MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

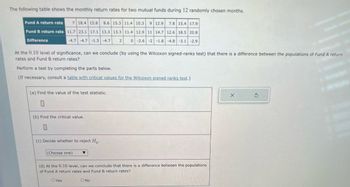

Transcribed Image Text:The following table shows the monthly return rates for two mutual funds during 12 randomly chosen months.

Fund A return rate 7 18.4 15.8 8.6 15.3 11.4 10.3 9 12.9 7.8 15.4 17.9

Fund B return rate 11.7 23.1 17.1 13.3 13.3 11.4 12.9 11 14.7 12.6 18.5 20.8

Difference

-4.7 -4.7 -1.3 -4.7 2 0 -2.6 -2 -1.8 -4.8 -3.1 -2.9

At the 0.10 level of significance, can we conclude (by using the Wilcoxon signed-ranks test) that there is a difference between the populations of Fund A return

rates and Fund B return rates?

Perform a test by completing the parts below.

(If necessary, consult a table with critical values for the Wilcoxon signed ranks test.)

(a) Find the value of the test statistic.

☐

(b) Find the critical value.

☐

(c) Decide whether to reject Ho

(Choose one)

(d) At the 0.10 level, can we conclude that there is a difference between the populations.

of Fund A return rates and Fund B return rates?

X

O Yes

O No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider the following. My recent marketing idea, the Miracle Algae Growing Kit, has been remarkably successful, with monthly sales growing by 7% every 6 months over the past 4 years. Assuming that I sold 100 kits the first month, how many kits did I sell in the first month of this year? Determine the following values given that FV = PV(1 + i)", where FV and PV are measured in kits and time is measured in 6 month periods. PV = i = n = Solve for FV. (Round your answer to the nearest whole number.) FV = How many kits did I sell in the first month of this year? kitsarrow_forwardA stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 65.03 — 2 71.90 $ .74 3 77.70 .79 4 63.97 .85 5 74.51 .94 6 86.75 1.01 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe following problem refers to the stock table for ABC Inc. (a tire company) given below. Use the stock table to answer the following questions. Where necessary, round the dollar amounts to the nearest cent. 52-Week Yld Vol Net High Low Stock SYM Div % PE 100s Hi Lo Close Chg 80.69 45.87 ABC Inc. ABC 2.99 1.5 17 5915 58.50 57.51 58.12 +1.41 ..... a. What were the high and low prices for a share for the past 52 weeks? High price: $ Low price: $arrow_forward

- 7. Calculate the simple interest earned on a $2000 investment at 3.5% per year if the investment period is 6 months. a.$34.50 b.$34.66 c.$420 d.$35.00arrow_forwardThe discount rate set by the central bank of Romulus for the past 6 quarters is shown below: Quarter Discount Rate Quarter Discount Rate 1 10.0% 4 8.5% 2 10.5% 5 9.6% 3 11.4% 6. 11.5% The median is closest to: A. 10.25%. B. 10.50%. C. 11.25%.arrow_forwardBREČMBC9 10.11.TB.014. DETAILS What is-the rate of interest on a loan of $2,000, for 286 days, if the amount of interest is $109.70, using the exact interest method? (Round your answer to the nearest tenth percent.) O 5.5% O 6.9% O 7.0% O 14.2%arrow_forward

- There is a 0.9991 probability that a randomly selected 33-year-old male lives through the year. A life insurance company charges $166 for insuring that the male will live through the year. If the male does not survive the year, the policy pays out $100,000 as a death benefit. Complete parts (a) through (c) below. a. From the perspective of the 33-year-old male, what are the monetary values corresponding to the two events of surviving the year and not surviving? The value corresponding to surviving the year is $ The value corresponding to not surviving the year is $ (Type integers or decimals. Do not round.) b. If the 33-year-old male purchases the policy, what is his expected value? The expected value is $ (Round to the nearest cent as needed.) c. Can the insurance company expect to make a profit from many such policies? Why? because the insurance company expects to make an average profit of $ on every 33-year-old male it insures for 1 year. (Round to the nearest cent as needed.)arrow_forward5. Vincent had these daily balances on his credit card for his last billing period. He did not pay the card in full the previous month, so he will have to pay a finance charge. The APR is 19.2%. 9 days @ $778.12 8 days @ $1,876.00 4 days @ $2,112.50 10 days @ $1,544.31arrow_forwardKier Company issued $740,000 in bonds on January 1, Year 1. The bonds were issued at face value and carried a 3-year term to maturity. They had a 5.50% stated rate of interest that was payable in cash on December 31st. Based on this information alone, the amount of interest expense shown on the December 31, Year 1 income statement and the cash flow from operating activities shown on the December 31, Year 1 statement of cash flows would be: Interest Expense Cash Outflow A. $40,700 zero B. zero $40,700 C. $40,700 $40,700 D. zero zero Multiple Choice Choice A Choice B Choice C Choice Darrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman