Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:b. Calculate the company's net income for 2019.

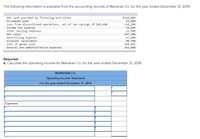

Transcribed Image Text:The following information is available from the accounting records of Manahan Co. for the year ended December 31, 2019:

Net cash provided by financing activities

Dividends paid

Loss from discontinued operations, net of tax savings of $45,400

Income tax expense

Other selling expenses

$116,000

19,800

136, 200

26,864

11,500

647,100

47,400

Net sales

Advertising expense

Accounts receivable

Cost of goods sold

General and administrative expenses

60,700

368,847

142,600

Required:

a. Calculate the operating income for Manahan Co. for the year ended December 31, 2019.

MANAHAN CO.

Operating Income Statement

For the year ended December 31, 2019

Expenses:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Corporation reported the following information for the year ended December 31: Balance sheet accounts: 2024 Accounts receivable Inventory Prepaid expenses Accounts payable Income tax payable 2023 $93,500 66,000 68,200 60,500 5,500 9,900 38,500 46,200 15,400 9,900 Net cash Save for Later Income statement accounts: Sales Gain on sale of land Cost of goods sold Operating expenses Depreciation expense Income tax expense 2024 $412,500 16,500 165,000 82,500 22,000 Calculate the net cash provided (used) by operating activities using the direct method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis e.g. (15,000).) operating activities 55,000 Attempts: 0 of 15 used Submit Answerarrow_forwardThe following information was taken from the 2021 financial statements of Jenny Gardner Corporation: Inventory, January 1, 2021 Inventory, December 31, 2021 Accounts payable, January 1, 2021 Accounts payable, December 31, 2021 Sales revenue Cost of goods sold $ 180,000 240,000 150,000 240,000 1,200,000 800,000 If the direct method is used in the 2021 statement of cash flows, what amount should Jenny Gardner report as cash payments to suppliers? $830,000 $950,000 $890,000 $770,000arrow_forwardKaila Company's financial statements show a net income of $567,000 in 2019. The following items also appear on Kaila's balance sheet: Depreciation expense $120,000 Accounts receivable decrease 36,000 Inventory increase 84,000 Accounts payable increase 24,000 Using the indirect method, what is Tu's net cash flow from operating activities in 2019?arrow_forward

- The balance sheets for Mary Company showed the following information. Additional information concerning transactions and events during 2021 are presented below. Mary CompanyBalance Sheet December 31 2021 2020 Cash $ 31,209 $ 10,302 Accounts receivable (net) 43,733 20,503 Inventory 35,350 42,420 Long-term investments 0 15,150 Property, plant & equipment 238,865 151,500 Accumulated depreciation (38,077) (25,250) $311,080 $214,625 Accounts payable $ 17,170 $ 26,765 Accrued liabilities 21,210 17,170 Long-term notes payable 70,700 50,500 Common stock 131,300 90,900 Retained earnings 70,700 29,290 $311,080 $214,625 Additional data: 1. Net income for the year 2021, $61,610. 2. Depreciation on plant assets for the year, $12,827. 3. Sold the long-term…arrow_forwardFollowing is the statement of financial position of Crane Industries, Ltd., as at December 31, 2023: Cash Accounts receivable Inventory Land Plant and equipment (net) Current liabilities Warranty liability Common shares Retained earnings Book Value Amount of goodwill $ $54,200 279,600 188,500 103,200 768,100 $1,393,600 $136,700 99,300 663,900 493,700 $1,393,600 Fair Value $54,200 284,900 179,800 129,000 895,400 136,700 131,400 The following day (January 1, 2024), Crane was purchased by Ivanhoe Enterprises Inc. for a lump-sum cash payment of $1.3 million. Calculate the amount of goodwill acquired by Ivanhoe this transaction.arrow_forwardhe current sections of Skysong, Inc.’s balance sheets at December 31, 2021 and 2022, are presented here.Skysong’s net income for 2022 was $152,700. Depreciation expense was $27,600. 2022 2021 Current assets Cash $107,600 $95,900 Accounts receivable 78,400 89,400 Inventory 167,800 172,100 Prepaid expenses 26,800 22,000 Total current assets $380,600 $379,400 Current liabilities Accrued expenses payable $15,800 $8,600 Accounts payable 84,900 95,500 Total current liabilities $100,700 $104,100 Prepare the net cash provided by operating activities section of the company’s statement of cash flows for the year ended December 31, 2022, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)arrow_forward

- The following selected data for ABC Corporation for the year ended December 31, 2020, is available to you for preparing the cash flow statement: Cost of goods sold $56,500 Sales revenue $97,300 Amortization expense 14,100 Interest revenue 4,100 Income tax expense 2,300 Dividend revenuearrow_forwardCadux Candy Company's income statement for the year ended December 31, 2021, reported interest expense of $6 million and income tax expense of $32 million. Current assets listed in its balance sheet include cash, accounts receivable, and inventory. Property, plant, and equipment is the company's only noncurrent asset. Financial ratios for 2021 are listed below. Profitability and turnover ratios with balance sheet items in the denominator were calculated using year-end balances rather than averages Debt to equity ratio Current ratio Acid-test ratio. Times interest earned ratio Return on assets Return on equity Profit margin on sales Gross profit margin (gross profit divided by net sales) Inventory turnover Receivables turnover Assets Current assets Cash CADUX CANDY COMPANY Balance Sheet At December 31, 2021 (All values are in millions) Required: Prepare a December 31, 2021, balance sheet for the Cadux Candy Company. (Enter your answers in millions. Round your intermediate calculations…arrow_forwardNet cash flow from operating activities for 2021 for Vaughn Manufacturing was $497000. The following items are reported on the financial statements for 2021: Depreciation and amortization $ 31000 Cash dividends paid on common stock 18400 Increase in accounts receivable 35500 Based only on the information above, Vaughn’s net income for 2021 was:arrow_forward

- Selected information taken from the financial statements of Verbeke Co. for the year ended December 31, 2019, follows: Gross profit $411,000 General and administrative expenses 81,000 Net cash used by investing activities 105,000 Dividends paid 52,000 Interest expense 62,000 Net sales 743,000 Advertising expense 74,000 Accounts payable 103,000 Income tax expense 82,000 Other selling expenses 42,000 Required:a. Calculate income from operations (operating income) for the year ended December 31, 2019. b. Calculate net income for the year ended December 31, 2019.arrow_forwardhelp mearrow_forwardThe following Information is available from the accounting records of Manahan Co. for the year ended December 31, 2019: Net cash provided by financing activities Dividends paid Loss from discontinued operations, net of tax savings of $39,700 Income tax expense Other selling expenses Net sales Advertising expense Accounts receivable Cost of goods sold General and administrative expenses Net sales Cost of goods sold Gross profit Expenses: Required: a. Calculate the operating Income for Manahan Co. for the year ended December 31, 2019. Advertising expense General and administrative expenses Operating income MANAHAN CO. Operating Income Statement For the year ended December 31, 2019 b. Calculate the company's net Income for 2019. Net income $ $119,000 18, 200 119,100 $ 27,288 11,500 646,600 47,000 59,300 368,562 141,800 0 0 0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education