FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

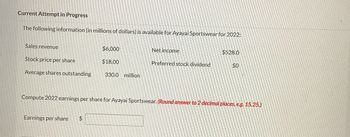

Transcribed Image Text:Current Attempt in Progress

The following information (in millions of dollars) is available for Ayayai Sportswear for 2022:

Sales revenue

Stock price per share

Average shares outstanding

Earnings per share

1551561

LOP9012

ª

Towels CD

Compute 2022 earnings per share for Ayayai Sportswear. (Round answer to 2 decimal places, e.g. 15.25.)

K

L

2007-10-06-20

ANTOR PENE

Men n

Sta

200

$6,000

$18.00

$

330.0 million

Net income

Preferred stock dividend

$528.0

$0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can anyone please help me with this? Question in picture.arrow_forwardThe Castle Company recently reported net profits after taxes of $14.7 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company's stock currently trades at $121 per share. Compute the stock's earnings per share (EPS). Round the answer to two decimal places.$_______________per share What's the stock's P/E ratio? Round the answer to two decimal places.$______________ times Determine what the stock's dividend yield would be if it paid $6.9 per share to common stockholders. Round the answer to two decimal places._______________ %arrow_forwardA7 please help.......arrow_forward

- Yellow Enterprises reported the following ($ in thousands) as of December 31, 2024. All accounts have normal balances. Deficit (debit balance in retained earnings) $ 2,300 Common stock 3,800 Paid-in capital—share repurchase 1,800 Treasury stock (at cost) 300 Paid-in capital—excess of par 31,100 During 2025 ($ in thousands), net income was $9,700; 25% of the treasury stock was resold for $600; cash dividends declared were $630; cash dividends paid were $460. What ($ in thousands) was shareholders' equity as of December 31, 2025?arrow_forwardA2 please help......arrow_forwardBelow is the financial data for Arla Inc. for the year ended December 31, 2020: Market price per share... Net Income...... $150.00 $1,750,000 Preferred Dividends declared... $75,000 Average # of common shares....... Dividends per share...... Average common shareholders' equity..... Total assets..... Total Liabilities... Accumulated Other Comprehensive Income..... 100,000 $2.50 10,000,000 $22,500,000 $11,675,000 $185,000 Instructions Calculate the Return on shareholders' equity (use up to 2 decimal places and do not include a % sign)arrow_forward

- The following information is available for Splish Brothers Inc. and Novak Corp.: Splish Brothers Inc. Novak Corp. (in millions) 2022 2021 2022 2021 Preferred dividends 22 9 27 Net income 545 475 515 565 Shares outstanding at the end of the 215 175 160 195 year Shares outstanding at the beginning of 175 160 195 215 the year Based on this information, what is the amount of Splish Brothers Inc. earnings per share (rounded to two decimals) for 2022? O $ 1.50 O $ 1.34 O $ 2.94 O $ 2.68arrow_forwardShares purchased one year ago for $8790 are now worth $15,390. During the year, the shares paid dividends totalling $280. Calculate the shares’: (Do not round intermediate calculations and round your final answer to 2 decimal places.) a. Income yield b. Capital gain yield c. Rate of total returnarrow_forwardThe firm’s earnings per share, rounded to the nearest centavos, for 202X was P0.53 P0.51 P0.30 P0.32arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education