FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

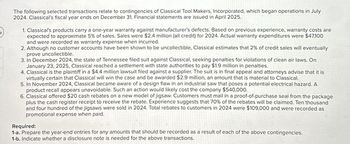

Transcribed Image Text:The following selected transactions relate to contingencies of Classical Tool Makers, Incorporated, which began operations in July

2024. Classical's fiscal year ends on December 31. Financial statements are issued in April 2025.

1. Classical's products carry a one-year warranty against manufacturer's defects. Based on previous experience, warranty costs are

expected to approximate 5% of sales. Sales were $2.4 million (all credit) for 2024. Actual warranty expenditures were $47,100

and were recorded as warranty expense when incurred.

2. Although no customer accounts have been shown to be uncollectible, Classical estimates that 2% of credit sales will eventually

prove uncollectible.

3. In December 2024, the state of Tennessee filed suit against Classical, seeking penalties for violations of clean air laws. On

January 23, 2025, Classical reached a settlement with state authorities to pay $1.9 million in penalties.

4. Classical is the plaintiff in a $4.4 million lawsuit filed against a supplier. The suit is in final appeal and attorneys advise that it is

virtually certain that Classical will win the case and be awarded $2.9 million, an amount that is material to Classical.

5. In November 2024, Classical became aware of a design flaw in an industrial saw that poses a potential electrical hazard. A

product recall appears unavoidable. Such an action would likely cost the company $540,000.

6. Classical offered $20 cash rebates on a new model of jigsaw. Customers must mail in a proof-of-purchase seal from the package

plus the cash register receipt to receive the rebate. Experience suggests that 70% of the rebates will be claimed. Ten thousand

and four hundred of the jigsaws were sold in 2024. Total rebates to customers in 2024 were $109,000 and were recorded as

promotional expense when paid.

Required:

1-a. Prepare the year-end entries for any amounts that should be recorded as a result of each of the above contingencies.

1-b. Indicate whether a disclosure note is needed for the above transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Farrow_forwardSunnyvale Computer Company sells a line of computers that carry a six-month warranty. Customers are offered the opportunity to buy a two-year extended warranty for an additional charge. During 2024, Sunnyvale received $328,000 from customers for these extended warranties. All sales are on credit, and funds are received evenly throughout the year and the warranties go into effect immediately after purchase. Required: Prepare a summary journal entry to record sales of the extended warranties. Also prepare any other entries associated with the warranties that should be recorded during 2024. 1. Record the $328,000 sale of the extended warranties. 2.Record the recognition of revenue from extended warranties for the year ending December 31, 2024.arrow_forwardConcord Ltd. manufactures a line of amplifiers that carry a three-year warranty against defects. Based on experience, the estimated warranty costs related to dollar sales are as follows: first year after sale-2% of sales; second year after sale-4% of sales; and third year after sale-5% of sales. Sales and actual warranty expenditures for the first three years of business were: Sales Warranty Expenditures 2021 $750,000 $ 15,900 2022 1,010,000 46, 000 2023 1,017, 000 80,000 (a) Calculate the amount that Concord should report as warranty expense on its 2023 income statement and as a warranty liability on its December 31, 2023 SFP using the assurance - type warranty (expense - based approach). Assume that all sales are made evenly throughout each year and that warranty expenditures are also evenly spaced according to the rates above. Warranty expense Warranty liabilityarrow_forward

- Flint Company sells products with a 2-year warranty. Past experience indicates that 2% of the units sold will be returned during the warranty period for repairs. The average cost of repairs under warranty is estimated to be $85 per unit. During 2020, 8,450 units were sold at an average price of $400. During the year, repairs were made on 55 units at a cost of $3,600. Prepare journal entries to record the repairs made under warranty and estimated warranty expense for the year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Warranty Expense (To record cost of honoring warranties) Warranty Expense Warranty Liability (To accrue estimated warranty costs) Debit 3600 Credit 3600arrow_forwardPrecision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.4 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries on October 1, 2024, to record (a) the…arrow_forwardIvanhoe Factory provides a 2-year warranty with one of its products which was first sold in 2020. Ivanhoe sold $909,800 of products subject to the warranty. Ivanhoe expects $124,480 of warranty costs over the next 2 years. In that year, Ivanhoe spent $73,090 servicing warranty claims. Prepare Ivanhoe's journal entry to record the sales (ignore cost of goods sold) and the December 31 adjusting entry, assuming the expenditures are inventory costs. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date 2020 During 2020 12/31/20 Account Titles and Explanation (To record sales) (To record warranty claims) Debit Creditarrow_forward

- Catskills guarantees its snowmobiles for three years. Company experience indicates that warranty costs will be approximately 7% of sales. Assume that the Catskills dealer in Colorado Springs made sales totaling $450,000 during 2018. The company received cash for 10% of the sales and notes receivable for the remainder. Warranty payments totaled$12,000 during 2018. Requirements: 1. Record the sales, warranty expense, and warranty payments for the company. Ignore cost of goods sold. 2. Assume the Estimated Warranty Payable is $0 on January 1, 20182018. Post the 2018transactions to the Estimated Warranty Payable T-account. At the end of 2018,how much in Estimated Warranty Payable does the company owe?arrow_forwardGrouper Ltd. manufactures a line of amplifiers that carry a three-year warranty against defects. Based on experience, the estimated warranty costs related to dollar sales are as follows: first year after sale-3% of sales; second year after sale-4% of sales; and third year after sale-5% of sales. Sales and actual warranty expenditures for the first three years of business were: Sales Warranty Expenditures 2021 $870,000 $17,100 2022 1,010,000 48,400 2023 1,041,000 80,000 (a) Calculate the amount that Grouper should report as warranty expense on its 2023 income statement and as a warranty liability on its December 31, 2023 SFP using the assurance-type warranty (expense-based approach). Assume that all sales are made evenly throughout each year and that warranty expenditures are also evenly spaced according to the rates above. Warranty expense $ Warranty liability $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education