FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

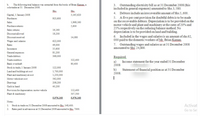

Transcribed Image Text:The following trial balance was extracted from the books of Brian Kamau, a

sole trader at 31 December 200s.

Outstanding electricity bill as at 31 December 2008 (this

3.

included in general expenses) amounted to Shs.3, 580.

Debtors indlude an irrecoverable amount of Shs.5, 600.

A five per cent provision for doubtful debts is to be made

on the recoverable debtors. Depreciation is to be provided on the

motor vehicle and plant and machinery at the rates of 20% and

25% respectively on the reducing balance method. No

depreciation is to be provided on land and building.

Shs

Shs

4.

Capital, 1 January 2008

3,165,620

Purchases

923,600

5.

Sales

1,968,160

Purchase retums

5,600

Sales returns

16,160

Discount allowed

18,200

6. Included in the wages and salaries is an amount of shs.62,

000 paid to the domestic workers of Mr. Brian Kamau.

7. Outstanding wages and salaries as at 31 December 2008

amounted to Shs. 24,800.

Discount received

14,080

Wages and salaries

622,000

Rates

49,000

Insurance

35,600

General expenses

81,200

Trade debtors

368,000

Required.

Trade creditors

322,400

Income statement for the year ended 31 December

a)

2008

Bank overdraft

80,400

Stock in trade, 1 January 2008

122,000

1,700,000

1,230,000

Statement of financial position as at 31 December

b)

2008.

Land and buildings at cost

Plant and machinery at cost

Motor vehicle at cost

562,000

Drawings

208,200

Cash in hand

40,200

Provision for depreciation: motor vehicle

112,400

Plant & machinery

307,500

5.976,160

5.976.160

Notes:

1. Stock in trade on 31 December 2008 amounted to Shs. 148,400.

Activat

2.

Rates paid in advance as at 31 December 2008 amounted to Shs, 7000.

Go to Set

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- © T O (@) Say Lee commenced business on 1 January 2010. At year ended 31 December 2010, the accounts receivables balance was RM10,000. To the date, Say Lee found that an additional irrecoverable debt amounting to RM560 were to be written off. In addition, she found that it was necessary to create an allowance for doubtful debt of RM960. During the year ended 31 December 2011, amount totaling RM840 proved to be bad and written off. The balance of account receivable as at 31 December 2011 was RM27,600 (after bad debt written off) it was decided to provide for doubtful debt up to 5% of account receivables. In 2012, RM3,600 debt were written off during the year. As at 31 December 2012 the balance of account receivables was RM24,000 (before bad debt written off). The allowance for doubtful debt was to be maintained at 5% of account receivables. [Say Lee memulakan perniagaan pada 1 Jamuari 2010. Pada tahun berakhir 31 Disember 2010, baki akaun penghuiang adalah RMI0,000. Pada tarikh yang…arrow_forwardAt year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $812, 000. Chan records its bad debts expense for that estimate. On the following February 1, Chan decides that the $406 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries to record the transactions of December 31, February 1, and June 5. Journal entry worksheet Record the estimated bad debts expense. Note: Enter debits before credits. Please explain and elaborate!arrow_forwardOn December 31 of the current year, a company's unadjusted trial balance included the following: Accounts Receivable, debit balance of $122,535; Allowance for Doubtful Accounts, credit balance of $1,198. What amount should be debited to Bad Debts Expense, assuming 7% of outstanding accounts receivable at the end of the current year will be uncollectible?arrow_forward

- Account of a debtor must be written off as irrecoverable..what is a document of this transaction?arrow_forwardProvide Correctarrow_forwardDuring its first year of operations, Fall Wine Tour earned net credit sales of $311,000. Industry experience suggests that bad debts will amount to 3% of net credit sales. At December 31, 2024, accounts receivable total $44,000. The company uses the allowance method to account for uncollectibles. Read the requirements. Requirement 1. Journalize Fall Wine Tour's Bad Debts Expense using the percent-of-sales method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 Requirement 2. Show how to report accounts receivable on the balance sheet at December 31, 2024. Balance Sheet (Partial): Current Assets:arrow_forward

- Rogan Company's total sales on account for the year amounted to $327,000. The company, which uses the allowance method, estimated bad debts at 1 percent of its credit sales. Required: Journalize the following selected entries: 2017 Dec. 31 Record adjusting entry. 2018 Mar. 2 Write off the account of A.M. Billson as uncollectible, $584. June. 6 Write off the account of W.H. Gilders as uncollectible, $492.arrow_forwardOn 31 Dec, Blue Ocean Pte Ltd's unadjusted trial balance includes the following items: Accounts Receivables Allowance For Doubtful Accounts $210,000 debit $2,500 credit There was objective evidence that 15% of a $20,000 debt owed by a debtor, Red Sea Logistics, would most probably be uncollectible. An aging analysis of the rest of the accounts receivables indicated that an estimated 5% of these accounts would not be collectible. The company uses the allowance method to value its accounts receivable. Present the adjusting entry to record Bad Debt Expenses. Show narration and workings. Explain why using the allowance method is better than the direct write-off method.arrow_forward1. Prepare the journal entries necessary to record the above transactions and calculate the amount to be recognised in the statement of profit or loss. 2. Write up and balance off the: (i) Bad debts expense account (ii) Doubtful debts expense account (iii) Allowance for doubtful debts account.arrow_forward

- The following balances are taken from the trial balance of Mike as on 31-03-2015. Debtors Bad Debt reserve Discount Allowed 2,00,000 5000 600 Bad Debts Discount Reserve on Debtors 10.000 400 Adjustments: (1) Write off $6000 as Bad debts from Debtors. (2) Provision for doubtful debts at 5% is to be made on debtors (3) Provision for discount reserve on Debtors at 1% is to be made. Prepare profit and loss A/C and Balance Sheet of Mike for the year ending on 31-03-2015arrow_forwardAt year-end (December 31), Chan Company estimates its bad debts as 1% of its annual credit sales of $487,500. Chan records its Bad Debts Expense for that estimate. On the following February 1, Chan decides that the $580 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries for the transactions. View transaction list Journal entry worksheet 1 2 3 4 Record the estimated bad debts expense. Note: Enter debits before credits. Debit Date General Journal Credit Dec 31arrow_forwardHi please assistarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education