FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

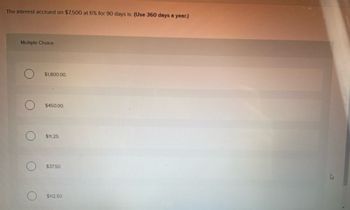

Transcribed Image Text:The interest accrued on $7,500 at 6% for 90 days is: (Use 360 days a year.)

Multiple Choice

O

$1,800.00.

$450.00.

$11.25.

$37.50

$112.50.

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the simple interest earned. Round to the nearest cent. P = $9070, r = 6.50%, t = 8 monthsarrow_forwardWhat is the present value of receiving $2,500 at the end of each year for 5 years, assuming 7% interest compounded annually? Please ideentify which table you used.arrow_forwardSuppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forward

- At the end of each quarter, Patti deposits $1,800 into an account that pays 10% interest compounded quarterly. How much will Patti have in the account in five years? (FV of $1, PV of $1, FVA of $1, and PVA of $1). (Use appropriate factor(s) from the tables provided.) Multiple Choice $45,980 $47,830 $47,780 $54,980 Prev 1 of 10 Next > APR 6. tv 4arrow_forwardWhat is the value today of receiving $3,400 at the end of four years, assuming an interest rate of 7% compounded annually? (FV of $1, PV of $1, FVA of $1, and PVA of $1). (Use appropriate factor(s) from the tables provided.) Multiple Choice $3,044 $2,794 $2,594 $2,448arrow_forwardSanchez placed $11114 into a five-year interest payout GIC at 4.2% compounded monthly. Calculate the interest payout amount every month. Select one: a. none b. 388.99 c. 38.90 d. 594.60arrow_forward

- If the appropriate interest rate is 7%, then present value of $500 paid at the beginning of each of the next 40 years is closest to: $5960. $7132. $6439. $6,666. (Please correct answer and don't use hend raiting this finanas question)arrow_forwardThe amount of interest on $X for two years is $330. The amount of discount on $X for one year is $144. Find the annual effective interest rate i and the value of X. (Round your answer for i to two decimal places. Round your answer for X to the nearest cent.) ¡ = 9.42 X X = $ 1672.66 X Submit Answer %arrow_forwardUSE BA 2 PLUS CALCULATOR PLEASEarrow_forward

- What is the equivalent AW of a one-year contract that pays $6,000 in the first month and increases by $700 for each month thereafter? MARR = 9% compounded monthly. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 0.75% per month. Choose the correct answer below. OA. The AW is $75,608. OB. The AW is $123,339. Oc. The AW is $200,736. OD. The AW is $122,420. OE. The AW is $47,730.arrow_forwardAccumulate 2,050 for 6 years at 4 3/8% simple interest. Discount 6,850 for 3 years and 8 months at 4 5/8% simple interest. Please answer both :( thank you!arrow_forwardAt the end of each quarter, Patti deposits $1,200 into an account that pays 10% interest compounded quarterly How much will Patti have in the account in five years? (EV of $1. PV of $1. EVA of S1, and PVA of 5) (Use appropriate factor(s) from the tables provided) Multiple Choice $30.654 $36.654 $31854 $30,854arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education