MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

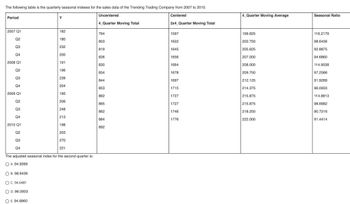

Transcribed Image Text:The following table is the quarterly seasonal indexes for the sales data of the Trending Trading Company from 2007 to 2010.

Uncentered

Centered

4 Quarter Moving Total

2x4 Quarter Moving Total

Period

2007 Q1

Q2

Q3

Q4

2008 Q1

Q2

Q3

Q4

2009 Q1

Q2

Q3

Q4

2010 Q1

Q2

2 88

Q3

Q4

Y

OE. 94.6860

182

180

232

200

191

196

239

204

195

206

248

213

198

270

221

The adjusted seasonal index for the second quarter is:

OA. 94.9269

OB. 98.6436

OC. 94.6481

D. 96.0933

203

794

803

819

826

830

834

844

853

862

865

862

884

892

1597

1622

1645

1656

1664

1678

1697

1715

1727

1727

1746

1776

4 Quarter Moving Average

199.625

202.750

205.625

207.000

208.000

209.750

212.125

214.375

215.875

215.875

218.250

222.000

Seasonal Ratio

116.2179

98.6436

92.8875

94.6860

114.9038

97.2586

91.9269

96.0933

114.8813

98.6682

90.7216

91.4414

Transcribed Image Text:In an ever-changing economy, the price of fuel is never constant for too long. The following table shows the average prices and quantities sold of petrol and diesel for June 2012 and June 2014 in the Western Cape.

Jun-12

Jun-14

Quantity sold Price Quantity sold

(millions of litres) (Rand) (millions of litres)

1698

9.83

1744

1406

10.80

1489

Fuel

Petrol

Diesel

If the base year is 2012, find the Laspeyres Price Index. Round off to four decimals.

O A. 95.9410

B. 104.0966

Price

(Rands)

8.27

7.67

O C. 77.7839

O D. 77.8842

Expert Solution

arrow_forward

Step 1

Solution:

According to the guidelines first question should be answered when there are multiple questions asked. In case the remaining questions are needed please repost them as separately.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- What is the relationship between the geometric average rate of return and compound interest?arrow_forwardThe following problem refers to the stock table for ABC Inc. (a tire company) given below. Use the stock table to answer the following questions. Where necessary, round the dollar amounts to the nearest cent. 52-Week Yld Vol Net High Low Stock SYM Div % PE 100s Hi Lo Close Chg 80.69 45.87 ABC Inc. ABC 2.99 1.5 17 5915 58.50 57.51 58.12 +1.41 ..... a. What were the high and low prices for a share for the past 52 weeks? High price: $ Low price: $arrow_forwardIf my bus is 3.5 years old, what are the projected annual maintenance costs? (Enter a whole number) Age of Bus(years)Annual Maintenance Cost($)2.4 3502.3 3702.4 4803.1 5203 5905.8 5504.8 7503.8 8003.6 7904.9 9505.5 915arrow_forward

- For the following cash flow, use the interpolation technique to compute the interest rate at which the $240 cost is equivalent to the subsequent benefits. Year 0 1 Cash Flow -240 75 2 95 3 100 4 85arrow_forwardThe accompanying data represent the annual rates of return of two companies' stock for the past 12 years. Complete parts (a) through (k). O A. OB. 0.50- 0.50- 0.00- 0.00- -0.50- -0.50- -0.3 RR of Company 2 0.0 0.3 -0.3 0.0 0.3 RR of Company 1 OC. 0.30- 0.50- 0.00- 0.00- -0.30- -0.50- o.0 0'5 0.0 0.3 -0.5 RR of Company 2 0.5 -0.3 RR of Company 1 (b) Determine the correlation coefficient between rate of return of Company 1 and Company 2. The correlation coefficient is 0.966. (Round to three decimal places as needed.) (c) Based on the scatter diagram and correlation coefficient, is there a linear relation between rate of return of Company 1 and Company 2? Yes No (d) Find the least-squares regression line treating the rate of return of Company 1 as the explanatory variable. y=x+O (Round to four decimal places as needed.) RR of Company 1 RR of Company 1 RR of Company 2 RR of Company 2arrow_forwardPlease Answer 3 Sub Parts the question and no Reject.... Thank uarrow_forward

- Monthly Sales 6267.19 7058.06 7119.5 7147.18 7198.52 7298.09 7325.7 7335.68 7355.97 7481.05 7490.23 7530.08 7616.09 7682.69 7684.14 7704.12 7704.98 7779.28 7798.23 7815.15 7844.16 7890.21 7977.6 7993.16 8021.03 8028.37 8068.86 8082.42 8096.17 8119.25 8129.21 8190.68 8255.28 8282.44 8376.31 8392.4 8400.95 8451.16 8456.66 8505.35 8539.25 8543.65 8573.05 8641.78 8667.48 8751.08 8777.97 8800.08 8888.65 8907.03 9096.87 9241.74 9411.68 9450.73 9484.62 9514.57 9521.4 9524.91 9733.44 10123.24 Given the company’s performance record and based on the empirical rule of normal distribution (also known as the 68%-95%-99.7% rule), what would be the lower bound of the range of sales values that contains 68% of the monthly sales? What would be the upper bound of the range of sales values that contains 68% of the monthly sales?arrow_forwardNjarrow_forwardVirginia Community College Syst X N Quiz: Quiz 2 - Unit 3 s/355859/quizzes/2912611/take Year CPI 2009 214.5 2010 218.1 2011 224.9 2012 229.6 2013 233.0 2014 236.7 2015 237.0 2016 240.0 Calculate the rate of inflation from 2011 to 2016. (round to the nearest tenth of a percent)arrow_forward

- The following investment requires a table factor for a period beyond the table. Calculate the new table factor and the present value (principal). Use Table 11-2. Round your new table factor to five decimal places and your present value to the nearest cent. CompoundAmount Term ofInvestment (years) NominalRate (%) InterestCompounded New TableFactor PresentValue $36,000 36 7 annually $arrow_forwardThe following data were taken from Miller Company's balance sheet: Dec. 31, Year 2 Dec. 31, Year 1 Total liabilities $150,000 $105,000 Total stockholders' equity 75,000 60,000 a. Compute the ratio of liabilities to stockholders' equity. Round your answers to one decimal place. Liabilities toStockholders' Equity 12/31/Year 2: fill in the blank 1 12/31/Year 1: fill in the blank 2 b. Has the creditors' risk increased or decreased from December 31, Year 1, to December 31, Year 2?arrow_forwardSuppose that a firm's sales were $3,750,000 five years ago and are $5,250,000 today. What was the geometric mean growth rate in sales over the past five years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman