Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

14) Can i please get help with this practice question.

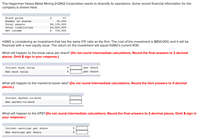

Transcribed Image Text:The Hagerman Heavy Metal Mining (H2M2) Corporation wants to diversify its operations. Some recent financial information for the

company is shown here:

Stock price

$

35,000

$8,100,000

$4,900,000

$

67

Number of shares

Total assets

Total liabilities

Net income

750,000

H2M2 is considering an investment that has the same P/E ratio as the firm. The cost of the investment is $850,000, and it will be

financed with a new equity issue. The return on the investment will equal H2M2's current ROE.

What will happen to the book value per share? (Do not round intermediate calculations. Round the final answers to 2 decimal

places. Omit $ sign in your response.)

Current book value

per share

New book value

2$

per share

What will happen to the market-to-book ratio? (Do not round intermediate calculations. Round the fianl answers to 3 decimal

places.)

Current market-to-book

New market-to-book

What will happen to the EPS? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in

your response.)

Current earnings per share

$

New earnings per share

Transcribed Image Text:What is the NPV of this investment? (Negative answer should be indicated by a minus sign. Do not round intermediate calculations.

Round the final answer to the nearest whole dollar. Omit $ sign in your response.)

NPV

Does accounting dilution occur here?

Yes

O No

Does market value dilution occur here?

Yes

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- This question is not graded. Can you please just help me do question 16.arrow_forwardIn the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardpart b is incorrect. Can you rework it?arrow_forward

- Can you further explain this to me to better understand the concept on what I'm supposed to do and what formulas I need to apply.arrow_forwardCan anyone explain how to do these problems step by step?arrow_forward1. What is a case and how to defining the Case and Creating Problem Statements? 2. What is Background of the Problem and Problem Statement?arrow_forward

- What information is provided by this statement? Describe the steps to create the statement - choose either the direct or indirect method in your response.arrow_forwardWhat is the formula used for the questions without using excel?arrow_forwardWhat does the concept "substance over form" stand for? Can you provide me with some examples?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education