ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

please show me complete and neat solution thank you

Transcribed Image Text:+

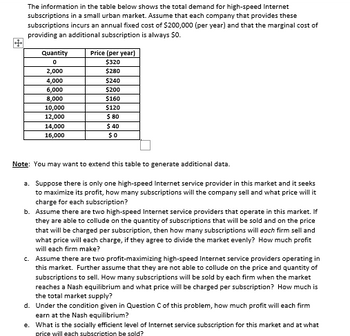

The information in the table below shows the total demand for high-speed Internet

subscriptions in a small urban market. Assume that each company that provides these

subscriptions incurs an annual fixed cost $200,000 (per year) and that the marginal cost of

providing an additional subscription is always $0.

Quantity

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

Price (per year)

$320

$280

$240

$200

$160

$120

$ 80

$ 40

$0

Note: You may want to extend this table to generate additional data.

a. Suppose there is only one high-speed Internet service provider in this market and it seeks

to maximize its profit, how many subscriptions will the company sell and what price will it

charge for each subscription?

b. Assume there are two high-speed Internet service providers that operate in this market. If

they are able to collude on the quantity of subscriptions that will be sold and on the price

that will be charged per subscription, then how many subscriptions will each firm sell and

what price will each charge, if they agree to divide the market evenly? How much profit

will each firm make?

c. Assume there are two profit-maximizing high-speed Internet service providers operating in

this market. Further assume that they are not able to collude on the price and quantity of

subscriptions to sell. How many subscriptions will be sold by each firm when the market

reaches a Nash equilibrium and what price will be charged per subscription? How much is

the total market supply?

d.

Under the condition given in Question C of this problem, how much profit will each firm

earn at the Nash equilibrium?

e. What is the socially efficient level of Internet service subscription for this market and at what

price will each subscription be sold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- how much if a barrel of oil does costs Chevron to produce for sale in the crude oil market, without refining costs. Show actual refernece if already calculated or show calculation to get the number.arrow_forwardJenkins Ltd manufactures remote control cars which sells for $500 each. The fixed cost is $70000 and the variable cost per unit is $300. Jenkins sold 200 units of car. Find the total cost and total revenue for Jenkins Ltd.arrow_forwardGraph the average total cost by plotting for three points only, Q = 1, Q = 5, Q = 14.The graph below shows the TC, TVC, and TFC.The problem I'm having is figuring out how to do so. I know the TC will be multiples of 25.How would I go about doing this? Graph not required, just the process to get the ATC.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardBags/Participants Fixed Cost Variable Cost Total Cost 0 $1,700 $ - $1,700 100 $1,700 $500 $2,200 200 $1,700 $1,200 $2,900 300 $1,700 $2,700 $4,400 400 $1,700 $5,200 $6,900 500 $1,700 $9,000 $10,700 600 $1,700 $15,000 $16,700 700 $1,700 $23,800 $25,500 800 $1,700 $36,800 $38,500 900 $1,700 $55,800 $57,500 1,000 $1,700 $83,000 $84,700 Given the above information on cost, if you charge $15 per entry, what is the breakeven quantity of bags that you should order? At what quantity of bags will profits be maximized? A Use the profit maximizing rule, MR ≥ MC, buy 300 bags. B Use the profit maximizing rule, MR ≥ MC, buy 200 bags. C Use Qb = F/(MR-AVC) where Qb is the breakeven quantity to be determined, the optimal quantity of bags is 300. D Use Qb = F/(MR-AVC) where Qb is the breakeven quantity to be determined, the optimal quantity of bags is 200.arrow_forwardThe sum of the 2011 revenue and four times the 2008 revenue for a particular company is $3,489 4 million The difference between the 2011 and 2008 revenues is $145 9 million if the company's revenue between 2008 and 2011 is an increasing inear function, find the 2008 and 2011 revenues The 2008 revenue is $ million (Type an integer or a decimal)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education