FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

what is the solution?

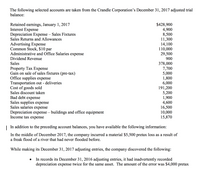

Transcribed Image Text:The following selected accounts are taken from the Crandle Corporation's December 31, 2017 adjusted trial

balance:

Retained earnings, January 1, 2017

Interest Expense

Depreciation Expense – Sales Fixtures

Sales Returns and Allowances

$428,900

4,900

8,500

11,300

14,100

110,000

29,500

Advertising Expense

Common Stock, $10 par

Administrative and Office Salaries expense

Dividend Revenue

900

378,000

7,700

5,000

1,800

6,000

191,200

5,200

1,900

4,600

16,500

10,000

15,870

Sales

Property Tax Expense

Gain on sale of sales fixtures (pre-tax)

Office supplies expense

Transportation out - deliveries

Cost of goods sold

Sales discount taken

Bad debt expense

Sales supplies expense

Sales salaries expense

Depreciation expense – buildings and office equipment

Income tax expense

| In addition to the preceding account balances, you have available the following information:

In the middle of December 2017, the company incurred a material $5,500 pretax loss as a result of

a freak flood of a river that had never flooded before.

While making its December 31, 2017 adjusting entries, the company discovered the following:

In records its December 31, 2016 adjusting entries, it had inadvertently recorded

depreciation expense twice for the same asset. The amount of the error was $4,000 pretax

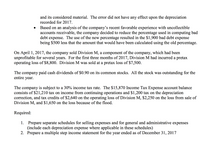

Transcribed Image Text:and its considered material. The error did not have any effect upon the depreciation

recorded for 2017.

Based on an analysis of the company's recent favorable experience with uncollectible

accounts receivable, the company decided to reduce the percentage used in computing bad

debt expense. The use of the new percentage resulted in the $1,900 bad debt expense

being $500 less that the amount that would have been calculated using the old percentage.

On April 1, 2017, the company sold Division M, a component of the company, which had been

unprofitable for several years. For the first three months of 2017, Division M had incurred a pretax

operating loss of $8,800. Division M was sold at a pretax loss of $7,500.

The company paid cash dividends of $0.90 on its common stocks. All the stock was outstanding for the

entire year.

The company is subject to a 30% income tax rate. The $15,870 Income Tax Expense account balance

consists of $21,210 tax on income from continuing operations and $1,200 tax on the depreciation

correction, and tax credits of $2,640 on the operating loss of Division M, $2,250 on the loss from sale of

Division M, and $1,650 on the loss because of the flood.

Required:

1. Prepare separate schedules for selling expenses and for general and administrative expenses

(include each depreciation expense where applicable in these schedules)

2. Prepare a multiple step income statement for the year ended as of December 31, 2017

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education