Principles Of Marketing

17th Edition

ISBN: 9780134492513

Author: Kotler, Philip, Armstrong, Gary (gary M.)

Publisher: Pearson Higher Education,

expand_more

expand_more

format_list_bulleted

Question

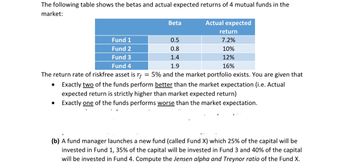

Transcribed Image Text:The following table shows the betas and actual expected returns of 4 mutual funds in the

market:

●

Fund 1

Fund 2

Fund 3

Fund 4

●

Beta

0.5

0.8

1.4

1.9

Actual expected

The return rate of riskfree asset is rf = 5% and the market portfolio exists. You are given that

Exactly two of the funds perform better than the market expectation (i.e. Actual

expected return is strictly higher than market expected return)

Exactly one of the funds performs worse than the market expectation.

return

7.2%

10%

12%

16%

(b) A fund manager launches a new fund (called Fund X) which 25% of the capital will be

invested in Fund 1, 35% of the capital will be invested in Fund 3 and 40% of the capital

will be invested in Fund 4. Compute the Jensen alpha and Treynor ratio of the Fund X.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Daniel Grady is the financial advisor for a number of professional athletes. An analysis of the long-term goals for many of these athletes has resulted in a recommendation to purchase stocks with some of their income that is set aside for investments. Five stocks have been identified as having very favorable expectations for future performance. Although the expected return is important in these investments, the risk, as measured by the beta of the stock, is also important. (A high value of beta indicates that the stock has a relatively high risk.) The expected return and the betas for five stocks are as follows: Stock 1 2 3 4 5 Expected Return (%) 11.0 9.0 6.5 15.0 13.0 Beta 1.20 0.85 0.55 1.40 1.25 Daniel would like to minimize the beta of the stock portfolio (calculated using a weighted average of the amounts put into the different stocks) while maintaining an expected return of at least 11%. Since future conditions may change, Daniel…arrow_forwardLarge-scale integrated (LSI) circuit chips are made in one department of an electronics firm. These chips are incorporated into analog devices that are then encased in epoxy. The yield is not particularly good for LSI manufacture, so the AQL specified by that department is 0.15 while the LTPD acceptable by the assembly department is 0.40. Assume the company is willing to accept a consumer's risk of 10 percent and a producer's risk of 5 percent. Find the sample size. Use Exhibit 10.16. Note: if the exact value of the computed LTPD ÷ AOQ ratio does not appear in Exhibit 10.16, use the next higher ratio. Note: Round up your answer to the next whole number. How would you tell someone to do the test?arrow_forwardConsider the case where the left tail of the implied distribution is thinner than that of the log-normal distribution and the right tail of the implied distribution is fatter than that of the log-normal distribution with the same mean and standard deviation. Which of the following statements is correct? A) The implied volatility of a deep out-of-the money put is greater than the one obtained from the Black-Scholes price. B) The implied volatility decreases as the strike price increases. C) The implied volatility of a deep out-of-the money call is smaller than the one obtained from the Black-Scholes price. D) The implied volatility increases as the strike price increases. Please explain and justify your choice. In your answer, discuss the shape of the relation of implied volatility to the strike price and explain how this is obtained.arrow_forward

- why we developed new probability distribution day by day from transformations?arrow_forwardWhich of the following statements is correct for the Black-Scholes model? A) The price of an American call written on a stock is: c = SN(d1)-Ke-rTN(d2) B) The stock price at a future point in time follows a log-normal distribution. C) The continuously compounded return on the stock follows a log-normal distribution. D) Black-Scholes prices may allow for arbitrage opportunities. Please explain and justify your choice.arrow_forwardFill in the P(X=x) values to give a legitimate probability distribution for the discrete random variable X, whose possible values are -3, 0, 4, 5, and 6. Value x of X P (X = x) -3 0 0.23 5 0.17 6 0.30arrow_forward

- Markov process models can be used to describe the probability that a consumer purchasing brand A in one time period 1.will sell brand A in the next period 2. all of the answers are correct. 3.will sell brand A after three time periods 4. will not purchase brand A in the next periodarrow_forwardSuppose the equilibrium price for good quality used cars is $20,000. And the equilibrium price for poor quality used cars is $10,000. Assume a potential used car buyer has imperfect information as to the condition of any given used car. Assume this potential buyer believes the probability a given used car is good quality is .60 and the probability a given used car is low quality is .40. Assume the seller has perfect information on all cars in inventory. If the seller sells the buyer a good quality car, what is the net-benefit to the seller? a. A net gain of $4,000. b. A net gain of $20,000. c. A net loss of $4,000. d. A net loss of $10,000.arrow_forward46. You are making several runs of a simulation model,each with a different value of some decision variable(such as the order quantity in the Walton calendarmodel), to see which decision value achieves thelargest mean profit. Is it possible that one value beatsanother simply by random luck? What can you do tominimize the chance of a “better” value losing out toa “poorer” value?arrow_forward

- Yearly Sales data for a product is given in Table SS Table SS (Yearly Sales) Sales (S) P(S) 120 0.12 140 0.25 160 0.17 180 0.25 200 0.09 220 0.12 Using the data in Table SS and the random numbers, 0.06, 0.10, 0.87, 0.14, 0.86, 0.32 the correct simulation of sales for 6 years is given by which of the following: IV 120 140 200 II II 120 120 120 200 120 120 120 200 200 140 180 180 140 200 140 140 180 180 140 140 140 Select one: O a. l O b. II Oc. II O d. IV 10:47 AM Ca D) ENG 12/16/2021 29°Carrow_forwardUnder normal liquidity management, deposit drains and loan commitment disbursement should not cause any major concerns for the financial institution. Major liquidity problems can arise where deposit drains are abnormally large; unexpected abnormal deposit drains (shocks) these may occur for all of the following reasons EXCEPT: a. The recent bankruptcy of a domestic bank sparks fear amoung depositors of a possible similar occurrence at another financial institution. b. Speculations of ongoing liquidity problems of a particular financial institution compared to its competitors´. c. The sudden withdrawal of funds by a significant number of depositors due to a major financial crisis taking place in the local economy. d. The sudden change in preference by investors from holding stocks and bonds to certain bank related deposits instruments.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education,

Principles Of MarketingMarketingISBN:9780134492513Author:Kotler, Philip, Armstrong, Gary (gary M.)Publisher:Pearson Higher Education, MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education

MarketingMarketingISBN:9781259924040Author:Roger A. Kerin, Steven W. HartleyPublisher:McGraw-Hill Education Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning

Foundations of Business (MindTap Course List)MarketingISBN:9781337386920Author:William M. Pride, Robert J. Hughes, Jack R. KapoorPublisher:Cengage Learning Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Marketing: An Introduction (13th Edition)MarketingISBN:9780134149530Author:Gary Armstrong, Philip KotlerPublisher:PEARSON

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Principles Of Marketing

Marketing

ISBN:9780134492513

Author:Kotler, Philip, Armstrong, Gary (gary M.)

Publisher:Pearson Higher Education,

Marketing

Marketing

ISBN:9781259924040

Author:Roger A. Kerin, Steven W. Hartley

Publisher:McGraw-Hill Education

Foundations of Business (MindTap Course List)

Marketing

ISBN:9781337386920

Author:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:Cengage Learning

Marketing: An Introduction (13th Edition)

Marketing

ISBN:9780134149530

Author:Gary Armstrong, Philip Kotler

Publisher:PEARSON

Contemporary Marketing

Marketing

ISBN:9780357033777

Author:Louis E. Boone, David L. Kurtz

Publisher:Cengage Learning