FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:5

Cc Ce X

Cla

v2.cengagenow.com

O search

Ce

Print Item

Date

Hc

Nov.

Fa

Item

So

Mohamed

In

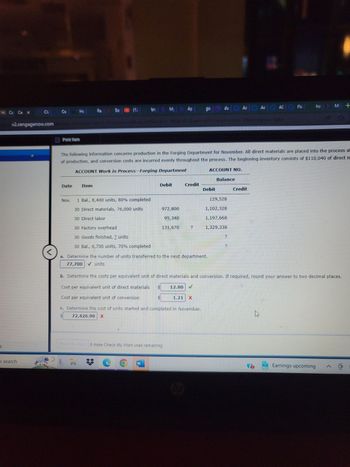

1 Bal., 8,400 units, 80% completed

30 Direct materials, 76,000 units

30 Direct labor

30 Factory overhead

30 Goods finished, ? units

30 Bal., 6,700 units, 70% completed

bry My

ofirvaker Winke/vekurs med extent Win

Debit

The following information concerns production in the Forging Department for November. All direct materials are placed into the process at

of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $110,040 of direct m

ACCOUNT Work in Process-Forging Department

972,800

95,340

131,670

W

Ap

Check My Work 0 more Check My Work uses remaining.

Credit

<

a. Determine the number of units transferred to the next department.

77,700 ✓ units

1.21

?

c. Determine the cost of units started and completed in November.

72,426.90 X

go

12.80 V

C

Debit

du Ac Ac AC

ACCOUNT NO.

Balance

129,528

1,102,328

1,197,668

1,329,338

2

a

?

b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places.

Cost per equivalent unit of direct materials

Cost per equivalent unit of conversion

Aca AC Fla

Credit

wprost inter

ho M +

10

AN

Earnings upcoming

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information about the work-in-process inventory pertains to the Remington Plant for the month of July (all materials are added at the beginning of the process): Materials Conversion Beginning work in process (26,000 units): Percentage complete with respect to 100 % 20% Costs $ 83,600 $ 18, 636 Ending work in process (42,000 units): Percentage complete with respect to 100 % 60% Costs ? ? ? ? The Remington Plant started 216,000 units and transferred out 200,000 in July. Materials costs incurred in July were $594,000 and conversion costs were $979,000. Required: Compute the cost per equivalent unit for materials and conversion costs using the FIFO method.arrow_forwardEquivalent units of materials cost The Rolling Department of Fortress Steel Company had 200 tons in beginning work in process inventory (60% complete) on July 1. During July, 3,900 tons were completed. The ending work in process inventory on July 31 was 300 tons (25% complete). What are the total equivalent units for direct materials for July if materials are added at the beginning of the process?arrow_forwardThe following production data were taken from the records of the finishing department for June: Inventory in process, June 1, 25% completed 220 units Transferred to finished goods during June 5,100 units Equivalent units of production during June 5,495 units Determine the number of equivalent units of production in the June 30, finishing department inventory, assuming that the first-in, first-out method is used to cost inventories. The completion percentage of 25% applies to both direct materials and conversion costs. a.360 units b.540 units c.675 units d.450 unitsarrow_forward

- Equivalent Units of Materials Cost The Rolling Department of Kraus Steel Company had 200 tons in beginning work in process inventory (60% complete) on October 1. During October, 3,900 tons were completed. The ending work in process inventory on October 31 was 300 tons (25% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process?arrow_forwardThe Rolling Department of Jabari Steel Company had 2,300 tons in beginning work in process inventory (90% complete) on October 1. During October, 38,000 tons were completed. The ending work in process inventory on October 31 was 1,900 tons (80% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process? unitsarrow_forwardThe following information concerns production in the Forging Department for June. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $18,000 of direct materials. ACCOUNT Work in Process-Forging Department Debit Credit Date Item June 1 Bal., 1,800 units, 60% completed 30 Direct materials, 25,800 units 30 Direct labor 30 Factory overhead 30 Goods transferred, ? units 30 Bal., 2,800 units, 70% completed Cost per equivalent units of $9.60 for Direct Materials and $3.00 for Conversion Costs. Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers (a-c) to the nearest dollar. a. Cost of beginning work in process inventory completed in June $ 247,680 43,300 33,740 b. Cost of units transferred to the next department during June $ c. Cost of ending work in process…arrow_forward

- Equivalent Units of Materials Cost The Rolling Department of Jabari Steel Company had 4,500 tons in beginning work in process inventory (30% complete) on October 1. During October, 74,300 tons were completed. The ending work in process inventory on October 31 was 3,700 tons (50% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process? X unitsarrow_forwardCosts per Equivalent Unit and Production Costs The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $109,020 of direct materials. ACCOUNT Work in Process-Forging Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Nov. 1 Bal., 7,900 units, 60% completed 118,026 30 Direct materials, 72,000 units 979,200 1,097,226 30 Direct labor 62,610 1,159,836 30 Factory overhead 86,450 1,246,286 30 Goods finished, 2 units ? 30 Bal., 6,300 units, 90% completed ? Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers (a-c) to the nearest dollar. a. Cost of beginning work in process inventory completed in November. b. Cost of units transferred to the next department during…arrow_forwardCosts per Equivalent Unit and Production Costs The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $33,320 of direct materials. ACCOUNT Work in Process—Forging Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit Nov. 1 Bal., 3,400 units, 70% completed 38,080 30 Direct materials, 31,000 units 294,500 332,580 30 Direct labor 28,000 360,580 30 Factory overhead 38,675 ? 399,255 30 Goods finished, ? units ? 30 Bal., 2,700 units, 90% completed ? Cost per equivalent units of $9.50 for Direct Materials and $2.10 for Conversion Costs. Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers…arrow_forward

- The following information summarizes the activities in the Mixing Department for the month of March. Beginning inventory 8,000 units, 80% complete Started and completed 196,000 units Ending inventory 24,000 units, 25% complete Material is added at the beginning of the process, and conversion costs are incurred evenly throughout the process. Calculate the equivalent units of production with respect to materials during the month of March using the weighted average method. Select one: a. 228,000 b. 212,000 c. 208,000 d. 244,000 e. 210,000arrow_forwardPlease don't give image formatarrow_forwardCosts per Equivalent Unit and Production Costs The following information concerns production in the Forging Department for June. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $18,000 of direct materials. ACCOUNT Work in Process-Forging Department Debit Credit Date Item June 1 Bal., 1,800 units, 60% completed 30 Direct materials, 25,800 units 30 Direct labor 30 Factory overhead 30 Goods transferred, 2 units 30 Bal., 2,800 units, 70% completed Cost per equivalent units of $9.60 for Direct Materials and $3.00 for Conversion Costs. Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers (a-c) to the nearest dollar. 247,680 43,300 33,740 Change in direct materials cost per equivalent unit Change in conversion cost per equivalent unit ACCOUNT NO. Balance Balance…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education