MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

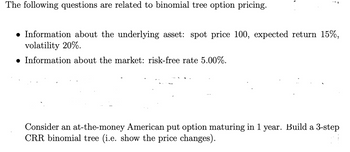

Transcribed Image Text:The following questions are related to binomial tree option pricing.

F

● Information about the underlying asset: spot price 100, expected return 15%,

volatility 20%.

● Information about the market: risk-free rate 5.00%.

Consider an at-the-money American put option maturing in 1 year. Build a 3-step

CRR binomial tree (i.e. show the price changes).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The "Dogs of the Dow" are the stocks listed on the Dow with the highest dividend yield. The following table shows the top 10 stocks of the "Dogs of the Dow" list for 2021, based on their performance the preceding year. Symbol Company Price ($) as of 12/31/2020 Yield as of 12/31/2020 CVX Chevron 84.45 6.11% IBM IBM 125.88 5.18% DOW Dow 55.50 5.05% WBA Walgreens 39.88 4.69% VZ Verizon 58.75 4.27% MMM 3M 174.79 3.36% CSCO Cisco 44.39 3.24% MRK Merck 81.80 3.18% AMGN Amgen 229.92 3.06% KO Coca-Cola 54.84 2.99% You decide to make a small portfolio consisting of a collection of 6 of the top 10 Dogs of the Dow. (a) How many portfolios are possible? portfolios (b) How many of these portfolios contain DOW but not MMM? portfolios (c) How many of these portfolios contain at most one stock priced above $100? portfoliosarrow_forwardA bank records the number of mortgage applications and its own prevailing interest rate (at the first of the month) for each of 16 consecutive months. Find the best-fitting line for the interest rate (x) and the number of applications (y).arrow_forwardhh.arrow_forward

- If the expected return on the market is 8% and the risk free rate is 4% and the expected return is 12%, what is the market risk premium ?arrow_forward3. Suppose an eight-year bond is purchased for $8100. The face value of the bond when it matures is $10,773. Find the APR.arrow_forward1. Claire wants to invest $10,000 she got as a graduation gift from her family. She has the following options. (ii) MORE RISKY: Put it in a stock index fund that had an average APR of 11% over the last year. * le wants to invest $10,000 she got as a graduation gift from her family, She has the following options. (1) SAFE: Put it in a savings account that has an APR of 1.5% interest compounded monthiy. (11) MORE RISKY: Put it in a stock index fund that had an average APR of 11% over the last year. Find the value of each investment in 5 vears and advise Claire about how to invest the money. There are dimeo. ways to advise Claire so be sure to give reasons for your advice.arrow_forward

- A stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 65.03 — 2 71.90 $ .74 3 77.70 .79 4 63.97 .85 5 74.51 .94 6 86.75 1.01 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe following table presents monthly interest rates, in percent, for 30 year and- 15 year fixed-rate mortgages, for a recent year. 30 Year 15 year 30 year 15 year 3.92 3.20 3.55 2.85 3.89 3.16 3.60 2.86 3.95 3.20 3.47 2.78 3.91 3.14 3.38 2.69 3.80 3.03 3.35 2.66 3.68 2.95 3.35 2.66 a. Construct a scatter plot of the 15- year rate (y) versus the 30-year rate (x). b. Compute the correlation coefficient between 30-year and 15-year rates.arrow_forward45. Use the following information regarding an equal-weighted equity index and assume that all dividend payments are made at the end of the year. Security Price at the End of 2020 Price at the End of 2021 Dividends per Share A $20 $25 $0.50 B $50 $45 $0.20 C $31.25 $36 $0.40 D $100 $135 $0.50 Note: The dollar value of the index on December 31, 2020 is $10,000 and using a divisor of 10, the index level equals 1,000. The weight of Security B in the index on December 31, 2021 before rebalancing is closest to: a. 18.55% b. 25.00% c. 19.35% d. 22.15% e. 16.75%arrow_forward

- Multiple Choice Assume that a company is considering purchasing a machine for $45,000 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. 0.85. ○ 1.14. ○ 1.18. о 1.24.arrow_forwardCalculate the missing values in the following table. Round your answers to two decimal places. List Price (L)(L) Single discount rate (d)(d) Amount of discount (d×L)(d×L) Net price (N)(N) 6.00% $51.50 % $219.50 $662.50 $12,800.00 % $640.00 $30,950.00 % $3,851.75 The net price of an item after trade discounts of 14%, 9.5%, and 1.5% is $1,241.93. a. What is the list price of the item? b. Calculate a single equivalent trade discount rate of the series of discount rates.arrow_forwardJames has an investment worth $175,609.50. The investment will make a special payment of X to James in 1 month from today and the investment also will make regular, fixed monthly payments of $1,440.00 to James forever. The expected return for the investment is 1.23 percent per month and the first regular, fixed monthly payment of $1,440.00 will be made to James in one month from today. What is X, the amount of the special payment that will be made to James in 1 month? An amount less than $58,600.00 or an anmount greater than $179,600.00 An amount equal to or greater than $58,600.00 but less than $88,950.00 An amount equal to or greater than $88,950.00 but less than $146,400.00 An amount equal to or greater than $146,400.00 but less than $176,000.00 O An amount equal to or greater than $176,000.00 but less than $179,600.00 Com SHEMAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman