Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

None

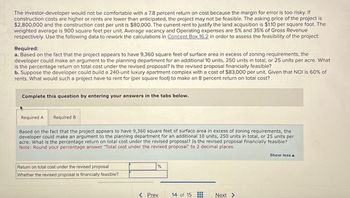

Transcribed Image Text:The investor-developer would not be comfortable with a 7.8 percent return on cost because the margin for error is too risky. If

construction costs are higher or rents are lower than anticipated, the project may not be feasible. The asking price of the project is

$2,800,000 and the construction cost per unit is $80,000. The current rent to justify the land acqusition is $1.10 per square foot. The

weighted average is 900 square feet per unit. Average vacancy and Operating expenses are 5% and 35% of Gross Revenue

respectively. Use the following data to rework the calculations in Concept Box 16.2 in order to assess the feasibility of the project:

Required:

a. Based on the fact that the project appears to have 9,360 square feet of surface area in excess of zoning requirements, the

developer could make an argument to the planning department for an additional 10 units, 250 units in total, or 25 units per acre. What

is the percentage return on total cost under the revised proposal? Is the revised proposal financially feasible?

b. Suppose the developer could build a 240-unit luxury apartment complex with a cost of $83,000 per unit. Given that NOI is 60% of

rents. What would such a project have to rent for (per square foot) to make an 8 percent return on total cost?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Based on the fact that the project appears to have 9,360 square feet of surface area in excess of zoning requirements, the

developer could make an argument to the planning department for an additional 10 units, 250 units in total, or 25 units per

acre. What is the percentage return on total cost under the revised proposal? Is the revised proposal financially feasible?

Note: Round your percentage answer "Total cost under the revised proposal" to 2 decimal places.

Return on total cost under the revised proposal

Whether the revised proposal is financially feasible?

%

< Prev

14 of 15

Next >

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education