FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

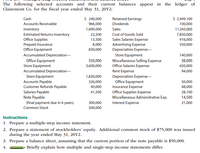

Transcribed Image Text:The following selected accounts and their current balances appear in the ledger of

Clairemont Co. for the fiscal year ended May 31, 20Y2:

$ 240,000

$ 2,949,100

Cash

Retained Earnings

Accounts Receivable

966,000

Dividends

100,000

Sales

11,343,000

Inventory

Estimated Returns Inventory

Office Supplies

Prepaid Insurance

Office Equipment

1,690,000

Cost of Goods Sold

Sales Salaries Expense

Advertising Expense

Depreciation Expense-

22,500

7,850,000

13,500

916,000

8,000

550,000

830,000

Accumulated Depreciation-

Store Equipment

140,000

Office Equipment

Store Equipment

550,000

Miscellaneous Selling Expense

Office Salaries Expense

38,000

3,600,000

650,000

Accumulated Depreciation-

Rent Expense

Depreciation Expense-

Office Equipment

94,000

Store Equipment

Accounts Payable

Customer Refunds Payable

1,820,000

326,000

50,000

40,000

48,000

Salaries Payable

Note Payable

(final payment due in 6 years)

Insurance Expense

Office Supplies Expense

Miscellaneous Administrative Exp.

41,500

28,100

14,500

300,000

Interest Expense

21,000

Common Stock

500,000

Instructions

1. Prepare a multiple-step income statement.

2. Prepare a statement of stockholders' equity. Additional common stock of $75,000 was issued

during the year ended May 31, 20Y2.

3. Prepare a balance sheet, assuming that the current portion of the note payable is $50,000.

- Briefly explain how multiple and single-step income statements differ.

4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 31, 20Y5, the balances of the accounts appearing in the ledger of Lange Daughters Inc. are as follows: Administrative Expenses $ 950,000 Inventory $ 800,000 Accumulated Dep. - Building 4,000,000 Notes Payable 900,000 Building 19,000,000 Office Supplies 50,000 Common Stock 1,000,000 Retained Earnings 12,365,000 Cash 2,970,000 Sales 17,850,000 Cost of Goods Sold 10,350,000 Selling Expenses 1,650,000 Dividends 200,000 Store Supplies 150,000 Interest Expense 45,000 Prepare a multiple-step income statement for the year ended March 31, 20Y5.arrow_forwardThe financial statements of New World, Incorporated, provide the following information for the current year: December 31 January 1 Accounts receivable $ 288,000 $ 391,500 Inventory $ 281,250 $ 267,000 Prepaid expenses $ 73,200 $ 70,500 Accounts payable (for merchandise) $ 259,800 $ 251,550 Accrued expenses payable $ 66,150 $ 79,950 Net sales $ 3,172,500 Cost of goods sold $ 1,672,500 Operating expenses (including depreciation of $64,000) $ 382,500 What is New World's net cash flow from operating activities for the current year?arrow_forwardMultiple-Step Income Statement and Report Form of Balance Sheet The following selected accounts and their current balances appear in the ledger of Kanpur Co. for the fiscal year ended June 30, 2019: Cash $120,200 Gerri Faber, Drawing $72,000 Accounts Receivable 326,200 Sales 4,344,900 Merchandise Inventory 365,300 Cost of Merchandise Sold 2,546,100 Estimated Returns Inventory 14,450 Sales Salaries Expense 716,000 Office Supplies 11,300 Advertising Expense 196,900 Prepaid Insurance 8,800 Depreciation Expense—Store Equipment 38,400 Office Equipment 264,500 Miscellaneous Selling Expense 16,800 Accumulated Depreciation—Office Equipment 179,700 Office Salaries Expense 390,900 Store Equipment 825,600 Rent Expense 57,700 Accumulated Depreciation—Store Equipment 264,500 Insurance Expense 17,900 Accounts Payable 183,000 Depreciation Expense—Office Equipment 28,900 Customer Refunds Payable 28,900 Office Supplies Expense 10,600 Salaries Payable…arrow_forward

- The following selected accounts and their current balances appear in the ledger of Druid Hills Co. for the fiscal year ended May 31, 20Y8: Cash $ 290,800 Kristina Marble, Drawing $ 121,200 Accounts Receivable 1,170,600 Sales 13,746,000 Merchandise Inventory 2,075,300 Cost of Merchandise Sold 9,513,000 Office Supplies 16,400 Sales Salaries Expense 1,110,100 Prepaid Insurance 9,700 Advertising Expense 666,500 Office Equipment 1,005,800 Depreciation Expense— Accumulated Depreciation— Store Equipment 169,700 Office Equipment 666,500 Miscellaneous Selling Expense 46,100 Store Equipment 4,362,700 Office Salaries Expense 787,700 Accumulated Depreciation— Rent Expense 113,900 Store Equipment 2,205,600 Depreciation Expense— Accounts Payable 395,100 Office Equipment 60,600 Customer Refunds Payable 48,500 Insurance Expense 58,200 Salaries Payable 50,300 Office Supplies Expense 34,100 Note Payable Miscellaneous Administrative Exp. 17,600 (final payment…arrow_forwardThe following selected account balances appeared on the financial statements of the Washington Company. Use these balances to answer the questions that follow. Accounts receivable, Jan. 1 $13,000 Accounts receivable, Dec. 31 9,000 Accounts payable, Jan. 1 4,000 Accounts payable, Dec. 31 7,000 Inventory, Jan. 1 10,000 Inventory, Dec. 31 15,000 Sales 56,000 Cost of goods sold 31,000 The Washington Company uses the direct method to calculate net cash flow from operating activities. Assume that all accounts payable are owed to merchandise suppliers. Cash collections from customers were Oa. $45,000 Ob. $56.000 Oc. $52,000 Od. $60,000arrow_forwardThe following information is available for Pharoah Company Accounts receivable $2,200 Cash $6,300 Accounts payable 4,500 Supplies 3,820 Interest payable 540 Unearned service revenue 920 Salaries and wages expense 5,000 Salaries and wages payable 760 Notes payable 32,500 Depreciation expense 670 Common stock 50,500 Equipment (net) 109,800 Inventory 2,910 Using the information above, prepare a balance sheet as of December 31, 2022. (Hint: Solve for the missing retained earnings amount after first determining total assets and total liabilities.) (List assets in order of liquidity.)arrow_forward

- The following selected account balances were taken from Buckeye Company's general ledger at January 1, 2019 and December 31, 2022: Accounts receivable Inventory Sales revenue Cost of goods sold January 1 $126,000 $163,000 The following information was taken from Buckeye Company's 2022 income statement: Salaries expense Income tax expense Net income December 31 $139,000 131,000 $967,250 $429, 240 $211,390 $ 97,986 $228,634 Calculate the average number of days that elapse between Buckeye Company buying their inventory from suppliers and then selling the inventory to customers.arrow_forward[The following information applies to the questions displayed below.] On January 1, Year 1, the general ledger of a company includes the following account balances: Debit Credit Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts $ 25,600 47,200 $ 4,700 Inventory Land 20,500 51,000 17,500 Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, Year 2) Common Stock 2,000 29,000 55,000 40,000 31,100 $161,800 Retained Earnings Totals $161,800 During January Year 1, the following transactions occur: 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date. 6 Purchase additional inventory on account, $152,000. January January January 15 The comapany sales for the first half the onth total $140,000. All of these sales are on account. The cost of the units sold is $76,300. January 23 Receive $125,900 from customers on accounts receivable. January 25 Pay $95,000 to inventory suppliers on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education