FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

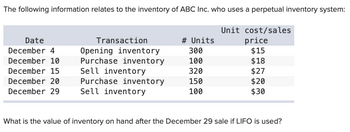

Transcribed Image Text:The following information relates to the inventory of ABC Inc. who uses a perpetual inventory system:

Date

December 4

December 10

December 15

December 20

December 29

Transaction

Opening inventory

Purchase inventory

Sell inventory

Purchase inventory

Sell inventory

# Units

300

100

320

150

100

Unit cost/sales

price

$15

$18

$27

$20

$30

What is the value of inventory on hand after the December 29 sale if LIFO is used?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Derzon, Inc. for an operating period. Beginning Inventory Sale No. 1 Purchase No. 1 Sale No. 2 Purchase No. 2 Totals Select one: O O O Units Unit Cost Total Cost Units Sold 30 $28 $ 840 A. $1,480 B. $1,600 C. $1,120 D. $1,680 50 20 100 40 44 2,000 880 $3,720 20 Assuming Derzon, Inc. uses FIFO perpetual inventory procedures, it records sale no. 2 as an entry to Cost of Goods Sold for: 40 60arrow_forwardJournalize the following transactions. Assume the Perpetual inventory system: December 9: Purchased merchandise from Ree Co. on account, $3,300, F.O.B. shipping point (buyer pays freight); terms 2/10, n/30. Freight to be paid on December 20. December 20: Paid freight on December 9 purchase, $110.arrow_forwardA company that uses a perpetual inventory system purchased inventory on account and later returned goods worth $900.00 to the vendor. Which of the following would be the correct journal entry to record these returns? OA. Accounts Payable 900 Merchandise Inventory 900 OB. Accounts Payable 900 Purchase Returns 900 OC. Merchandise Inventory 900 Accounts Payable 900 OD. Purchase Returns 900 Accounts Payable 900arrow_forward

- Beginning inventory, purchases, and sales for Product XCX are as follows: Sep. 1 Beginning Inventory 22 units @ $12 5 Sale 12 units 17 Purchase 20 units @ $14 30 Sale 15 units Assuming a perpetual inventory system and the last - in, first-out method, determine (a) the cost of the goods sold for the September 30 sale and (b) the inventory on September 30. a) Cost of goods sold Sfill in the blank 1 b) Inventory, September 30 Sfill in the blank 2arrow_forwardSubject: accountingarrow_forwardPerpetual inventory using LIFO and FIFO In the spaces provided below, determine the cost of good sold and ending inventory under the FIFO and LIFO method for Kimbrell Corporation which uses a perpetual inventory system. Below is the data for the October: Beginning inventory 120 units @ $39 each October 2 purchase 100 units @ $41 each October 8 sale 80 units October 15 purchase 200 units @ $42 each October 22 sale 250 units FIFO Purchases Cost of Goods Sold Inventory Balance Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost…arrow_forward

- Please help me. Thankyou.arrow_forwardRequired information [The following information applies to the questions displayed below.] Total Date March 1 March 5 March 9 March 18 March 25 March 29 Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Beginning inventory Purchases: March 5 March 18 March 25 Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals Saved Required: 1. Compute cost of goods available for sale and the number of units available for sale. # of units Cost per Unit Units Acquired at Cost 100 units @ $51.00 per unit 225 units @ $56.00 per unit 130 units @ $96.00 per unit 390 units Subnarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education