Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Find out solution for account solution

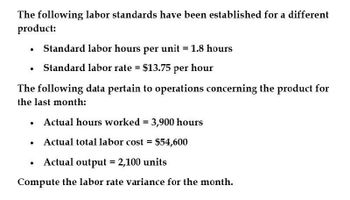

Transcribed Image Text:The following labor standards have been established for a different

product:

Standard labor hours per unit = 1.8 hours

Standard labor rate = $13.75 per hour

The following data pertain to operations concerning the product for

the last month:

•

Actual hours worked = 3,900 hours

.

Actual total labor cost = $54,600

Actual output = 2,100 units

Compute the labor rate variance for the month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ellis Companys labor information for September is as follows: A. Compute the standard direct labor rate per hour. B. Compute the direct labor time variance. C. Compute the standard direct labor rate if the direct labor rate variance was $2,712.30 (unfavorable).arrow_forwardPower Co.s labor information for June is as follows: A. What was the actual labor rate per hour? B. What was the standard labor rate per hour? C. What was the total standard labor cost for units produced in June? D. What was the direct labor time variance for June?arrow_forwardCase made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. A. Compute the direct labor rate and time variances for the month of June, and also calculate the total direct labor variance. B. If the standard rate per hour was $16.00, what would change?arrow_forward

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardBreakaway Companys labor information for May is as follows: A. What is the actual direct labor rate per hour? B. What is the standard direct labor rate per hour? C. What was the total standard direct labor cost for May? D. What was the direct labor rate variance for May?arrow_forwardCalculating factory overhead The standard capacity of a factory is 8,000 units per month. Cost and production data follow: Calculate the amount of factory overhead allowed for the actual volume of production each month and the variance between budgeted and actual overhead for each month.arrow_forward

- Direct materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardEagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forwardGeorgia Gasket Co. budgets 8,000 direct labor hours for the year. The total overhead budget is expected to amount to 20,000. The standard cost for a unit of the companys product estimates the variable overhead as follows: The actual data for the period follow: Using the four-variance method, calculate the overhead variances. (Hint: First compute the budgeted fixed overhead rate.)arrow_forward

- Standard cost summary; materials and labor cost variances Perkins Processors Inc. produces an average of 10,000 units each month. The factory standards are 20,000 hours of direct labor and 10,000 pounds of materials for this volume. The standard cost of direct labor is 9.00 per hour, and the standard cost of materials is 4.00 per pound. The standard factory overhead at this level of production is 20,000. During the current month the production and cost reports reflected the following information: On the basis of this information: 1. Prepare a standard cost summary. 2. Calculate the materials (use the materials purchase price variance) and labor cost variances, and indicate whether they are favorable or unfavorable, using the formulas on pages 421422 and 424.arrow_forwardMisterio Company uses a standard costing system. During the past quarter, the following variances were computed: Misterio applies variable overhead using a standard rate of 2 per direct labor hour allowed. Two direct labor hours are allowed per unit produced. (Only one type of product is manufactured.) During the quarter, Misterio used 30 percent more direct labor hours than should have been used. Required: 1. What were the actual direct labor hours worked? The total hours allowed? 2. What is the standard hourly rate for direct labor? The actual hourly rate? 3. How many actual units were produced?arrow_forwardIf a factory operates at 100% of capacity one month, 90% of capacity the next month, and 105% of capacity the next month, will a different cost per unit be charged to the work-in-process account each month for factory overhead assuming that a predetermined annual overhead rate is used?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning