ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

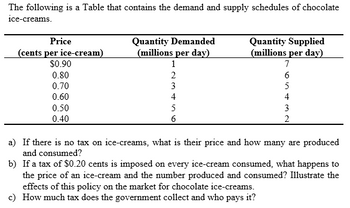

Transcribed Image Text:The following is a table that contains the demand and supply schedules of chocolate ice creams.

| Price (cents per ice-cream) | Quantity Demanded (millions per day) | Quantity Supplied (millions per day) |

|-----------------------------|--------------------------------------|--------------------------------------|

| $0.90 | 1 | 7 |

| $0.80 | 2 | 6 |

| $0.70 | 3 | 5 |

| $0.60 | 4 | 4 |

| $0.50 | 5 | 3 |

| $0.40 | 6 | 2 |

**Questions:**

a) If there is no tax on ice creams, what is their price and how many are produced and consumed?

b) If a tax of $0.20 is imposed on every ice cream consumed, what happens to the price of an ice cream and the number produced and consumed? Illustrate the effects of this policy on the market for chocolate ice creams.

c) How much tax does the government collect and who pays it?

Expert Solution

arrow_forward

Step 1

Here, the given table provides information about the amount of quantity demanded and quantity supplied of ice-cream at different price level.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. New advances in recycling technology reduce the cost of producing paper made from recycled material. SELECT THE CORRECT ANSWER a. Which of the following will occur in the market for paper made from recycled material? -supply will decrease -supply will increase -demand will decrease -demand will increase b. Will the advancement in recycling technology result in a shortage or surplus of paper made from recycled material at the previous price? Will the price of paper made from recycled material rise or fall? -surplus, rise -shortage, rise -shortage, fall -surplus, fallarrow_forwardMarket for Game Consoles 600 Tools 550 500 CS PS 450 400 350 ESeq 300 250 200 150 100 50 D 10 20 30 40 50 60 70 80 90 100110 Quantity a. What is the quantity demanded at $150 per game console? Quantity demanded: 20 game consoles b. What is the quantity supplied at $150 per game console? Quantity supplied:| 80 game consoles c. What is the consumer surplus generated at a price of $150 per game console? Instructions: Use the tool provided "CS" to illustrate this area on the graph. Consumer surplus: $ 30000 d. What is the producer surplus generated at a price of $150 per game console? Instructions: Use the tool provided “PS" to illustrate this area on the graph. Producer surplus: $ 3750 e. What is total economic surplus at a price of $150 per game console? Economic surplus: $ 33750 f. What is the economic surplus generated if the market were in equilibrium? Instructions: Use the tool provided “ESeg" to illustrate this area on the graph. Economic surplus in equilibrium: $ 56250 Price…arrow_forward2. Supply and Demand Schedules for A Gallon of Gasoline Price Quantity Supplied Quantity Demanded $4.00 $5.00 $6.00 $7.00 $8.00 6500 7000 7500 8000 8500 8000 7000 6000 5000 4000 Complete parts a, b, and c and either part d OR part e. a. Graph the supply and demand schedules in a supply curve and demand curve, respectively, on one graph. b. What are the equilibrium price and quantity? c. Show on your graph from part a and explain how the sanctions being placed upon Russia as a result of their actions in the Ukraine has affected the world market for the gallons of gasoline. Label what you did as R. d. If the government determined that the price for the gallon of gas in the marketplace should be set at $4.00, would this indicate that they were setting a price ceiling or a price floor? At this price of $4.00, how many gallons of gas will be soldarrow_forward

- (Figure: The Blu-ray Disc Rental Market) Use Figure: The Blu-ray Disc Rental Market. If the rental price of Blu-ray discs rises from $5 to $7: Question 2 options: v supply will increase from 50 to 70 rentals per weekend. the quantity demanded will decrease from 50 to 30 rentals per weekend. the quantity supplied will increase from 50 to 60 rentals per weekend. demand will decrease from 50 to 30 rentals per weekend.arrow_forward4. In order to reduce farm output, raise farm prices, and thus raise farm incomes (revenues), the government pays farmers to set aside a portion of their land from production. Using a graph, explain in terms of the elasticity of demand for farm products why farmers may be better-off when harvests are low even if we ignore the money they receive from the set-aside program.arrow_forward13. The table below gives part of the supply schedule for personal computers in the United States. Price Quantity Supplied before tech change Quantity Supplied after tech $1,100 $900 12,000 8,000 change 13,000 9,000 a) Calculate the price elasticity of supply when price rises from $900 to $1,100 using the arc elasticity formula (the midpoint method). b) Now suppose that technology changes such that at every price, 1000 more computers are supplied. Now, as prices rise from $900 to $1,100, is the elasticity of supply smaller than, larger than, or equal to the elasticity in part a)? c) Does the change in b) change the slope of the supply curve? Are slope and elasticity the same thing? Explain.arrow_forward

- 2. The following graph shows the demand and supply for i-Pods. Price 100 80 60 40 20 0 0 80 160 240 Quantity of i-pods 320 is D 400 a. What is equilibrium price and quantity? b. Suppose that a $20 per unit sales tax is placed on the product. What is the new equilibrium price and quantity? c. What proportion of the tax is paid by the consumer, and what proportion is paid by the seller in this case?arrow_forward7. Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. Suppose the government institutes a tax of s20.30 per pair. This places a wedge between the price buyers pay and the price sellers receive. 100 90 80 Demand Supply 70 50, 50 60 50 Тах Wedge 40 30 20 10 10 20 30 40 50 60 70 B0 90 100 QUANTITY (Pairs of jeans) Fill in the following table with the quantity sold, the price buyers pay, and the price sellers receive before and after the tax. Quantity Price Buyers Pay Price Sellers Receive (Pairs of jeans) (Dollars per pair) (Dollars per pair) Before Tax After Tax Using the data you entered in the previous table, calculate the tax burden that falls on buyers and on sellers, respectively, and calculate the price elasticity of demand and supply over the relevant ranges using the midpoint method. Enter your results in the following table. Tax Burden (Dollars per pair) Elasticity Buyers Sellers The burden of the tax falls more heavily on the elastic…arrow_forwardFigure 4-3 Price $20 18 16 14 12 10 8 4 2 10 20 30 40 50 60 70 80 90 100 Quantity 2. Refer to the Figure 4-3. If price in this market is currently S14, what would happen? a. Quantity supplied would be 40 and quantity demanded would be 60. b. Quantity supplied would be 60 and quantity demanded would be 40. c. Quantity supplied would be 50 and quantity demanded would be 50. d. Quantity supplied would be 70 and quantity demanded would be 30.arrow_forward

- 2arrow_forward8. Suppose we want regular cars to be gradually replaced by electric cars. There are several kinds of government interventions that could be used to make this happen, or at least to push the car market to produce and sell more electric cars. Explain how a tax could be used for this purpose, and then explain how a subsidy could be used for this purpose.arrow_forward16- What is the price elasticity of supply for a good that sees a 1% increase in quantity supplied for a 5% increase in price? 0.2 1 4 5 6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education