FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

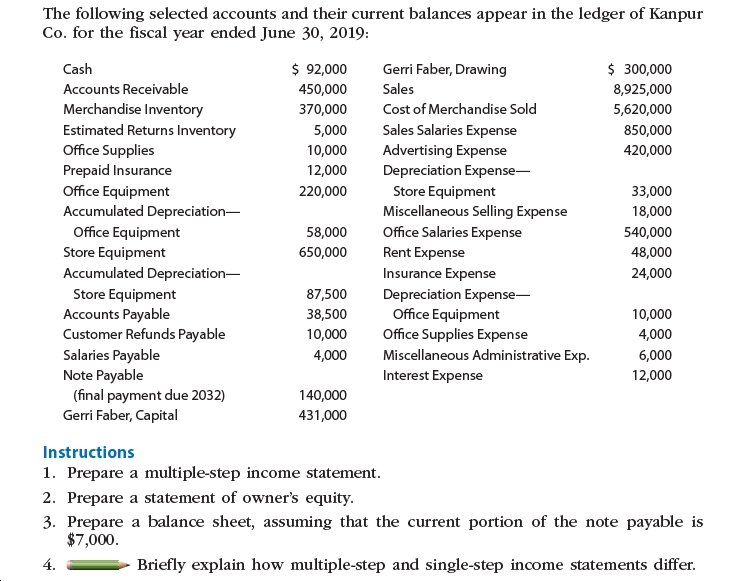

Selected accounts and related amounts for Kanpur Co. for the fiscal year ended June 30, 2019, are presented in Problem 6-5B.

Instructions

1. Prepare a single-step income statement in the format shown in Exhibit 12.

2. Prepare closing entries as of June 30, 2019.

Transcribed Image Text:The following selected accounts and their current balances appear in the ledger of Kanpur

Co. for the fiscal year ended June 30, 2019:

$ 92,000

$ 300,000

8,925,000

Gerri Faber, Drawing

Cash

Accounts Receivable

Sales

450,000

Merchandise Inventory

Estimated Returns Inventory

Office Supplies

Prepaid Insurance

Office Equipment

Accumulated Depreciation-

Office Equipment

Store Equipment

Accumulated Depreciation-

370,000

Cost of Merchandise Sold

5,620,000

Sales Salaries Expense

5,000

850,000

Advertising Expense

10,000

420,000

12,000

Depreciation Expense-

220,000

Store Equipment

Miscellaneous Selling Expense

Office Salaries Expense

Rent Expense

33,000

18,000

58,000

540,000

48,000

650,000

Insurance Expense

24,000

Store Equipment

87,500

Depreciation Expense-

Accounts Payable

Customer Refunds Payable

Salaries Payable

Note Payable

(final payment due 2032)

Gerri Faber, Capital

Office Equipment

Office Supplies Expense

Miscellaneous Administrative Exp.

38,500

10,000

10,000

4,000

4,000

6,000

Interest Expense

12,000

140,000

431,000

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a statement of owner's equity.

3. Prepare a balance sheet, assuming that the current portion of the note payable is

$7,000.

4.

Briefly explain how multiple-step and single-step income statements differ.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

what is Gerri Faber, Capital

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

what is Gerri Faber, Capital

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Planning Wizards, LLC is an event-planning company. Which of the following would be included in the current asset section of a classified balance sheet dated December 31, 2019? a. 15-month certificate of deposit b. Customer advances on New Year's parties c. Last month rent payment (lease expires in 2021) d. Investment in stocks, to be sold in 2020 e. Income tax refund receivable f. Inventory Select one: d, e, and f e and f a, b, c, e, and f a, b, c, d, e, and f b, e, farrow_forwardSweet home Inc., includes the following selected accounts in its general ledger at December 31, screenshot attacahed thanks fas fakopearrow_forwardHow are open encumbrances at year-end reported in the financial statements?arrow_forward

- Assume that Lululemon Athletica Inc. reported the following summarized data at December 31, 2020. Accounts appear in no particular order. Revenues: $275, Other Liabilities: $38, Other assets: $101, Cash and other Current assets: 53, Accounts Payable: $5, Expenses: $244, Shareholder's equity: $80. Prepare the Trail Balance of Lululemon at December 31,2020. List the accounts in proper order, as shown on "in class" practice. How much was Lululemon's net income or net loss?arrow_forwardFollowing are selected accounts for Best Buy, Inc., for the fiscal year ended February 2, 2019. (a) Indicate whether each account appears on the balance sheet (B) or income statement (I). Best Buy, Inc. ($ millions)Amount Classification Sales $42,879 Answer B I Accumulated depreciation 6,690 Answer B I Depreciation expense 770 Answer B I Retained earnings 2,985 Answer B I Net income 1,464 Answer B I Property, plant & equipment, net 2,510 Answer B I Selling, general and admin expense 8,015 Answer B I Accounts receivable 1,015 AnswerB I Total liabilities 9,595 Answer B I Stockholders' equity 3,306 Answer B I (b) Using the data, compute total assets and total expenses. Total Assets Answer Total Expenses Answer answer complete and correct and in detail with all workarrow_forwardByrd Company had the following transactions during 2019 and 2020: 1. Prepare the journal entries for Byrd for both 2019 and 2020. Assume that the net price method is used to account for the credit terms. 2. Show how the preceding items would be reported in the current liabilities section of Byrd’s December 31, 2019, balance sheet. 3. Next Level Assuming Byrd’s current assets were $1,200,000 and its current ratio was 2.4 at the end of 2018, compute the current ratio at the end of 2019 (based solely on the effects of the preceding transactions).arrow_forward

- Please help mearrow_forwardLuxAll Inc., includes the following selected accounts in its general ledger at December 31, attached in ss below thanks ng wparrow_forward1.32. Creating Balance Sheets and Income Statements. Using the information in the below table, prepare a classified balance sheet for Erie Company as of December 31, 2019 and December 31, 2020, along with multi-step income statements for the years then endedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education