FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. How many pools did Surf Side originally think it would install in April?

2. How many pools did Surf Side actually install in April?

3. How many pools is the flexible budget based on? Why?

4. What was the budgeted sales price per pool?

5. What was the budgeted variable cost per pool?

6. Define the flexible budget variance . What causes it?

7. Define the volume variance. What causes it?

8. Fill in the missing numbers in the performance report.

Transcribed Image Text:The following is a partially completed performance report for Surf Side.

E (Click the icon to view the information.)

Read the requirements.

1. How many pools did Surf Side originally think they would install in April?

The

that Surf Side planned to sell

pools in April.

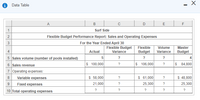

Transcribed Image Text:Data Table

A

E

F

1

Surf Side

2

Flexible Budget Performance Report: Sales and Operating Expenses

For the Year Ended April 30

Flexible Budget

Flexible

Budget

Volume

Master

Budget

4

Actual

Variance

Variance

5 Sales volume (number of pools installed)

?

4

$ 100,000

$ 106,000

$ 84,800

6 Sales revenue

?

7 Operating expenses:

Variable expenses

$ 58,000

$ 61,000

$ 48,800

?

Fixed expenses

21,000

25,300

25,300

10 Total operating expenses

?

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 10. Additional Exercises on GP Variance Analysis 10A) Pharsa Company had the following results in May: Sales Cost of goods sold (P 5 per unit) Gross profit Actual sales were 500 units higher than the budgeted sales. Determine the FALSE statement. a. The sales price variance is P 1,500 unfavorable. b. The sales volume variance is P 4,000 favorable. c. The cost price variance is zero (0). d. The cost volume variance is P 2,500 favorable. Net Sales Cost of Sales Gross Profit Budget P 160,000 100,000 P 60,000 Items 10B to 10F are based on the following information The management of Marvel Company asked you to submit an analysis of the increase in the in 2021 based on the past two-year comparative income statements, which are shown below 2021 P 1,237,500 950,000 P 287,500 The selling price increased by 12.5% beginning January 1, 2021. 10B) What is the increase in gross profit due to increase in volume? (VOLUME FACTOR) a. P 20,000 C. P 50,000 b. P 35,000 d. 10E) What is the percentage change…arrow_forwardK The following direct materials variance computations are incomplete = $5.400 U Price variance Efficiency variance = ?U Flexible budget variance 5? (52-54)×10 800 kg (?-10 200 kg)x54 Requirement 1. Fill in the missing values and identify the flexible budget variance as favourable or unfavourable in the first computation the missing value is the (Enter the amount as a positive number. Round your answers to the nearest whole number) In the second computation the first missing value is the The flexible budget variance is This variance is ats (Round your answer to the nearest cent) Ap The second missing value is the ▼ats F (Enter the amount as a positive nember. Round your answers to the nearest whole number) Time Remaining:02:51:45 Nextarrow_forwardverify whether variances favorable of unfavorable: budgeted cost at actual volue would be 25344 (21.12*1200) and total variance to be explained is 2536 (unfavorable 27880-25344). what is the amount of variance that is attributed to the diffence between the budgeted and actual wage rate per hour. what is the amount of variance that is attributed to the change in labor productivity? what is the amount of variance that can be attributed tothe diffence between budgeted and actual volume budget actual wage rate per hour 16 17 fixed hours 320 320 variable hours per relative value unit (RVU) 1 1.1 Relative Value unite (RVUs) 1000 1200 total labor hours 1320 1640 labor cost 21120 27880 cost per RVU 21.12 23.23arrow_forward

- Clementine Company makes skateboards. They prepare master and flexible budgets and then perform variance analysis after the budget plan period elapses. Their data is as follows: Budget Actual Selling price per $99 $96 unit Variable cost per $57 $41 unit Quantity sold 1,030 1,007 What is the Clementine's flexible budget variance for VARIABLE COSTS? If the variance is unfavorable put a minus sign in front of your answer. Enter your answer without commas or decimals.arrow_forwardQuestion 4- Variance Analysis Required: The owners can see that the company sold a different amount of units than budgeted. They have asked vou to determine the flexible budget amounts and calculate the variances when comparing the flexible budget to the actual results S marksl. Flexible Budget Report Variance (show Static Flexible or Budget Budget Actual as positive Unfavorable Amount Amount Results amount) (U) Sales in Linits 6,500 6,200 Sales $ 650,000 650,000 Variable Cost 260,000 275,500 Foed Cost 26,000 25,000 Jet Operating Income 364 000 349,500arrow_forwardI need help nowarrow_forward

- PRINCIPLE OF HEALTHCARE FINANCEarrow_forwardBlue Industries has a Flexible Budget Variance of $474, favorable and a Sales Activity Variance of $274, unfavorable. What is the Master Budget Variance for Blue Industries? Master budget variance tAarrow_forwardWhy is the identification of favorable and unfavorable variances so important to a company? How can the identification of the variances help management control costs? Please explain. Considering the flexible budgeting topic, it is important to look at this analysis as a significant contribution to the management of the company. Knowing what the bottom line profit or loss is important. But what is more important is to understand how your actual results varied in terms of units sold versus how the actual cost of each unit differed from the budget. What is a good example of this?arrow_forward

- A 100-room hotel budgeted an occupancy of 75% and an average room rate of $100 per room for year 2020. Actual occupancy was 50% and average room rate was $90. Assume 365 days in a year. Find the variance in total room revenue, variance in rooms sold and variance in average room rate, and then use the variance analysis matrix to find the constituents in total rooms revenue variance by breaking it up into price variance and quantity variance.arrow_forward13arrow_forwardCorrect answer please Do not give solution in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education