FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

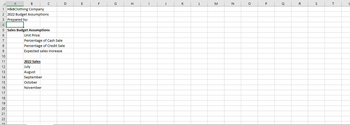

fill out the sales budget assumptions

and 2022 sales

screenshot attached

thanks

Transcribed Image Text:The H&BClothing Company manufactures luxury brand silk

jackets. Currently the company makes classic style jackets in

a single size. The production process involves drawing,

cutting, and assembling the pattern pieces. Direct materials

include two types of fabric - silk, and viscose for lining.

Other materials, such as shoulder pads, stitching threads,

buttons, labels, and packaging, are treated as indirect

materials. H&BClothing is preparing budgets for the third quarter ending September

30, 2023. For each of the requirements (1-8) below, prepare monthly budgets for July,

August, and September, along with a total budget for the quarter.

1. The previous year's sales (2022) for the corresponding period were:

July

580 jackets

600 jackets

August

September

October

650 jackets

November

850 jackets

1,000 jackets

The company expects the above volume of jacket sales to increase by 15% for the

period July 2023 - November 2023. The budgeted selling price for 2023 is $735.00

per jacket. The company expects 10% of its sales to be cash (COD) sales. The

remaining 90% of sales will be made on credit. Prepare a Sales Budget for

H&BClothing.

Transcribed Image Text:A

B

1 H&BClothing Company

2 2022 Budget Assumptions

3 Prepared by:

4

5 Sales Budget Assumptions

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

с

2022 Sales

July

August

Unit Price

Percentage of Cash Sale

Percentage of Credit Sale

Expected sales increase

September

October

November

D

E

F

G

H

T

J

K

L

M

N

O

P

Q

R

S

T

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Splish Company has accumulated the following budget data for the year 2022: 1. 2. 3. 4. 5. 6. 19 Sales: 27,900 units; unit selling price $82 Cost of one unit of finished goods: direct materials, 2 kg at $5 per kilogram; direct labour, 3 hours at $13 per hour; and manufacturing overhead, $6 per direct labour hour Inventories (raw materials only): beginning, 9,900 kg; ending, 14,100 kg Raw materials cost: $5 per kilogram Selling and administrative expenses: $201,000 Income taxes: 30% of income before income taxesarrow_forwardChoice optionarrow_forwardjarrow_forward

- WileyPLUS Kimmel, Accounting, 7e Help I System Announcements CALCULATOR PRINTER VERSION BACK NEXT Problem 22-03A a-b, c1, d Hill Industries had sales in 2019 of $7,200,000 and gross profit of $1,158,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2019 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 111,000 units. At the end of 2019, Hill has 40,000 units of inventory on hand. If Plan A is accepted, the 2020 ending inventory should be equal to 5% of the 2020 sales. If Plan B is accepted, the ending inventory should be equal to 68,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2020 should be $1,507,530. Prepare a sales budget for 2020 under…arrow_forwardkar \\WHAT IS THE FIRST STEP YOU WILL TAKE TO SUCESSFULLY COMPLETE A BUDGET FOR YOURSELF ?arrow_forwardHi, please help :) Use the appropriate mixed cell references and relative references to reflect the percentages in range A22:B27 to determine the projected expenses for each of the Budgeted Selling and Budgeted Administrative Expenses for the year of 2022.arrow_forward

- hello, help pleasearrow_forwardDiane Buswell is preparing the 2022 budget for one of Current Designs' rotomolded kayaks. Extensive meetings with members of the sales department and executive team have resulted in the following unit sales projections for 2022. Quarter 1 1,300 kayaks Quarter 2 2,000 kayaks Quarter 3 950 kayaks Quarter 4 950 kayaks Current Designs' policy is to have finished goods ending inventory in a quarter equal to 25% of the next quarter's anticipated sales. Preliminary sales projections for 2023 are 1,100 units for the first quarter and 2,000 units for the second quarter. Ending inventory of finished goods at December 31, 2021, will be 325 rotomolded kayaks. Production of each kayak requires 44 pounds of polyethylene powder and a finishing kit (rope, seat, hardware, etc.). Company policy is that the ending inventory of polyethylene powder should be 20% of the amount needed for production in the next quarter. Assume that the ending inventory of polyethylene powder on December 31, 2021, is 21,800…arrow_forward2. Which of the following budgets will typically have the longest budget period? a. Capital expenditures budget b. Cash budget c. Sales budget d. Budgeted income statementarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education