Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

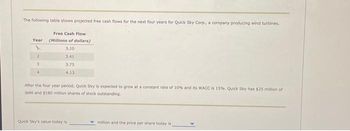

Transcribed Image Text:The following table shows projected free cash flows for the next four years for Quick Sky Corp., a company producing wind turbines.

Year

2

2

3

Free Cash Flow

(Millions of dollars)

3.10

3.41

3.75

4.13

After the four year period, Quick Sky is expected to grow at a constant rate of 10% and its WACC is 15%. Quick Sky has $25 million of

debt and $180 million shares of stock outstanding.

Quick Sky's value today is

million and the price per share today is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- A project generates 10 years of cash flows. The cash flow for the first year is 100,000. For the remaining years cash flows are projected to grow at a rate of 3%. The required initial investment is $250,000. Assume that the company is 100% equity finance (there is no debt in the capital structure of this company). The risk-free rate of interest of 3% and the expected market risk premium is 7%. If we assume that the beta of the firm is 0.9 when in fact the beta is really 1.5, for how much more or less (in dollars) are we valuing the investment project? Explain in words why the estimation of the value of project assuming a beta of 0.9 is incorrect. Please show excel formulasarrow_forwardMajong Inc. forecasts that it will have the free cash flows shown below. The free cash flows are expected to grow by 5% per year after year 3. Year 1 2 3 CF (S million) - 20 48 54 The weighted average cost of capital is 13%. The firm has $55 million of debt and 10 million shares outstanding. What is the firm value today (in $ million)? What is a good estimate of Majong's value per share?arrow_forwardA retail coffee company is planning to open new coffee 95 outlets that are expected to generate $13.3 million in free cash flows per year, with a growth rate of 3.3% in perpetuity. If the coffee company's WACC is 10.6%, what is the NPV of this expansion?arrow_forward

- A cash flow of $25,000 is paid 30 times per year for the next 52 years. The NAR53 is 30%. What is the present value of this series? Empty Excel Sheet For Calculations $2,332,649.44 $4,332,549.44 $4,331,549.44 $2,494,589.15arrow_forwardGumtree Ltd will invest in an asset that is currently trading at $171,000. This is expected to generate a quarterly cash flow that grows at a constant rate of 6% p.a. compounded quarterly forever. The expected cost of capital is 10%p.a. compounded annually. How much would the first cash flow be from such an asset? Group of answer choices a. $1,107.52 b. $1,789.65 с. $1,558.44 d. $1,324.61 e. $1,961.37arrow_forwardPraxis Corp. is expected to generate a free cash flow (FCF) of $5,670.00 million this year (FCF, = $5,670.00 million), and the FCF is expected to grow at a rate of 22.60% over the following two years (FCF, and FCF). After the third year, however, the FCF is expected to grow at a constant rate of 3.18% per year, which will last forever (FCF). Assume the firm has no nonoperating assets. If Praxis Corp.'s weighted average cost of capital (WACC) is 9.54%, what is the current total firm value of Praxis Corp.? (Note: Round all intermediate calculations to two decimal places.) $155,715.35 million O $17,453.56 million $122,645.86 million $147,175.03 million Praxis Corp.'s debt has a market value of $91,984 million, and Praxis Corp. has no preferred stock. If Praxis Corp. has 375 million shares of common stock outstanding, what is Praxis Corp.'s estimated intrinsic value per share of common stock? (Note: Round all intermediate calculations to two decimal places.) $81.76 $80.76 $89.94 $245.29arrow_forward

- A company projects a rate of return of 20% on new projects. The executive team plan to plow back 20% of all earnings into the firm. Earnings this year will be $6 per share, and investors expect a rate of return of 12% on stocks facing the same risks as the company. 1) what is the sustainable growth rate 2) what is the stock price 3) What is the present value growth opportunities 4) what is the P/E ration 5) what would the price and PE ratio be if the firm paid out all earnings as dividends?arrow_forwardA retail coffee company is planning to open 95 new coffee outlets that are expected to generate $15.5 million in free cash flows per year, with a growth rate of 3.2% in perpetuity. If the coffee company's WACC is 10.7%, what is the NPV of this expansion? The present value of the free cash flows is $ __ million ? (Round to two decimal places.)arrow_forwardThe following are the projected cash flows to the firm over the next five years: Year Cash Flows to the Firm (Million) 1 $120 2 $145 3 $176 4 $199 5 $245 The firm has a cost of capital (WACC )of 12% and the cash flows are expected to grow at the rate of 4% in perpetuity? a) What is the value of the firm today? b) At what growth rate will the firm have a value of $3000 Million? Solution in excel pleasearrow_forward

- Wild Berry (WB) will remain in business for one more year. At the end of next year, the firm will generate a liquidating cash flow of S370M in a boom year and S150M in a recession year; both states are equally likely. The cost of equity for the unlevered firm is rU = 10%. The firm's outstanding debt matures in a year and has amarket (and book) value of S150M today. The interest payment on this debt is S15M at the end of next year. The corporate tax is ?c = 35%. Corporate taxes is the only relevant market imperfection. 23. What s WB's value as an unlevered firm (VU )2 (A)5 236.4M (8)S 260.0M (€)5336.4M (D) $370.0Marrow_forwardWhat is the cash cow value and the value of its growth opportunities (NPVGO) if a corporation has current earnings of $5 per share and expects to be able to make an investment of 20% of its earnings next year in a new one-time project with an expected return on invested capital of 24%? The discount rate for the firm is 8%. Cash cow value is $62.50 and NPVGO is $1.85 Cash cow value is $20.83 and NPVGO is $2 Cash cow value is $62.50 and NPVGO is $14 Cash cow value is $25.00 and NPVGO is $3 Cash cow value is $25.00 and NPVGO is $3arrow_forward#5!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education