Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Don't want wrong answer

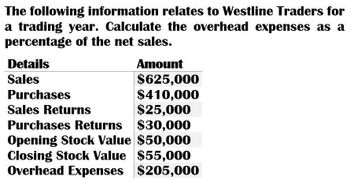

Transcribed Image Text:The following information relates to Westline Traders for

a trading year. Calculate the overhead expenses as a

percentage of the net sales.

Details

Sales

Purchases

Sales Returns

Purchases Returns

Amount

$625,000

$410,000

$25,000

$30,000

Opening Stock Value $50,000

Closing Stock Value $55,000

Overhead Expenses $205,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentages, except for per-share amounts: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forward

- If the net salesarrow_forwardThe following information relates to Westline Traders for a trading year. Calculate the overhead expenses as a percentage of the net sales. Details Sales Purchases Sales Returns Purchases Returns Amount $625,000 $410,000 $25,000 $30,000 Opening Stock Value $50,000 Closing Stock Value $55,000 Overhead Expenses $205,000arrow_forwardCalculate the overhead expenses as a percentage of the net sales.arrow_forward

- Calculate the activity and liquidity ratios for P for the year ended 31 December 20X9. Revenue Gross profit Inventory Trade receivables Trade payables Cash Short-term investments Other current liabilities $m 1,867.5 489.3 147.9 393.4 275.1 53.8 6.2 284.3 Current ratio= Current assets Current liabilities Inventory days Inventory days = inventory+ cost of sales × 365 Receivable days Receivable days - receivables + credit sales x 365 Payable days Payable days = payables ÷ credit purchases x 365.arrow_forwardOperating data for Cheyenne Corp. are presented below. 2022 2021 Sales revenue $831,900 $629,500 Cost of goods sold 529,700 410,900 Selling expenses 125,400 74,300 Administrative expenses 79,400 52,000 Income tax expense 37,000 24,500 Net income 60,400 67,800 Prepare a schedule showing a vertical analysis for 2022 and 2021. (Round percentages to 1 decimal place, e.g. 12.1%.)arrow_forwardPrepare a statement of retained earnings for 2019arrow_forward

- Operating data for Riverbed Corp are presented below. 2022 2021 Sales revenue $850,500 $643,000 Cost of goods sold 529,000 409,600 Selling expenses 121,800 75,900 Administrative expenses 73,300 50,700 Income tax expense 33,000 23,500 Net income 93,400 83,300 Prepare a schedule showing a vertical analysis for 2022 and 2021. (Round percentages to 1 decimal place, e.g. 12.1%.) RIVERBED CORPCondensed Income Statementchoose the accouning period For the Years Ended December 31December 31For the Month Ended December 31 2022 2021 Amount Percent Amount Percent Sales $850,500 enter percentages % $643,000 enter percentages % Cost of goods sold 529,000 enter percentages % 409,600 enter percentages % Gross profit 321,500 enter percentages % 233,400 enter percentages % Selling…arrow_forwardPrepare a vertical analysis of the income statement data for Whispering Winds Corporation for both years. (Round percentages to 1 decimal place, e.g. 12.1%.) WHISPERING WINDS CORPORATIONComparative Income StatementsFor the Years Ended December 31 2022 2021 $ Percent $ Percent Net sales $688,000 Enter percentages % $576,000 Enter percentages % Cost of goods sold 445,000 Enter percentages % 417,000 Enter percentages % Gross profit 243,000 Enter percentages % 159,000 Enter percentages % Operating expenses 145,000 Enter percentages % 108,000 Enter percentages % Net income $98,000 Enter percentages % $51,000 Enter percentages %arrow_forwardGeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning