FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

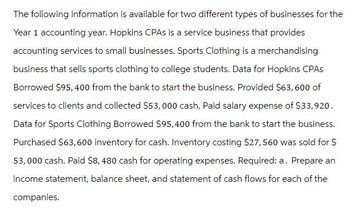

Transcribed Image Text:The following information is available for two different types of businesses for the

Year 1 accounting year. Hopkins CPAs is a service business that provides

accounting services to small businesses. Sports Clothing is a merchandising

business that sells sports clothing to college students. Data for Hopkins CPAS

Borrowed $95, 400 from the bank to start the business. Provided $63, 600 of

services to clients and collected $53,000 cash. Paid salary expense of $33,920.

Data for Sports Clothing Borrowed $95,400 from the bank to start the business.

Purchased $63,600 inventory for cash. Inventory costing $27,560 was sold for $

53,000 cash. Paid $8,480 cash for operating expenses. Required: a. Prepare an

income statement, balance sheet, and statement of cash flows for each of the

companies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1 The following information is available for two different types of businesses for the Year 1 accounting year. Hopkins CPAs is a service business that provides accounting services to small businesses. Sports Clothing is a merchandising business that sells sports clothing to college students. Data for Hopkins CPAs 1. Borrowed $44,000 from the bank to start the business. 2. Provided $34,000 of services to clients and collected $34,000 cash. 3. Paid salary expense of $21,800. Data for Sports Clothing 1. Borrowed $44,000 from the bank to start the business. 2. Purchased $23,000 inventory for cash. 3. Inventory costing $19,300 was sold for $35,000 cash. 4. Paid $2,800 cash for operating expenses. Required: a. Prepare an income statement, balance sheet, and statement of cash flows for each of the companies. Complete this question by entering your answers in the tabs below. Hopkins Income Statement Hopkins Balance Sheet Hopkins Statement Cash Flows Prepare an income statement for Hopkins.…arrow_forwardThe following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $4,390 from a local bank on a note due in six months. b. Received $5,080 cash from investors and issued common stock to them. c. Purchased $1,900 in equipment, paying $650 cash and promising the rest on a note due in one year. d. Paid $750 cash for supplies. e. Bought and received $1,150 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginni Debit Beginning Balance Ending Balance Debit F Cash Equipment Credit Credit Debit Beginning Balance Ending Balance Debit Supplies Accounts Payablearrow_forwardMr. Juan Lopez opened a mini grocery store with business ame lopez Freta Mart. Operations began on Apr 1, 20xX, and the following transactions were completed during the month: 1. The business was registered as single proprietorship with the Department of Trade and Industry, Juan Lope invested P39,000. 2 Bought computer equipment for P10,000 cash. 2 Bought merchandise on account from LOWTOWN Supply Co. P15,900, Term, 2/10, n/30. 3. Bought office supplies on cash basis for P700 4. Sold merchandize on account P15,200 FOB Destination, terms 2/10, n/30. 5. Paid P200 freight on April 4 sale. 6. Received credit memo LOWTOWN Supply Co. for merchandise return P300. 11 Paid LOWTOWN. 13.Collected from April 4 customers. 14 Bought merchandise on cash basis for P14,400. 15Salaries paid P1,500. 16.Borrowed money from RCBC Bank, signed a promissory note for p12,000. 17. Received refund from a supplier on cash purchase of April 14, P500 18. Bought merchandize from MESDA, P14,200 FOB Shipping,…arrow_forward

- Tami Tyler opened Tami's Creations, Incorporated, a small manufacturing company, at the beginning of the year. Getting the company through its first quarter of operations placed a considerable strain on Ms. Tyler's personal finances. The following income statement for the first quarter was prepared by a friend who has just completed a course in managerial accounting at State University. Tami's Creations, Incorporated Income Statement For the Quarter Ended March 31 $ 1,128,000 Sales (28,200 units) Variable expenses: Variable cost of goods sold Variable selling and administrative Contribution margin Fixed expenses: $ 431,460 172,020 603,480 524,520 Fixed manufacturing overhead Fixed selling and administrative 249,600 536,520 $ (12,000) 286,920 Net operating loss Ms. Tyler is discouraged over the loss shown for the quarter, particularly because she had planned to use the statement as support for a bank loan. Another friend, a CPA, insists that the company should be using absorption…arrow_forward[The following information applies to the questions displayed below.] While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called eSys Answers. During year 1, they bought the following assets and incurred the following start-up fees: Year 1 Assets Purchase Date Basis Computers (5-year) October 30, Year 1 $ 16,400 Office equipment (7-year) October 30, Year 1 10,000 Furniture (7-year) October 30, Year 1 5,800 Start-up costs October 30, Year 1 19,520 In April of year 2, they decided to purchase a customer list from a company providing virtually the same services, started by fellow information systems students preparing to graduate. The customer list cost $12,520, and the sale was completed on April 30. During their summer break, Dallin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full time after graduation.…arrow_forward3. Samson bought a new cutting machine for P5,000,000.00. The machine could be sold for P50,000.00 after 20 years of use. What is the Book Value of the machine after 12 years? Compute using a) Straight Line Method and b) any other accepted method.arrow_forward

- Assume Down, Incorporated, was organized on May 1 to compete with Despair, Incorporateda company that sells de - motivational posters and office products. Down, Incorporated, encountered the following events during its first month of operations.a. Received $40,000 cash from the investors who organized Down, Incorporatedb. Borrowed $19,000 cash and signed a note due in two years.c. Ordered equipment costing $22,000.d. Purchased $10,000 in equipment, paying $3,000 in cash and signing a six-month note for the balance.e. Received the equipment ordered in (c), pald for half of it, and put the rest on account. Pleaae tell me the cash and equipmentarrow_forwardIn its first year of operations, Maria Corp.earned 48,100 in service revenue.Of that amount, 8,200 was on account and the remainder, 39, 900, was collected in cash from customers. The company incurred various expenses totalling 32,300, of which 28,800 was paid in cash. At the year end, 3,500 was still owing on account. In addition, Maria prepaid 2,000 for insurance coverage that covered the last half of the first year and the first half of the second year. maria expects to owe 3000 of income tax when it files its corporate income tax return after year end.arrow_forwardCintu is a large marketer and distributor of food service products serving restaurants, hotels, schools, hospitals, and other institutions. The following transactions are typical of those that occurred in a recent year, but the amounts are simplified. a. Borrowed $101,000 from a bank, signing a short-term note payable. b. Provided $106,300 in service to customers, with $100,100 on account and the rest received in cash. c. Purchased equipment for $146,000 in cash. d. Incurred and paid employee wages of $2,450. e. Received $430 on account from a customer. f. Incurred and paid $4,850 cash for travel costs during the year. g. Paid $9,100 cash on accounts payable. h. Incurred $24,300 in utility expenses during the year, of which $18,800 was paid in cash and the rest owed on account. Required: 1. For each of the above transactions, prepare accrual basis journal entries. 2. Calculate the company's preliminary net income.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education