Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

rna.4

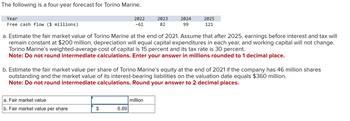

Transcribed Image Text:The following is a four-year forecast for Torino Marine.

Year

Free cash flow ($ millions)

a. Fair market value

b. Fair market value per share

2022

-61

$

a. Estimate the fair market value of Torino Marine at the end of 2021. Assume that after 2025, earnings before interest and tax will

remain constant at $200 million, depreciation will equal capital expenditures in each year, and working capital will not change.

Torino Marine's weighted-average cost of capital is 15 percent and its tax rate is 30 percent.

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place.

6.89

2023

82

b. Estimate the fair market value per share of Torino Marine's equity at the end of 2021 if the company has 46 million shares

outstanding and the market value of its interest-bearing liabilities on the valuation date equals $360 million.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

2024

99

million

2025

121

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- The following is a four-year forecast for Torino Marine. Year Free cash flow ($ millions) a. Fair market value b. Fair market value per share 2022 -61 $ a. Estimate the fair market value of Torino Marine at the end of 2021. Assume that after 2025, earnings before interest and tax will remain constant at $200 million, depreciation will equal capital expenditures in each year, and working capital will not change. Torino Marine's weighted-average cost of capital is 15 percent and its tax rate is 30 percent. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place. 6.89 2023 82 b. Estimate the fair market value per share of Torino Marine's equity at the end of 2021 if the company has 46 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $360 million. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. 2024 99 million 2025 121arrow_forwardPlease correctly with stepsarrow_forwardThe following is a four-year forecast for Torino Marine. Year 2022 2023 2024 2025 Free cash flow ($ millions) −59 80 97 119 Estimate the fair market value of Torino Marine at the end of 2021. Assume that after 2025, earnings before interest and tax will remain constant at $200 million, depreciation will equal capital expenditures in each year, and working capital will not change. Torino Marine’s weighted-average cost of capital is 12 percent and its tax rate is 40 percent. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place. Estimate the fair market value per share of Torino Marine’s equity at the end of 2021 if the company has 44 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $340 million. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forward

- Qw.15.arrow_forwardThe following is a four-year forecast for Torino Marine. Year 2022 2023 2024 2025 Free cash flow ($ millions) −52 73 90 112 Estimate the fair market value of Torino Marine at the end of 2021. Assume that after 2025, earnings before interest and tax will remain constant at $200 million, depreciation will equal capital expenditures in each year, and working capital will not change. Torino Marine’s weighted-average cost of capital is 10 percent and its tax rate is 30 percent. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place. Estimate the fair market value per share of Torino Marine’s equity at the end of 2021 if the company has 37 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $270 million. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardThe following is a four-year forecast for Torino Marine. Year 2022 2023 2024 2025 Free cash flow ($ millions) −60 81 98 120 Estimate the fair market value of Torino Marine at the end of 2021. Assume that after 2025, earnings before interest and tax will remain constant at $200 million, depreciation will equal capital expenditures in each year, and working capital will not change. Torino Marine’s weighted-average cost of capital is 13 percent and its tax rate is 20 percent. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place. Estimate the fair market value per share of Torino Marine’s equity at the end of 2021 if the company has 45 million shares outstanding and the market value of its interest-bearing liabilities on the valuation date equals $350 million. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. I have the second question right…arrow_forward

- please provide well explained computated formulated answer with steps thanks million thanksarrow_forwardWhat is the adjusted cash flow from asset in 2018? What is the predicted adjusted cash flow from asset in 2019?arrow_forwardYou are evaluating a prospective LBO investment and determine that the Year 5 free cash flow (FCF) estimate is $850 million. Additionally, based on related work you estimate that the appropriate discount rate is 8.5% and the long term growth rate is 3.5%. Based on the perpetuity growth method, the Terminal Value of the company is _________ in Year Group of answer choices a. $17.6 bn, year 5 b. $17.0 bn, year 6 c. $10.0 bn, year 5 d. $17.6 bn, year 6arrow_forward

- Net Income for Company A is $200,000 in 2014, $300,000 in 2015, $400,000 in 2016, $500,000 in 2017, and $600,000 in 2018. The expected growth for all years after 2018 is 5%, the 90-Day T-Bill Rate is 20%, and the appropriate percentage above risk-free rate is 12%. Using this information, what is Net Present Value? A. 412,020.21 B. 812,020.21arrow_forwardAssume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income [EBIT(1 – T)] will be $420 million and its 2020 depreciation expense will be $70 million. Barrington's 2020 gross capital expenditures are expected to be $100 million and the change in its net operating working capital for 2020 will be $30 million. The firm's free cash flow is expected to grow at a constant rate of 5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 8.8%; the market value of the company's debt is $2.15 billion; and the company has 190 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Also, the firm has zero non-operating assets. Using the corporate valuation model, what should be the company's stock price today (December 31, 2019)? Do not round intermediate calculations. Round your…arrow_forwardA firm after -tax operating income ( after-tax EBIT)$90,000 in 2018. The value of depreciation is $8000 in 2018. Operating working capital increased by $20,000, and the firm purchased $30,000 of assets. The firm's free cash flow is Given the rate information in the table belowCan you calculate the maturity risk premium? 3 month T-bill = 2.5% (risk-free rate), 30 years Bonds-5.0%, 30year corporate bonds 7.0% Inflation Rate- 3.6% and the liquidity risk premium is 0.03%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education