FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:5.

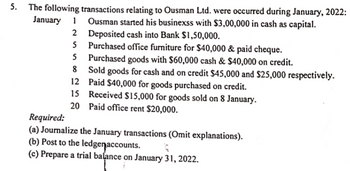

The following transactions relating to Ousman Ltd. were occurred during January, 2022:

Ousman started his businexss with $3,00,000 in cash as capital.

Deposited cash into Bank $1,50,000.

Purchased office furniture for $40,000 & paid cheque.

5 Purchased goods with $60,000 cash & $40,000 on credit.

8

12

20

January 1

2

5

Sold goods for cash and on credit $45,000 and $25,000 respectively.

Paid $40,000 for goods purchased on credit.

Received $15,000 for goods sold on 8 January.

Paid office rent $20,000.

Required:

(a) Journalize the January transactions (Omit explanations).

(b) Post to the ledge accounts.

R

(c) Prepare a trial balance on January 31, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 49. The accountant of Jepjep Holdings presented the following account balances as of December 31, 2021: Cash in bank – Checking,P2,600,000Cash in bank - Savings, P700,000 Cash on hand, P300,000 Cash in bank – restricted, P2,000,000 Treasury bills, P3,000,000 The restricted cash in bank account is opened specifically for building construction expected to be disbursed in Q1 2022. The cash on hand includes a P100,000 check payable to Jepjep, dated January 5, 2022. The Treasury bills are purchased December 1, 2021 and due on February 28, 2022. If you are the Accountant of Jepjep Holdings, what amount of "cash and cash equivalents" should be reported as of December 31, 2021?arrow_forward29arrow_forwardOn June 30, Year 3, Franklin Company's total current assets were $500,500 and its total current liabilities were $275,500. On July 1, Year 3, Franklin issued a short-term note to a bank for $39,400 cash. Required a. Compute Franklin's working capital before and after issuing the note. b. Compute Franklin's current ratio before and after issuing the note. (Round your answers to 2 decimal places.) a. Working capital b. Current ratio Before the transaction After the transactionarrow_forward

- Headlands has the following assets at December 31, 2017. Cash in bank-savings account 138,800 Certificates of deposit (270-day) 244,000 Cash on hand 1,200 Postdated checks 6,500 Cash refund due from State Taxing Authority 31,500 Checking account balance 10,800 What amount should be reported as cash? Cash to be reported 2$arrow_forwardQuestion Carlene Johnson is the Accountant in the Finance Department at Fairway Trading Limited who manages the company Accounts Receivables. She was given the following information by the Finance Manager which was extracted from the debtor's ledger as at December 31, 2022. Category of Total value of Customers Sales To Customer $ Keith Green Karen White June Hinds John Wayne 180,0000 240,000 390,000 380,000 Paul Gayle 346,000 Date of Sales December 16, 30 days 2021 December 10, 60 days 2021 November 15, 2022 30 days June 26, 2022 30 days 30 days August 25, 2022 Terms Percentage provision to be created Date of Last Payment on A/C January 15, 2022 February 14, 2022 December 20, 2022 October 24, 2022 September 24, 2022 Total Amount Paid to Date on Account S 90,500 180,000 170,000 295,000 235,000 The Accountant decided that she would age the debt outstanding in the following category and the percentage to be provided for bad debt in the amount stated beside each category accordingly. Aging…arrow_forwardPlease help mearrow_forward

- "Marquis Smith started IT Consulting Services Incorporated on January 1, Year 1. The company experienced the following events during its first year of operation 1 On June 1 Year 1, the company borrowed $21.600 cash from the bank. The note had a one-year term and 6% annual interest rate 2. On December 31. Year 1, the company adjusted the accounting records to recognize accrued interest expense on the bank note Required: Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA) Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Event Number Assets Cash 21 600 2 Total CNet change in cash 01 21.600 Notes Payable 21,600…arrow_forwardThe are the auditor of CK Company for the year ended, Dec. 31, 2020. The finance manager of the company presented the following information relating to cash balances: Petty Cash (Imprest fund balance) - P20,000 Cash in Bank – LBP (checking account) - 526,000 Cash in Bank – BDO (savings account) - 700,000 Cash in Bank – Metrobank (peso savings acct) - 200,000 Cash in Bank – Metrobank (dollar savings acct) - $2,000 The following information was gathered during the conduct of your audit: The total bills and coins as per cash count amounts to P3,000 A total of receipts amounting to P16,240 relating to travel expenses were unreplenished from PCF as of Dec, 31, 2020 The LBP account has the following transactions and details: Bank Statement Balance as of Dec. 31, 2020 – P700,000 A total of P50,000 Deposits in Transit Outstanding Checks amounting to P300,000 Total deposits already included in the bank but not yet recorded in the book, P70,000 A check that…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education