FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

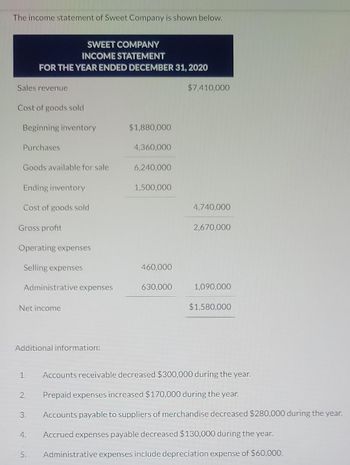

Transcribed Image Text:The income statement of Sweet Company is shown below.

Sales revenue

Cost of goods sold

Beginning inventory

Purchases

Goods available for sale

SWEET COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2020

Ending inventory

Cost of goods sold

Gross profit

Operating expenses

Selling expenses

Administrative expenses

Net income

Additional information:

1.

2.

3.

4.

5.

$1,880,000

4,360,000

6,240,000

1,500,000

460,000

630,000

$7,410,000

4,740,000

2,670,000

1,090,000

$1,580,000

Accounts receivable decreased $300,000 during the year.

Prepaid expenses increased $170,000 during the year.

Accounts payable to suppliers of merchandise decreased $280,000 during the year.

Accrued expenses payable decreased $130,000 during the year.

Administrative expenses include depreciation expense of $60,000.

Transcribed Image Text:The income statement of Sweet Company is shown below.

Sales revenue

Cost of goods sold

Beginning inventory

Purchases

Goods available for sale

SWEET COMPANY

INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2020

Ending inventory

Cost of goods sold

Gross profit

Operating expenses

Selling expenses

Administrative expenses

Net income

Additional information:

1.

2.

3.

4.

5.

$1,880,000

4,360,000

6,240,000

1,500,000

460,000

630,000

$7,410,000

4,740,000

2,670,000

1,090,000

$1,580,000

Accounts receivable decreased $300,000 during the year.

Prepaid expenses increased $170,000 during the year.

Accounts payable to suppliers of merchandise decreased $280,000 during the year.

Accrued expenses payable decreased $130,000 during the year.

Administrative expenses include depreciation expense of $60,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Following is an incomplete current-year income statement. Determine Net Sales, Cost of goods sold and Net Income. Additional information follows: Return on total assets is 16% (average total assets is $62,500). Inventory turnover is 5 (average inventory is $7,800). Accounts receivable turnover is 8 (average accounts receivable is $7,700). Income Statement Net Sales Cost of goods sold Selling, general, and administrative expenses 8800 Income tax expenses 3800 Net Incomearrow_forwardFor the Year Ended December 31, 2020 Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling Expenses: Salaries Expense Rent Expense Advertising Expense Total Selling Expenses Administrative Expenses: Salaries Expense Insurance Expense Rent Expense Deprecaition Expense Total Administrative Expenses Total Operating Expenses Operating Income Other Income and Expenses Sales Discounts Forfeited 125,466 45,167 80,299 2,615 725 3,340 12,543 2,563 1,562 1,253 17,921 21,261 59,038 1,575 (265) Interest Expenses Total Other Income and Expenses Net Income 1,310 57.728 What type of financial statement is this? Statement of Owner's Equity Multiple-step Income Statement Balance Sheet O Single-step Income Statementarrow_forwardPrepare the statement of financial position as at 31 December 2020.arrow_forward

- Supply the missing dollar amounts for the income statement of Williamson Company for each of the following independent cases: Sales Revenues, gross Sales Returns and Allowances Net Sales Cost of Goods Sold Gross Profit $ Case A 8,500 200 6,000arrow_forwardThe income statement of Bob Christiana Company is presented here. BOB CHRISTIANA COMPANY Income Statement For the Year Ended November 30, 2012 Sales revenue $7,700,000 Cost of goods sold Beginning inventory Purchases $1,900,000 4,400,000 Goods available for sale Ending inventory 6,300,000 1,400,000 Total cost of goods sold 4,900,000 Gross profit 2,800,000 Operating expenses 1,150,000 Net income $1,650,000 Additional information: Accounts receivable increased $380,000 during the year, and inventory decreased $250,000. Prepaid expenses increased $170,000 during the year. Accounts payable to suppliers of merchandise decreased $340,000 during the year. Accrued expenses payable decreased $50,000 during the year. Operating expenses include depreciation expense of $110,000. Instructions Prepare the operating activities section of the statement of cash flows for the year ended November 30, 2012, for…arrow_forwardThe following information in the table is available for Huge Corporation in 2018. Huge’s cost of goods sold for 2018 is Sales $ 1,500,000 Beginning Inventory $ 360,000 Ending Inventory $ 190,000 Purchase $ 430,000 a. $400,000 b. $600,000 c. $690,000 d. $880,000arrow_forward

- Excerpts from Hulkster Company's December 31, 2021 and 2020, financial statements are presented below: Accounts receivable Merchandise inventory Net sales Cost of goods sold Total assets Total shareholders' equity Net income Hulkster's 2021 average collection period is: Multiple Choice O 109 days. O 128 days. 2021 $ 40,000 $ 28,000 O 73 days. 190,000 114,000 425,000 240,000 32,500 2020 $ 36,000 35,000 186,000 108,000 405,000 225,000 28,000arrow_forwardpate Selected information from the accounting records of Gavina Company is as follows: P 2,000,000 Net sales for 2021 500,000 Cost of goods sold for 2021 Inventory on December 31, 2020 600,000 Inventory on December 31, 2021 200,000 Gavina's inventcxy for 2021 is: Inventory turnover = Cost of goods sold Average inventory a. 1.25 times b. 3.66 times O c. 4.0 times d. 10.00 timesarrow_forwardThis information is available for Sunland's Photo Corporation for 2020, 2021, and 2022. \table[[, 2020, 2021,2022], [Beginning inventory, $110,000, $316,000,$ 411,000 Calculate inventory turnover for 2020, 2021 and 2022 Calculate days in inventory for 2020, 2021 and 2022 Calculate gross profit rate flr 2020, 2021 and 2022arrow_forward

- Bergo Bay's accounting system generated the following account balances on December 31. The company's manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory, and the accrued factory payroll (Factory Wages Payable) has not been recorded. Cash Accounts receivable Raw materials inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Cost of goods sold Factory overhead General and administrative expenses Totals Debit Credit $ 79,000 48,000 29,000 0 12,000 4,000 $ 9,200 12,200 40,000 82,000 197,600 107,000 27,000 35,000 $ 341,000 $ 341,000 These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materials requisition 11: Materials requisition 12: Labor time ticket 52: Labor time ticket 53: Labor time ticket 54: $ 4,100 direct materials to Job 402. $ 7,400 direct materials…arrow_forwardCondensed income statements for Jennifer Corporation are shown below for two years. Sales Cost of Goods Sold Gross Profit Operating Expense Net Income 2021 $90,000 54,000 $36,000 18,000 $18,000 Corrected net income Compute the corrected net income for 2021 and 2022 assuming that the inventory at the end of 2021 was mistakenly overstated by $6,000. 2021 2022 $108,000 64,800 $43,200 18,000 $25,200 S 2022 Sarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education