FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please do not give solution in image format ? and explain proper steps by Step.?

Transcribed Image Text:The general ledger of Pop's Fireworks includes the following account balances in 2024:

Accounts

Credit

Cash

Accounts Receivable

Allowance for Uncollectible Accounts

Supplies

Notes Receivable (8%, due in 2 years)

Land

Accounts Payable.

Common Stock

Retained Earnings

Service Revenue

Salaries Expense

Utilities Expense

Supplies Expense

Totals.

Debit

$22,200

44,000

June 3

June 8

8,200

20,000

90,000

71,400

25,700

17,200

$298,700

$3,200

13,300

126,000

30,400

125,800

$298,700

In addition, the following transactions occurred during 2024 and are not yet reflected in the account balances above:

Provide additional services on account for $12,000. All services on account include terms 2/10, n/30.

Receive cash from customers within 10 days of the services being provided on account. The customers were

originally charged $7,500.

November 15 Write off customer accounts of $3,500 as uncollectible.

The following information is available on December 31.

a. Estimate that 10% of the balance of accounts receivable (after transactions in requirement 1) will not be collected. (Hint Use the

January 31 accounts receivable balance calculated in the general ledger to determine the total estimate of uncollectible accounts.)

b. Accrue interest on the note receivable of $20,000, which was accepted on October 1, 2024. Interest is due each September 30.

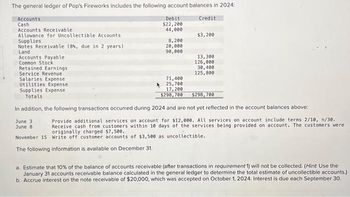

Transcribed Image Text:ces

Journal entry worksheet

<

Record the entry to close the revenue accounts.

Note: Enter debits before credits.

Date

December 31, 2024 Service Revenue

Show Transcribed Text

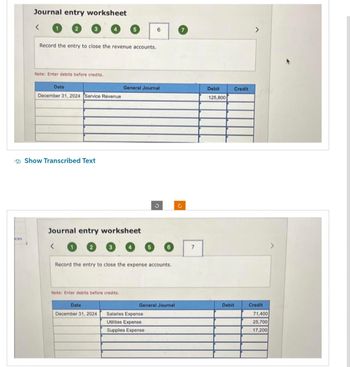

<

5

Journal entry worksheet

Note: Enter debits before credits.

Date

December 31, 2024

General Journal

6

5

Record the entry to close the expense accounts.

Salaries Expense

Utilities Expense

Supplies Expense

6

General Journal

7

Debit

125,800

Credit

Debit

Credit

71,400

25,700

17,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education