Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Finance

all parts with accuracy

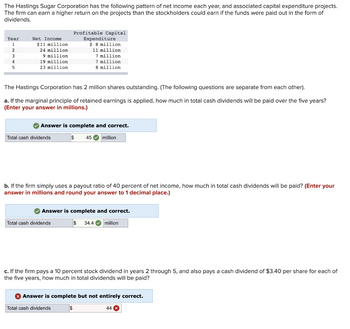

Transcribed Image Text:The Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects.

The firm can earn a higher return on the projects than the stockholders could earn if the funds were paid out in the form of

dividends.

Year

1

2

3

4

5

Net Income

$11 million

24 million

9 million

19 million

23 million

The Hastings Corporation has 2 million shares outstanding. (The following questions are separate from each other).

a. If the marginal principle of retained earnings is applied, how much in total cash dividends will be paid over the five years?

(Enter your answer in millions.)

Total cash dividends

Profitable Capital

Expenditure

$ 8 million

11 million

Answer is complete and correct.

7 million

7 million

8 million

Total cash dividends

$ 45

b. If the firm simply uses a payout ratio of 40 percent of net income, how much in total cash dividends will be paid? (Enter your

answer in millions and round your answer to 1 decimal place.)

million

✔ Answer is complete and correct.

$ 34.4

Total cash dividends

million

c. If the firm pays a 10 percent stock dividend in years 2 through 5, and also pays a cash dividend of $3.40 per share for each of

the five years, how much in total dividends will be paid?

Answer is complete but not entirely correct.

$

44 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- you have developed the following pro forma income statement for your? corporation: it represents the most recent? year’s operations, which ended yesterday. a.if sales should increase by 25 ?percent, by what percent would earnings before interest and taxes and net income? increase? b.if sales should decrease by 25 ?percent, by what percent would earnings before interest and taxes and net income? decrease? q c.if the firm were to reduce its reliance on debt financing such that interest expense were cut in? half, how would this affect your answers to parts a and b?? sales $ 45,750,000 variable costs -22,800,000 revenue before fixed costs $ 22,950,000 fixed costs -9,200,000 ebit $ 13,750,000 interest expense -1,350,000 earnings before taxes $ 12,400,000 taxes (50%) -6,200,000 net income $ 6,200,000arrow_forwardTo help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: Do = $1.45; Po = $22.50; and g = 6.50% (constant). Based on the dividend growth approach, what is the cost of common from reinvested earnings? 11.68% 12,30% 12.56% 12.94% 13.36% O O o O o Oarrow_forwardTo help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: D₁ = $1.45; Po = $22.50; and gL = 6.50% (constant). Based on the dividend growth approach, what is the cost of common from reinvested earnings? O a. 13.59% O b. 12.94% c 11.10% d. 12.30% e. 11.68% Oarrow_forward

- What should be the price earnings ratio of this company on these general accounting question?arrow_forwardGTB, Incorporated has a 21 percent tax rate and has $100 million in assets, currently financed entirely with equity. Equity is worth $7 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below: State Probability of state Expected EBIT in state Pessimistic 0.45 $ 5 million Standard deviation in EPS The firm is considering switching to a 40-percent-debt capital structure and has determined that it would have to pay a 12 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if it switches to the proposed capital structure and can take full advantage of the debt interest tax shields? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Optimistic 0.55 $19 million %arrow_forward4arrow_forward

- You are given the financial information for the Unic Company: Earnings Before Interest and Tax (EBIT) = $126.58 Corporate tax rate (TC) = 0.21 Debt (D) = $500 Unlevered cost of capital (RU) = 0.20 The cost of debt capital is 10 percent. Question: Determine the value of Unic Company equity? Determine the cost of equity capital for Unic Company? Determine the WACC for Unic Company?arrow_forward14arrow_forwardAnle Corporation has a current price of $16, is expected to pay a dividend of $1 in one year, and its expected price right after paying that dividend is $24. a. What is Anle's expected dividend yield? b. What is Anle's expected capital gain rate? c. What is Anle's equity cost of capital?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning