ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

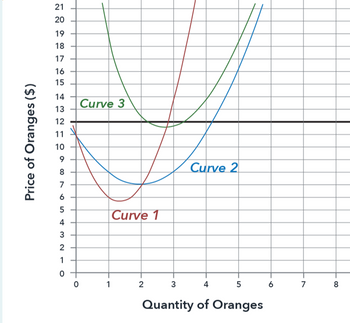

The graph below shows cost curves for a typical firm operating in a

Suppose that the

a. No new entry/no exit.

b.Existing firms will exit.

c.New firms will enter.

Transcribed Image Text:Price of Oranges ($)

21

20

19

18

17

16

15

14

13

12

11

10

9

8

96

7

5

4

325

2

1

O

0

Curve 3

1

Curve 1

Curve 2

2

3

4

5

Quantity of Oranges

LO

7

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a perfectly competitive market that was in a long-run equilibrium when a permanent increase in demand occurs. Which of the following will occur as a result? i. The existing firms will start to earn an economic profit. ii. New firms will be motivated to enter the market. iii. Some firms that cannot meet the new demand will exit the market. A) i and ii only B) ii and ii only C) i and iii D) ii only E) i, ii and iiarrow_forwardAvocados have been proven to bring many health benefits if consumed regularly. Many others including Gavin are huge fans of avocados and have plans to start a new business selling avocados. Assume the market for avocados to be perfectly competitive. Answer the following questions: a. If these firms are able to continue entering the market for avocados, it is likely that they are earning an economic profit. In order to earn an economic profit, firms must ensure that the price is above its Type ATC for Average Total Cost, AVC for Average Variable Cost, TC for Total Cost or VC for Variable Cost. b. Gavin decided to build an avocado farm in Brisbane. It is estimated that Gavin will need to spend $14.55 thousand on farming equipment costs. Gavin will also need to spend $20.95 thousand on labour and overhead costs. However, it is expected that Gavin will be able to sell 5 tonnes of avocados and gain revenue of $47.66 thousand from selling these avocados. Calculate the thousand. Answer to the…arrow_forwardIn Problem 5, the market demand decreases and the demand schedule becomes: If firms have the same costs set out in Problem 5, what is the market price and the firm’s economic profit or loss in the short run? Problem 5 The market for paper is perfectly competitive and 1,000 firms produce paper. The table sets out the market demand schedule for paper. The table in the next column sets out the costs of each producer of paper. Calculate the market price, the market output, the quantity produced by each firm, and the firm’s economic profit or loss.arrow_forward

- Equilibrium in Competitive Market in the Long Run The long-run average cost function of a competitive firm is AC(Q)= 40 − 6Q + Q2/3. The market demand curve is D(P) = 2200 − 100P. What is the long-run equilibrium price in this industry, and at thisprice, how much would an individual firm produce? How manyactive producers are in the market?arrow_forwarda) Describe the factors that drive profits to zero in perfectly competitive markets in the long run. Explain carefully the incentives that drive the market to a long run equilibrium. b) Why would a firm choose to operate at a loss in the short run? Explain carefully. c) When do firms decide to shut down production in the short run? Explain carefully.arrow_forwardConsider a perfectly competitive market where all firms produce using the same technology. In the long run the equilibrium price equals (Need help? Read chapter 4.6 of the textbook, here: https://playconomics.com/textbooks/view/playconomics4-2019t3/part2/ch4/s6) the Fixed Cost. the minimum Marginal Cost. the minimum Average Total Cost. the maximum Average Variable Cost. None of these.arrow_forward

- Explain in detail how purely competitive markets, in the long-run, know how to adjust to and provide the correct output, at the correct price. Give an example of a good or service you might buy that is closest to being in a purely competitive market. Explain your logic.arrow_forwardConsider the perfectly competitive market for sports jackets. The following graph shows the marginal cost ( MCMC ), average total cost ( ATCATC ), and average variable cost ( AVCAVC ) curves for a typical firm in the industry.arrow_forwardFirms in the market for dog food are selling in a purely competitive market. A firm producing dog food has an output of 10,000 pounds of dog food, for which it sells for $0.50 a pound. At the output level of 10,000 pounds the average variable cost is $0.40, the average total cost is $0.70, and the marginal cost is $0.50. What do expect will happen in the long-run? Explain.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education