, in 10-oz boxes P = price per box, in dollars A = advertising expenditures on daytime television, in dollars N = proportion of the population under 12 years old, in percent What is the point price elasticity of demand for Tweetie Sweeties? 1.75 -1.23 2.70 -2.15 What is the advertising elasticity of demand? 0.65 1.75 -2.15 2.70 According to the estimated model, a percent increase in the proportion of the population under 12 years old by percent. the quantity demandedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education