FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Dog

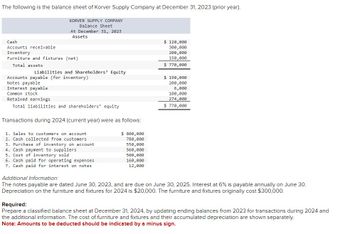

Transcribed Image Text:The following is the balance sheet of Korver Supply Company at December 31, 2023 (prior year).

KORVER SUPPLY COMPANY

Balance Sheet

At December 31, 2023

Assets

Cash

Accounts receivable

Inventory

Furniture and fixtures (net)

Total assets

Liabilities and Shareholders' Equity

Accounts payable (for inventory)

Notes payable

Interest payable

Common stock

Retained earnings

Total liabilities and shareholders' equity

Transactions during 2024 (current year) were as follows:

1. Sales to customers on account

2. Cash collected from customers

3. Purchase of inventory on account.

4. Cash payment to suppliers

5. Cost of inventory sold

6. Cash paid for operating expenses

7. Cash paid for interest on notes

$ 800,000

780,000

550,000

560,000

500,000

160,000

12,000

$ 120,000

300,000

200,000

150,000

$ 770,000

$ 190,000

200,000

6,000

100,000

274,000

$ 770,000

Additional Information:

The notes payable are dated June 30, 2023, and are due on June 30, 2025. Interest at 6% is payable annually on June 30.

Depreciation on the furniture and fixtures for 2024 is $20,000. The furniture and fixtures originally cost $300,000.

Required:

Prepare a classified balance sheet at December 31, 2024, by updating ending balances from 2023 for transactions during 2024 and

the additional information. The cost of furniture and fixtures and their accumulated depreciation are shown separately.

Note: Amounts to be deducted should be indicated by a minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education