Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Subject: acounting

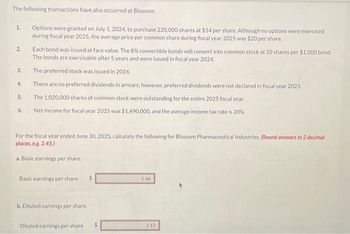

Transcribed Image Text:The following transactions have also occurred at Blossom.

Options were granted on July 1, 2024, to purchase 220,000 shares at $14 per share. Although no options were exercised

during fiscal year 2025, the average price per common share during fiscal year 2025 was $20 per share.

1.

2.

3.

4.

5.

6.

Each bond was issued at face value. The 8% convertible bonds will convert into common stock at 50 shares per $1,000 bond.

The bonds are exercisable after 5 years and were issued in fiscal year 2024.

The preferred stock was issued in 2024.

There are no preferred dividends in arrears; however, preferred dividends were not declared in fiscal year 2025.

The 1,020,000 shares of common stock were outstanding for the entire 2025 fiscal year.

Net income for fiscal year 2025 was $1,490,000, and the average income tax rate is 20%.

For the fiscal year ended June 30, 2025, calculate the following for Blossom Pharmaceutical Industries. (Round answers to 2 decimal

places, e.g. 2.45.)

a. Basic earnings per share.

Basic earnings per share $

b. Diluted earnings per share.

Diluted earnings per share.

146

117

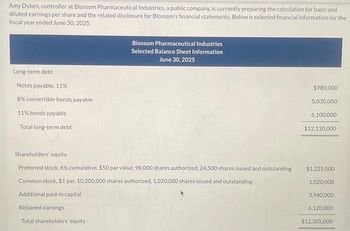

Transcribed Image Text:Amy Dyken, controller at Blossom Pharmaceutical Industries, a public company, is currently preparing the calculation for basic and

diluted earnings per share and the related disclosure for Blossom's financial statements. Below is selected financial information for the

fiscal year ended June 30, 2025.

Long-term debt

Notes payable, 11%

8% convertible bonds payable

11% bonds payable

Total long-term debt

Blossom Pharmaceutical Industries

Selected Balance Sheet Information

June 30, 2025

Shareholders' equity

Preferred stock, 6% cumulative, $50 par value, 98,000 shares authorized, 24,500 shares issued and outstanding

Common stock, $1 par, 10,200,000 shares authorized, 1,020,000 shares issued and outstanding

Additional paid-in capital

Retained earnings

Total shareholders' equity

$980,000

5,030,000

6,100,000

$12,110,000

$1,225,000.

1,020,000

3,940,000

6,120,000

$12,305,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education