FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

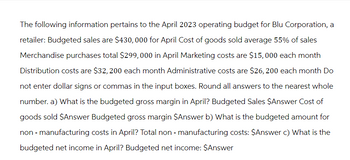

Transcribed Image Text:The following information pertains to the April 2023 operating budget for Blu Corporation, a

retailer: Budgeted sales are $430,000 for April Cost of goods sold average 55% of sales

Merchandise purchases total $299,000 in April Marketing costs are $15,000 each month

Distribution costs are $32, 200 each month Administrative costs are $26, 200 each month Do

not enter dollar signs or commas in the input boxes. Round all answers to the nearest whole

number. a) What is the budgeted gross margin in April? Budgeted Sales $Answer Cost of

goods sold $Answer Budgeted gross margin $Answer b) What is the budgeted amount for

non - manufacturing costs in April? Total non-manufacturing costs: $Answer c) What is the

budgeted net income in April? Budgeted net income: $Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: Sales are budgeted at $460,000 for November, $440,000 for December, and $430,000 for January. Collections are expected to be 45% in the month of sale and 55% in the month following the sale. The cost of goods sold is 80% of sales. The company would like to maintain ending merchandise inventories equal to 60% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $25,200. Monthly depreciation is $16,200. Ignore taxes. Balance SheetOctober 31 Assets Cash $ 20,000 Accounts receivable 70,000 Merchandise inventory 153,000 Property, plant and equipment, net of $572,000 accumulated depreciation 1,094,000 Total assets $ 1,337,000 Liabilities and Stockholders' Equity Accounts payable $ 254,000 Common stock 820,000 Retained earnings…arrow_forwardplease answer do not image formatarrow_forwardTimpco, a retailer, makes both cash and credit sales (i.e., sales on open account). Information regarding budgeted sales for the last quarter of the year is as follows: October November December Cash sales $ 80,000 $ 71,000 $ 83,000 Credit sales 80,000 85,200 91,300 Total $ 160,000 $ 156,200 $ 174,300 Past experience shows that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale; the remaining 40% are collected in the month following the month of sale. Customers are granted a 1.5% discount for payment within 10 days of billing. Approximately 75% of collectible credit sales take advantage of the cash discount. Inventory purchases each month are 100% of the cost of the following month’s projected sales. (The gross profit rate for Timpco is approximately 30%.) All merchandise purchases are made on credit, with 20% paid in the month of purchase and the remainder paid in the following month. No cash discounts…arrow_forward

- Shakira Inc. sells drones. The company is in the process of preparing its Selling and Administrative Expense Budget for the year. The following budget data are available: Variable Cost Per Drone Sold Monthly Fixed Cost Sales commissions $0.40 $ 12,000 Shipping 3.20 Advertising 0.25 Executive salaries 60,000 Depreciation on office equipment 4,000 Expenses are paid in the month incurred. If the company has budgeted to sell 20,000 drones in July, how much is the total budgeted selling and administrative expenses for July?arrow_forwardMary's Baskets Company expects to manufacture and sell 23,000 baskets in 2019 for $6 each. There are 3,000 baskets in beginning finished goods inventory with target ending inventory of 3,000 baskets. The company keeps no work- in-process inventory. What amount of sales revenue will be reported on the 2019 budgeted income statement? O A. $120,000 B. $156,000 OC. $102,000 OD. $138,000 Calculator Nextarrow_forwardPlease do not give solution in image format thankuarrow_forward

- sarrow_forwardThe following information applies to questions 25 and 26 The sales budget for Fred Limited contains the following information: October November December Units 300 550 700 $ (thousands) 75,000 165,000 210,000 Sales are all on credit, with 30% collected in the month of sale and 70% in the following month. Finished goods inventory at the end of each month should be 58% of the following month's sales requirements. Prepare a finished goods inventory budget and use it to answer Following Calculate the closing finished goods inventory, in units, for October. Calculate the required production, in units, for October.arrow_forwardPlease do not give solution in image format and give answers proper steps by steps and give calculations also......arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education