Algebra and Trigonometry (6th Edition)

6th Edition

ISBN: 9780134463216

Author: Robert F. Blitzer

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Question

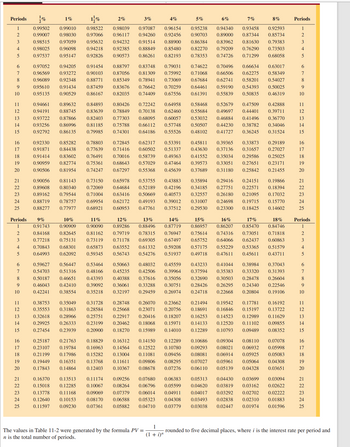

Transcribed Image Text:The following investment requires a table factor for a period beyond the table. Calculate the new table factor and the present value (principal). Use Table 11-2. Round your new

table factor to five decimal places and your present value to the nearest cent.

Term of

Compound

Amount Investment (years)

$34,000

34

Nominal

Rate (%)

7

Interest

Compounded

annually

New Table

Factor

tA

Present

Value

Transcribed Image Text:Periods

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Periods

1

2

3

4

5

6

Prag HDINS DE 2

7

12

14

19

20

21

22

23

24

25

0.99502

0.99007 0.98030

0.98515 0.97059

0.98025 0.96098

0.97537 0.95147

0.97052

0.96569

0.96089

0.95610

0.95135

1%

1/1/%

2%

0.99010 0.98522 0.98039

0.90056

0.89608

0.89162

0.94205

0.93272

0.92348

0.91434

0.90529

0.94661 0.89632

0.84893 0.80426

0.94191 0.88745 0.83639 0.78849

0.93722 0.87866 0.82403 0.77303

0.93256 0.86996 0.81185 0.75788

0.92792 0.86135 0.79985 0.74301

0.92330

0.91871 0.84438

0.85282 0.78803

0.77639

0.83602 0.76491

0.90959 0.82774 0.75361

0.91414

0.90506

0.81954 0.74247

3%

4%

5%

6%

7%

8%

0.93458 0.92593

0.97087 0.96154

0.94260 0.92456

0.95238 0.94340

0.97066 0.96117

0.90703 0.89000 0.87344 0.85734

0.95632 0.94232 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383

0.94218 0.92385 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503

0.92826 0.90573 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058

0.91454

0.88797 0.83748

0.90103

0.87056

0.88771

0.85349

0.87459

0.83676

0.86167 0.82035

0.59627 0.56447

0.54703 0.51316

0.50187 0.46651

0.46043 0.42410

0.42241 0.38554

0.16370

0.15018

0.81143 0.73150

0.80340

0.72069

0.79544

0.71004

0.88719 0.78757 0.69954

0.88277 0.77977

0.38753 0.35049

0.35553 0.31863

0.32618 0.28966

0.29925 0.26333

0.27454 0.23939

0.25187 0.21763

0.23107 0.19784

0.21199 0.17986

0.19449 0.16351

0.17843

0.14864

0.72845

0.71416

0.53464

0.48166

0.43393

0.39092

0.35218

0.70016

0.68643

0.67297

0.18829

0.16963

0.15282

0.13768

0.12403

0.81309 0.75992

0.78941 0.73069

0.76642

0.74409 0.67556

0.72242 0.64958

0.70138

0.68095 0.60057 0.53032

0.66112 0.57748 0.50507

0.64186 0.55526 0.48102

0.62317

0.60502

0.79031 0.74622 0.70496

0.71068 0.66506

0.67684 0.62741

0.70259 0.64461 0.59190

0.61391 0.55839

0.53391

0.51337

0.58739

0.49363 0.41552

0.57029 0.47464

0.55368 0.45639 0.37689

0.58468 0.52679

0.62460 0.55684 0.49697

0.65978 0.53755 0.43883 0.35894 0.29416 0.24151 0.19866

0.64684 0.52189 0.42196 0.34185 0.27751

0.22571

0.18394

0.63416 0.50669 0.40573 0.32557 0.26180 0.21095 0.17032

0.62172 0.49193 0.39012 0.31007 0.24698 0.19715

0.68921 0.60953 0.47761 0.37512 0.29530 0.23300 0.18425

15%

0.86957

0.75614

0.65752

9%

10%

11%

12%

13%

14%

16%

17%

18%

0.91743 0.90909 0.90090 0.89286 0.88496 0.87719

0.86207 0.85470 0.84746

0.84168 0.82645 0.81162 0.79719 0.78315 0.76947

0.74316 0.73051 0.71818

0.77218 0.75131 0.73119 0.71178 0.69305 0.67497

0.64066 0.62437 0.60863

0.70843 0.68301 0.65873 0.63552 0.61332 0.59208 0.57175 0.55229 0.53365

0.51579

0.64993 0.62092 0.59345 0.56743 0.54276 0.51937 0.49718 0.47611 0.45611 0.43711

0.50663 0.48032 0.45559 0.43233 0.41044 0.38984 0.37043

0.45235 0.42506 0.39964 0.37594 0.35383

0.33320

0.31393

0.40388 0.37616 0.35056 0.32690 0.30503 0.28478 0.26604

0.36061 0.33288 0.30751 0.28426 0.26295 0.24340 0.22546

0.32197 0.29459 0.26974 0.24718 0.22668

0.20804

0.31728 0.28748 0.26070 0.23662 0.21494

0.28584 0.25668 0.23071 0.20756 0.18691

0.25751 0.22917 0.20416 0.18207 0.16253

0.23199 0.20462 0.18068 0.15971 0.14133

0.20900 0.18270 0.15989 0.14010 0.12289

0.19106

The values in Table 11-2 were generated by the formula PV =

n is the total number of periods.

0.45811

0.43630

1

(1 + i)"

0.47509 0.42888

0.44401 0.39711

0.46884 0.41496 0.36770

0.44230 0.38782 0.34046

0.41727

0.36245

0.31524

0.66634 0.63017

0.62275 0.58349

0.58201 0.54027

0.54393 0.50025

0.50835 0.46319

0.39365 0.33873 0.29189

0.37136 0.31657 0.27027

0.29586 0.25025

0.27651 0.23171

0.25842 0.21455

0.35034

0.39573 0.33051

0.31180

0.16312 0.14150 0.12289 0.10686 0.09304 0.08110 0.07078

0.14564 0.12522 0.10780 0.09293 0.08021 0.06932 0.05998

0.13004 0.11081 0.09456 0.08081 0.06914 0.05925 0.05083

0.11611 0.09806 0.08295 0.07027 0.05961 0.05064 0.04308

0.10367 0.08678 0.07276 0.06110 0.05139 0.04328 0.03651

0.09256 0.07680 0.06383

0.05313 0.04430 0.03699 0.03094

0.08264 0.06796 0.05599 0.04620 0.03819 0.03162 0.02622

0.11168 0.09069 0.07379 0.06014 0.04911 0.04017 0.03292 0.02702 0.02222

0.12640 0.10153 0.08170 0.06588 0.05323 0.04308 0.03493 0.02838 0.02310 0.01883

0.11597 0.09230 0.07361 0.05882 0.04710 0.03779 0.03038 0.02447 0.01974

0.01596

0.13513

0.11174

0.12285

0.10067

0.13778

0.15770

0.14602

0.19542 0.17781 0.16192

0.16846 0.15197 0.13722

0.14523 0.12989 0.11629

0.12520 0.11102 0.09855

0.10793 0.09489 0.08352

Periods

1

2

3

4

5

6

7

8

9

10

HDDHD 95%98

18

21

25

Periods

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

rounded to five decimal places, where i is the interest rate per period and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Manually calculate the compound interest on an investment of $7,500 at 6% interest, compounded semiannually, for 18 months. a. $675.00 b. $685.05 c. $695.45 d. $8,195.48arrow_forwardFind the amount necessary to fund the given withdrawals. Semiannual withdrawals of $900 for 7 years; interest rate is 6.2% compounded semiannually. ... The amount necessary to fund the given withdrawals is Sarrow_forwardFind the accumulated value of an investment of $15,000 at 7% compounded semiannually for 3 years. $18,471.59 $18,505.17 $18,438.83 $18,471.59arrow_forward

- Find the present value of $90,000 due in 7 years at the given rate of interest. (Use a 365-day year. Round your answer to the nearest cent.) 3%/year compounded quarterlyarrow_forwardManually calculate the compound interest on an investment of $8,750 at 12% interest, compounded semiannually, for 18 months. O $1,575.00 O $1,621.38 $1,671.39 O $10,421.43arrow_forwardThe principal represents an amount of money deposited in a savings account subject to compound interest at the given rate. Principal $10,000 Compounded semiannually Rate Time 3% 4 years A. Find how much money there will be in the account after the given number of years. B. Find the interest earned. A Click the icon to view some finance formulas. A. The amount of money in the account after 4 years is $ (Round to the nearest hundredth as needed.) B. The amount of interest earned is $. (Round to the nearest hundredth as needed.)arrow_forward

- Given a nominal interest rate of 2.5% compounded daily (ie: compounded on each calendar day), determine the starting principal required to produce an accumulated amount of $10000 after a term of 5 years. Round your answer to the nearest dollar. Starting Principal = $ Checkarrow_forwardThe principal P is borrowed at simple interest rate r for a period of time t. Find the loan's future value, A, or the total amount due at time t. Round answer to the nearest cent. P = $700, r = 8.25%, t = 3 months %3D (Round to the nearest cent as needed.) $719.44 $714.44 $715.75 $873.25arrow_forwardUse the timeline below to help you! An employee is planning to retire in 10 years. To plan for this retirement, she deposits $1250 at the end of each month into a savings plan. The balance is then converted into a fund from which end-of-month withdrawals are made for the next 20 years. Money is worth 3.5% compounded monthly. What is the value of PV2? Select one: a. $126,408.36 b. $179,290.64 c. $12,665.35 d. $2,180,868.44arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning

Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON

Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press

Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:9781305657960

Author:Joseph Gallian

Publisher:Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:9781285463247

Author:David Poole

Publisher:Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:9780135163078

Author:Michael Sullivan

Publisher:PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:9780980232776

Author:Gilbert Strang

Publisher:Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:9780077836344

Author:Julie Miller, Donna Gerken

Publisher:McGraw-Hill Education