FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

| Purchase related transactions the following selected transactions were completed by epic co-during |

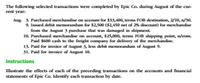

Transcribed Image Text:The following selected transactions were completed by Epic Co, during August of the cur-

rent year:

Aug. 3. Purchased merchandise on account for $33,400, terms FOB destination, 2/10, n/30.

9. Issued debit memorandum for $2,500 (S2,450 net of % discount) for merchandise

from the August 3 purchase that was damaged in shipment

10. Purchased merchandise on account, $25,000, terms FOB shipping point, n/eom.

Paid $600 cash to the freight company for delivery of the merchandise.

13. Paid for invoice of August 3, less debit memorandum of August 9.

31. Paid for imoice of Auguast 10.

Instructions

Illustrate the effects of cach of the preceding transactions on the accounts and financial

statements of Epic Co. Identify cach transaction by date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- match each item with one of the 6 classifications listed below:arrow_forwardA company paid $660,000 cash to buy a group of plant assets. An independent appraiser assigned the following values to the assets acquired: Land Building Equipment Total $ 297,500 382,500 170,000 $ 850,000 Prepare the journal entry to record the acquisition of these assets. Note: Round answers to the nearest whole dollar amount. View transaction list Journal entry worksheetarrow_forwardpurchase on account on effect on current ratioarrow_forward

- 2 In the current year, Company A made the following cash purchases: 1. The exclusive right to manufacture and sell equipment from Company B for $210,000. Company B created the unique design for the equipment. Company A also paid an additional $15,000 in legal and filing fees to attorneys to complete the transaction. 2. An initial fee of $295,000 for a three-year agreement with Company C to use its name for a new facility in the local area. Company C has locations throughout the country. Company A is required to pay an additional fee of $6,000 for each month it operates under the Company C name, with payments beginning in March of the current year. Company A also purchased $410,000 of equipment to be placed in the new facility. 3. The exclusive right to sell a book, for $29,000. Required: Prepare a summary journal entry to record expenditures related to initial acquisitions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account…arrow_forwardListed below are selected examples of transactions related to the purchase and sale of inventory from the perspective of the seller or the buyer as indicated. Assume a perpetual inventory system is in use. 1. N 2. 3. 4. 5. 6. 7. 8. 9. 10. 3. For each of the above transactions, indicate (a) the basic type (asset, liability, revenue, or expense) of each account to be debited and credited; (b) the specific name(s) of the account(s) to debit and credit (for example, Inventory); and (c) whether each account is increased (+) or decreased (-) and by what amount. The first one has been done for you as an example. (Enter specific debited account items in alphabetical order. Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses e.g. (45).) 4. (a) Item Basic Type of Account 1. Asset 2. 5. 6. 7. 8. Buyer: Purchase of $2,940 of inventory for cash. Buyer: Return of $630 of inventory to seller for credit on account. Buyer: Purchase of $3,360 of inventory on…arrow_forwardThe trade discount on purchases is recorded A. O When it is received B.When the inventory is purchased C.When the inventory is sold D. O Not at all recorded in the booksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education